BTC's "bullish news followed by a drop" is not a failure: the market is heading towards a grand capital rotation

The U.S. government shutdown lasted for more than 40 days, and the market was almost frozen amid prolonged uncertainty.

When the shutdown finally ended, many traders expected BTC to immediately surge and break out—but the price quickly fell back to the 95 range, triggering panic.

However, this is not a failure of the signal, but rather a very typical prelude to a market structure that has repeatedly appeared in history.

1. Why did the market fall instead of rise after the shutdown ended? The market’s first reaction is always “safety”

After prolonged uncertainty dissipates, the market usually goes through a psychological phase:

No rush to chase the rally

First, cash in profits

Then observe whether the trend is truly established

Therefore, the first step for BTC after the shutdown ended was not a surge, but a “reset of sentiment.”

This type of downturn reflects a change in risk appetite rather than a collapse of fundamentals.

2. Market events are priced in advance: Good news realized → Sell the fact, a common behavior

The expectations for major events are often already reflected in the price chart.

Before the shutdown ended, optimism had already entered the price structure. When the good news actually materializes:

Funds choose to take profits rather than continue pushing higher.

This is the typical “Sell the News” structure.

History saw exactly the same situation in 2018–2019:

Short-term dip → Range-bound consolidation → Then BTC rose 50% → Followed by a 300% main bull run.

The current structure is extremely similar to that time.

3. This decline is not due to deteriorating fundamentals: The market has not shown any structural problems

The key points are:

Liquidity has not disappeared

Institutions have not withdrawn

Risk premium has not expanded

Network and on-chain indicators remain stable

This pullback is purely an emotional reaction, not a trend reversal.

“It looks dangerous, but is actually very healthy”—this is a typical signal before many major cycle reversals.

4. The real big event is happening: Leadership is shifting from BTC to other assets

When bitcoin’s trend slows down and enters a consolidation range, the market usually undergoes a dramatic change:

Funds begin to look for targets with higher returns.

This is not funds leaving the market, but funds migrating.

BTC cools down

Traders rebalance their positions

Capital accelerates its flow into high-elasticity assets

This type of rotation structure is often the starting point of every Altseason.

5. Evidence of capital rotation has already appeared: DeFi, L2, and real demand are starting to recover

Several key indicators have begun to turn:

TVL on mainstream DeFi platforms is rising again

L2 trading volume is showing steady recovery

Narrative-driven hype is shifting toward actual products and application value

Small and mid-cap projects are starting to attract incremental attention

These are all typical leading signals:

Altseason does not start when BTC surges, but is ignited when BTC enters a sideways range.

6. Bitcoin’s consolidation range is not bearish, but a “capital redistribution phase”

When BTC enters a deeper range-bound phase, it usually brings two things:

Risk appetite rises again

Funds chase higher ARR (annualized return rate)

This is exactly the time for altcoins to awaken.

History has proven many times:

When BTC stops, Altcoins start the next major rally.

7. How to position in advance? Those who wait for confirmation signals are always too late

If you want to gain an advantage in this round of potential capital rotation, you need to focus on three directions:

Liquidity flows

Activity indicators for L2 and DeFi

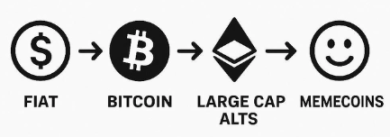

Structural migration of funds from BTC → ETH/L2 → small and mid-cap assets

Capital rotation never waits for the public’s confirmation before it starts.

The real opportunity belongs to those who position early, study the structure, and dare to enter during the adjustment period.

Conclusion:

The pullback in bitcoin after the shutdown ended is not a failure, but a normal, recurring phase in market structure.

Historical experience and on-chain indicators both show: this is the beginning of a round of capital rotation from BTC to higher-return assets.

Liquidity has not declined, fundamentals have not deteriorated, and BTC’s consolidation range instead provides an ideal window for Altseason to start.

The recovery in DeFi and L2 activity has already given early signals.

The current environment is not one of panic, but of opportunity.

Those who understand how to analyze liquidity structure and position early during the pullback will seize the initiative in the next major round of capital migration.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Zcash Faces Weekend Challenges with Price Pressures

Ethereum ETF cut as Defiance pulls products from market

Samson Mow Challenges Bitcoin Growth Projections with Bold Assertions

Popular Burger restaurant Steak ’n Shake acquires $10 million worth of bitcoin