Ethereum Price Rebound or Breakdown? The Fed Might Hold the Key

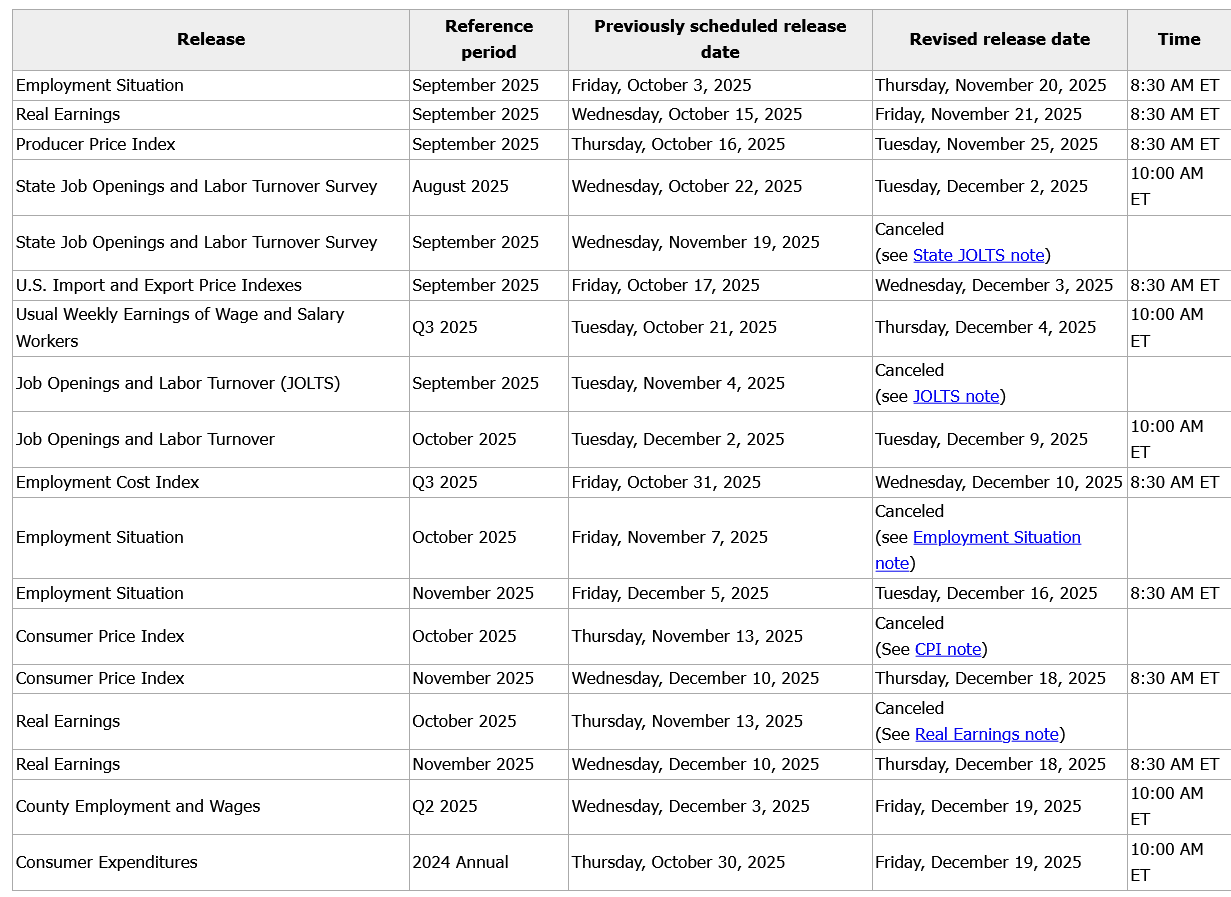

Ethereum price daily chart shows tentative signs of recovery just as the Federal Reserve faces one of its most complicated meetings of the year. With policymakers debating whether to delay or even cancel December’s meeting due to missing job data, markets are reacting with uncertainty. For Ethereum price, this kind of macro hesitation has often fueled volatility—especially when interest rate expectations shift rapidly.

Ethereum Price Prediction: The Fed’s Indecision and Investor Nerves

The Fed’s dilemma is simple but critical. Without November labor data , they’re forced to decide between cutting rates for the third time or holding steady to fight inflation. Historically, rate cuts have spurred risk assets like Ethereum, but the timing matters.

