Is This the Next Big Crypto Shift? Quantum Tokens Hit $9 Billion

The quantum-resistant crypto sector now exceeds $9 billion in market capitalization, seeing daily trading volumes above $1.5 billion. Investor focus on specialized blockchain projects has surged after Vitalik Buterin, Ethereum’s co-founder, warned about the threats posed by quantum computing that could compromise current cryptographic security. Market Data Reveals Growing Quantum-Resistant Sector Analysts expect quantum resistance

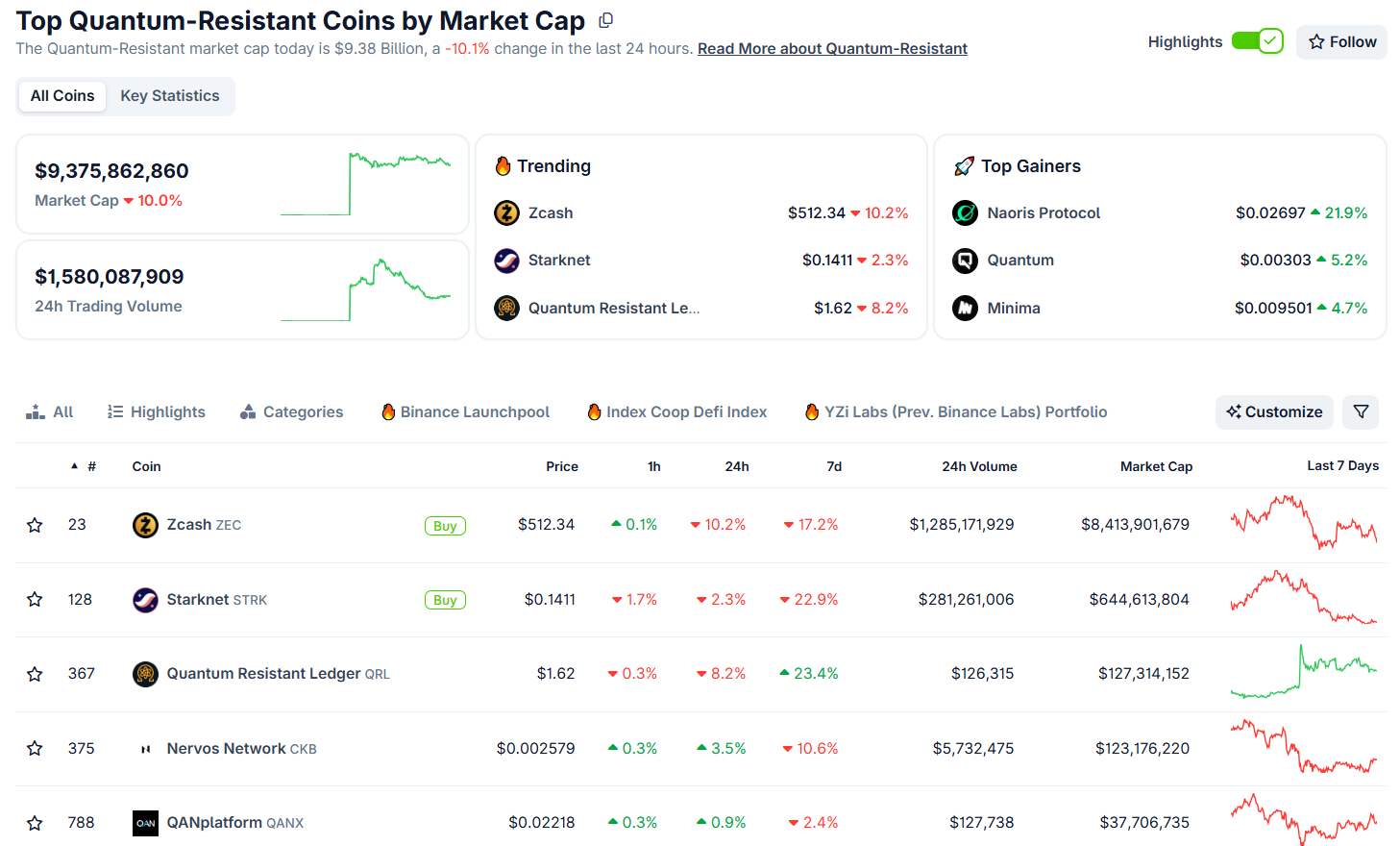

The quantum-resistant crypto sector now exceeds $9 billion in market capitalization, seeing daily trading volumes above $1.5 billion.

Investor focus on specialized blockchain projects has surged after Vitalik Buterin, Ethereum’s co-founder, warned about the threats posed by quantum computing that could compromise current cryptographic security.

Market Data Reveals Growing Quantum-Resistant Sector

Analysts expect quantum resistance to become a key theme by 2026, due to both technological urgency and investor sentiment.

Major projects, including Zcash, Starknet, Nervos Network, Quantum Resistant Ledger, and Abelian, are attracting attention from those seeking protection against future quantum vulnerabilities.

According to CoinGecko data, quantum-resistant tokens reached a market capitalization of $9.37 billion on November 25, 2025, despite a 10% drop over the previous 24 hours. The daily trading volume reached $1.58 billion, indicating strong activity and liquidity.

Quantum Resistant Tokens Market Cap. Source:

CoinGecko

Quantum Resistant Tokens Market Cap. Source:

CoinGecko

These projects stand out with the use of post-quantum cryptographic techniques. Hash-based and lattice-based algorithms are at the heart of these architectures, offering resistance against quantum attacks.

In contrast to blockchains that use elliptic curve cryptography, quantum-resistant tokens employ alternative methods validated by institutions like the National Institute of Standards and Technology.

Zcash leads the sector, trading at $512.34 despite a 10.7% gain. Starknet and Quantum Resistant Ledger follow in the top three.

