Bitkub Eyes Hong Kong IPO as Thai Market Downturn Stalls Local Listing Plans

Quick Breakdown

- Thailand’s largest crypto exchange is weighing a $200M IPO in Hong Kong.

- Volatile Thai markets and a five-year SET Index low stall the local debut.

- Hong Kong’s booming IPO scene and crypto-friendly stance attract Bitkub.

Bitkub considers overseas listing amid Thai market turmoil

Bitkub, Thailand’s largest cryptocurrency exchange, is exploring an initial public offering (IPO) abroad amid weak market conditions that continue to weigh on local investor sentiment. According to a Bloomberg report citing people familiar with the matter, the company is targeting about $200 million in a potential Hong Kong listing.

The move comes after Bitkub’s earlier plan to go public in Thailand in 2025 was put on hold due to heightened volatility and uncertainty in the domestic equities market.

Thai stock market hits five-year low in 2025

Thailand’s stock market has struggled to find stability throughout 2025 amid escalating political tensions with Cambodia and concerns over trade disruptions.

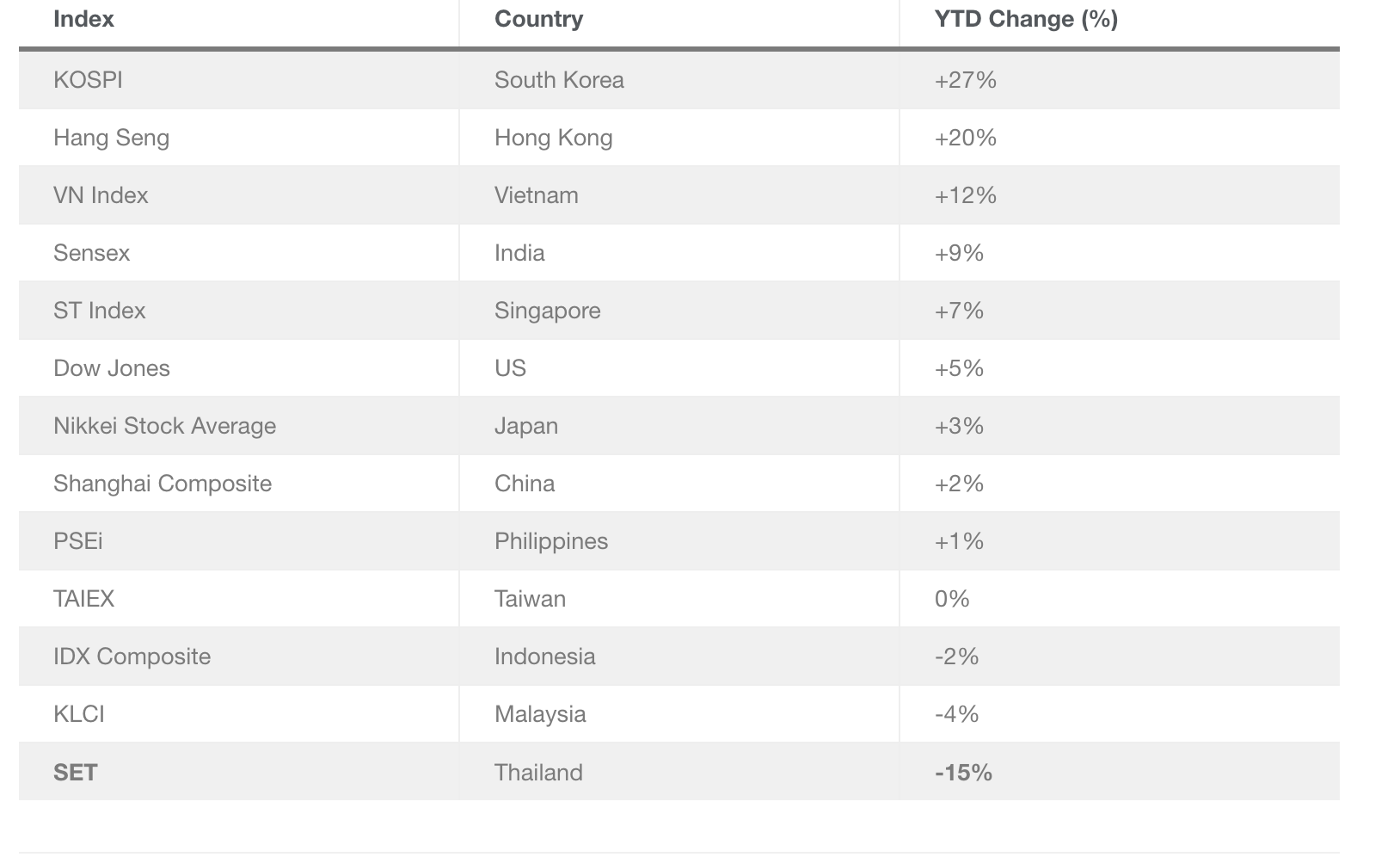

The Stock Exchange of Thailand (SET) has dropped roughly 10% this year, sliding to a five-year low in the first half of 2025, one of the weakest performances in Asia.

Source

:

Thailand Business News

Source

:

Thailand Business News

Even after two months of modest recovery, foreign investors remained net sellers, offloading more than 100 billion baht (about $3 billion) in equities during the first 10 months of the year.

This contrasts sharply with broader regional performance: major Asian markets, including South Korea and Hong Kong, saw gains of 27% and 20%, respectively, over the same period.

Hong Kong’s IPO boom draws global crypto firms

For Bitkub, Hong Kong’s surging IPO ecosystem presents a more attractive path. The Hong Kong Stock Exchange reported raising HK$216 billion (around $27.8 billion) from IPOs between January and October 2025, a massive 209% jump from the previous year.

The city has quickly become a hotbed for digital asset companies. Bitcoin Depot, the world’s largest Bitcoin ATM operator, is among the notable crypto firms expanding into the region.

In October, local crypto heavyweight HashKey Group also filed for a public listing, aiming to raise $500 million ahead of a planned 2026 debut, potentially one of the first local crypto IPOs.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Texas becomes first US state to buy $10 million in Bitcoin for strategic reserve

Bank of Japan may signal December interest rate hike, sources say

Bitcoin Updates: Diverging Fed Policies Leave Crypto Stuck in Unstable Deadlock

- Fed officials split on December rate cut urgency, with Collins opposing further easing while others cite stagflation risks. - Mixed economic data and 33-day government shutdown delay key metrics, forcing reliance on outdated indicators for policy decisions. - Crypto markets react to Fed uncertainty: Bitcoin dips below $80k amid 70% cut odds, while Ethereum rebounds on institutional buying. - Institutional investors favor liquid Bitcoin ETFs over VC projects, reflecting risk mitigation trends despite $4.6

Bitcoin News Today: The Lasting Appeal of Bitcoin: Digital Gold Amid Uncertain Times

- Bitcoin fell over 30% from its October peak amid ETF outflows, stablecoin liquidity declines, and leveraged position liquidations, yet retains its status as digital gold. - Institutional buyers like Texas and Hyperscale Data continue accumulating Bitcoin as an inflation hedge, with the latter holding 77% of its market cap in crypto treasuries. - On-chain data shows mid-tier "whales" accumulating during the dip, while macroeconomic shifts and high-yield markets fail to undermine Bitcoin's decentralized re