If the Fed delays the meeting , that uncertainty could temporarily stall bullish momentum across crypto. As of now, futures markets are pricing in an 83% probability of a rate cut, but any hint of hesitation could lead to another wave of volatility before the decision.

ETH Price Battles the Mid-Band Resistance

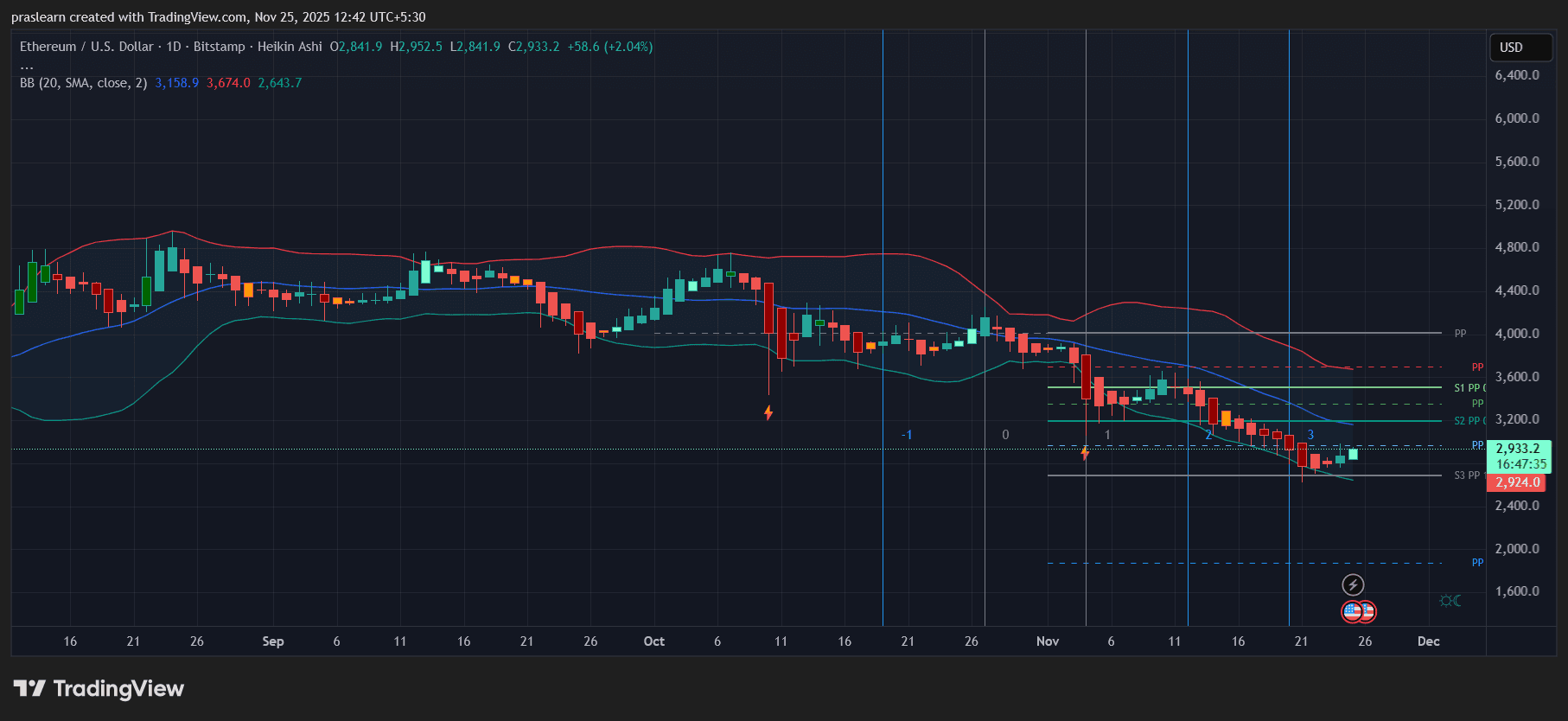

ETH/USD Daily Chart- TradingView

ETH/USD Daily Chart- TradingView

On the daily chart, Ethereum price is trading around $2,933, testing the mid-line of its Bollinger Bands after a multi-week downtrend. The recent candles are Heikin Ashi bullish, suggesting short-term reversal strength, but the 20-day SMA near $3,158 remains a key resistance barrier.