Technical progress has accompanied the sector’s growth. Zcash recently launched a shielded-balance verifier to enable portable proof of funds, bolstering quantum-resistant privacy.

Buterin’s Warning Catalyzes Industry Attention

Vitalik Buterin, co-founder of Ethereum, has repeatedly warned about the risks quantum computing poses to blockchain security.

He cited Metaculus, a prediction platform, estimating a 20% chance that quantum computers capable of breaking modern encryption might appear before 2030.

Speaking at the Devconnect conference in 2025, he cautioned that quantum breakthroughs could endanger blockchain cryptography as soon as 2028.

Buterin’s warnings highlight the vulnerabilities of elliptic curve cryptography, which support networks like Ethereum and Bitcoin.

His advocacy for quantum-resistant protocols has sparked research and redirected investments toward forward-looking projects.

The legitimacy of quantum resistance has been reinforced by government actions. In March 2025, NIST chose HQC (Hamming Quasi-Cyclic) as its fifth post-quantum encryption algorithm to back up ML-KEM.

NIST had earlier standardized ML-DSA (Dilithium) and SLH-DSA (sphincs+) as signature methods, giving blockchain developers trusted cryptographic options.

In April 2025, the Canadian Centre for Cyber Security backed NIST’s adoption process, showing growing global convergence on post-quantum cryptography.

This regulatory unity is speeding up the adoption of quantum-resistant methods across cryptocurrency infrastructure.

Technical Preparedness Sets Leading Projects Apart

Some blockchain projects have integrated quantum-resistant features proactively, rather than relying on future upgrades.

Zcash uses shielded pools for privacy, even if elliptic curve cryptography fails. Starknet’s proof systems, designed with quantum safety in mind, use hash-based cryptography to guard against quantum attacks.

- Nervos Network enables developers to add NIST-standardized quantum signatures without hard forks.

- Quantum Resistant Ledger has used hash-based signatures since launch, omitting vulnerable elliptic curves.