- Support Zone: $2,640–$2,700

- Resistance Zone: $3,150–$3,200

- Next Pivot Target: $3,400 if the breakout sustains above the 20-day SMA

ETH’s current movement hints at consolidation before a possible bullish expansion. The Bollinger Bands have started to narrow, which often precedes a volatility breakout. A decisive daily close above $3,200 would likely confirm the start of that phase.

Fed Policy Meets Technical Pressure

Ethereum’s chart behavior over the past two months mirrors investor sentiment toward Fed policy. Each time expectations for a rate cut strengthen, ETH bounces from its lower band—just as it did this week from near $2,640. If the Fed delays the meeting or signals policy uncertainty, traders could take profits early, sending ETH back toward support.

However, if the Fed moves forward and confirms a cut, liquidity inflows could lift ETH price toward the upper Bollinger Band near $3,674. This aligns with the Fibonacci retracement from the last major swing, marking a strong confluence for mid-term resistance.

Short-Term Ethereum Price Prediction: “Vibes Over Data” Market

UBS analysts called the current Fed situation “operating in a fog,” and that sentiment captures Ethereum price setup perfectly. Technicals show ETH price trying to reverse, but conviction remains weak. A lot depends on whether macro clarity returns before December 10.

If ETH maintains support above $2,850 for three consecutive days, the odds of retesting $3,200–$3,400 grow sharply. But a drop below $2,800 would invalidate this rebound and reopen the path to $2,600 or even $2,400 support.

Ethereum Price Prediction: ETH’s Reaction to the December Decision

If the Fed cuts rates or delays its decision but signals dovish intent, Ethereum price could rally toward $3,600 in December. A no-cut stance combined with continued inflation warnings could drag it back into the $2,600–$2,700 zone.

The next move will be less about charts and more about macro confidence. Ethereum’s price is now moving at the intersection of policy uncertainty and trader psychology—and whichever way that breaks, volatility is guaranteed. Ethereum’s rebound from $2,640 shows early strength, but it needs confirmation above $3,150 to prove this isn’t just another relief rally. The Fed’s December meeting will decide whether $ETH reclaims its bullish trend—or slips back into winter.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: Bitcoin ETF Withdrawals Underscore Rising Altcoin Momentum Amid Changing Crypto Focus

- BlackRock's IBIT Bitcoin ETF saw $3.79B in November outflows, marking its worst month since launch amid Bitcoin's 13% weekly price drop below $80,000. - Analysts link redemptions to profit-taking after October's $126,000 peak and macro concerns like delayed Fed rate cuts, creating a self-reinforcing price decline cycle. - Institutional buyers see Bitcoin's $90,000 level as a buying opportunity, while altcoin ETFs like Solana's BSOL attract $660M inflows with competitive staking yields. - Citigroup warns

Bitcoin News Today: Bitcoin Faces $80K Turning Point: Will a Short Squeeze Ignite or Is a Further Decline Ahead?

- Bitcoin fell below $80,000 in November 2025, triggering debates over short-squeeze rebounds vs. deeper bear markets amid macroeconomic fears and ETF outflows. - A "death cross" technical signal and $800M in on-chain losses highlight market fragility, with $1T wiped from crypto since October. - Analysts remain divided: bullish targets ($200K) clash with bearish warnings of $74,500 retests, while institutions like Harvard buy dips. - Negative funding rates suggest short-covering potential, but $20B in liqu

Astar 2.0: Transforming Blockchain Scalability and Pioneering DeFi Advancements

- Astar 2.0 tackles blockchain scalability via ZK Rollups, zkEVM, and LayerZero interoperability, enabling cross-chain liquidity and Ethereum compatibility. - Hybrid AMM-CEX models reduce slippage while AI-powered security attracts institutions, with TVL reaching $1.4B and 20% QoQ institutional wallet growth. - Tokenomics 3.0 caps ASTR supply at 10.5B tokens, paired with Burndrop PoC to create scarcity, while governance shifts to community councils by mid-2026. - Startale App (2026) and Polkadot Plaza inte

The Emergence of Aster DEX and Its Impact on the Future of Decentralized Finance

- Aster DEX, a perp DEX with 31% market share and $3T+ trading volume, bridges institutional-grade infrastructure with retail accessibility through incentives and user-friendly design. - Its Stage 4 airdrop, $10M trading competitions, and 200× leverage on $ASTER collateral lower entry barriers while enhancing token utility for novice traders. - A hybrid AMM-CEX model with Aster Chain (10k TPS) and ZKP privacy, plus cross-chain interoperability, addresses scalability and security concerns critical for risk-