- Abelian, meanwhile, implemented lattice-based cryptography from its genesis.

Market observers note the importance of proactive implementation. One analyst pointed to Starknet’s second-place rank among quantum-resistant tokens.

The project’s quantum-safe design contrasts with protocols that could face disruptive migration down the line.

This technical edge extends beyond cryptographic tools. Projects with modular, quantum-resistant systems can update security as NIST standards evolve, providing long-term protection while maintaining network continuity.

Psychology and Practicality Shape the 2026 Narrative

Though technical groundwork exists, some question whether quantum resistance is more a market narrative than an urgent need.

The arrival of quantum computers is uncertain. While Buterin estimates a 20% chance before 2030, many expect critical advances after 2034.

This uncertainty allows narrative and psychology to influence valuations. Fear of quantum risk could fuel price volatility, as has happened with previous crypto trends linked to anticipated events. Price action can precede real-world adoption or implementation.

Still, the line between speculation and preparation is often blurred in crypto. Investors focused on potential threats can help fund and validate useful project advances.

Market participants are already citing quantum resistance as a likely “next big narrative in 2026,” naming QRL, QANX, XDC, QTC, MCM, and CKB among likely beneficiaries.

This dual dynamic, technical innovation, and powerful market narrative could benefit real quantum-resistant projects, but also brings scrutiny to valuations.

As 2026 nears, the sector’s future will depend on the interplay of quantum technology, regulatory standards, and shifting sentiment.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: Bitcoin ETF Withdrawals Underscore Rising Altcoin Momentum Amid Changing Crypto Focus

- BlackRock's IBIT Bitcoin ETF saw $3.79B in November outflows, marking its worst month since launch amid Bitcoin's 13% weekly price drop below $80,000. - Analysts link redemptions to profit-taking after October's $126,000 peak and macro concerns like delayed Fed rate cuts, creating a self-reinforcing price decline cycle. - Institutional buyers see Bitcoin's $90,000 level as a buying opportunity, while altcoin ETFs like Solana's BSOL attract $660M inflows with competitive staking yields. - Citigroup warns

Bitcoin News Today: Bitcoin Faces $80K Turning Point: Will a Short Squeeze Ignite or Is a Further Decline Ahead?

- Bitcoin fell below $80,000 in November 2025, triggering debates over short-squeeze rebounds vs. deeper bear markets amid macroeconomic fears and ETF outflows. - A "death cross" technical signal and $800M in on-chain losses highlight market fragility, with $1T wiped from crypto since October. - Analysts remain divided: bullish targets ($200K) clash with bearish warnings of $74,500 retests, while institutions like Harvard buy dips. - Negative funding rates suggest short-covering potential, but $20B in liqu

Astar 2.0: Transforming Blockchain Scalability and Pioneering DeFi Advancements

- Astar 2.0 tackles blockchain scalability via ZK Rollups, zkEVM, and LayerZero interoperability, enabling cross-chain liquidity and Ethereum compatibility. - Hybrid AMM-CEX models reduce slippage while AI-powered security attracts institutions, with TVL reaching $1.4B and 20% QoQ institutional wallet growth. - Tokenomics 3.0 caps ASTR supply at 10.5B tokens, paired with Burndrop PoC to create scarcity, while governance shifts to community councils by mid-2026. - Startale App (2026) and Polkadot Plaza inte

The Emergence of Aster DEX and Its Impact on the Future of Decentralized Finance

- Aster DEX, a perp DEX with 31% market share and $3T+ trading volume, bridges institutional-grade infrastructure with retail accessibility through incentives and user-friendly design. - Its Stage 4 airdrop, $10M trading competitions, and 200× leverage on $ASTER collateral lower entry barriers while enhancing token utility for novice traders. - A hybrid AMM-CEX model with Aster Chain (10k TPS) and ZKP privacy, plus cross-chain interoperability, addresses scalability and security concerns critical for risk-