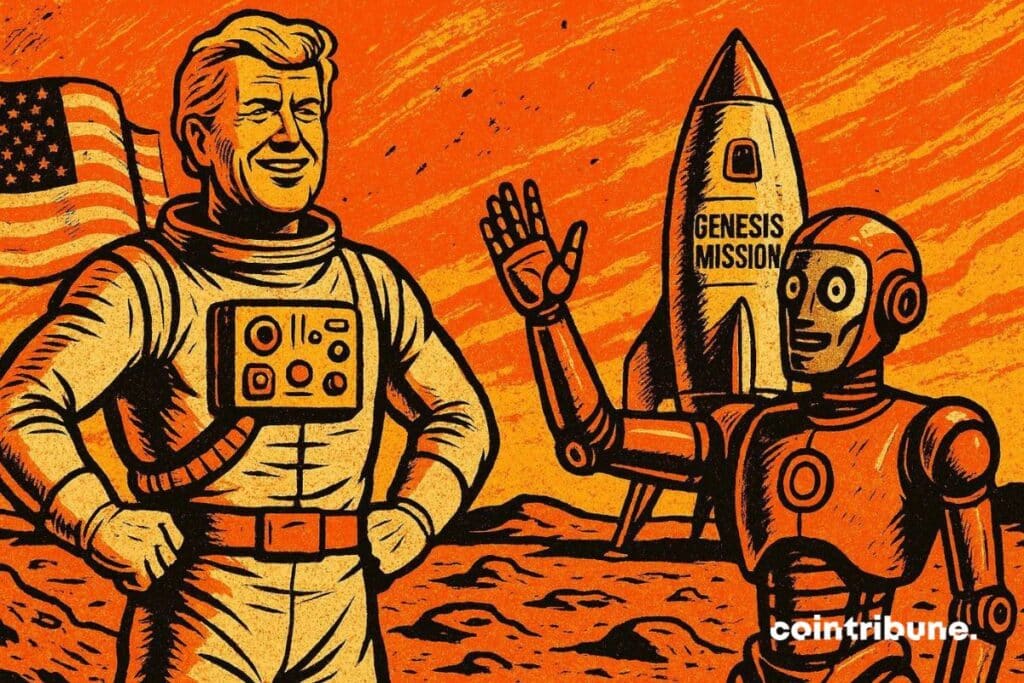

Trump Signs "Genesis Mission" Order to Boost AI Innovation in the United States

On November 24, 2025, Donald Trump signed an executive order launching the “Genesis Mission“, an ambitious federal project to accelerate research in artificial intelligence (AI). Compared to the Apollo program, this initiative aims to position the United States as the global leader in technological innovation. What are its objectives, key players, and implications for the future?

In brief

- Donald Trump signs the “Genesis Mission” executive order to accelerate AI research in the United States.

- The Genesis Mission relies on public-private partnerships with companies such as Nvidia, AMD, and AWS.

- The initiative could indirectly benefit AI-related cryptocurrencies, while creating new challenges for Bitcoin.

The “Genesis Mission“: a federal revolution for AI by Trump

The “Genesis Mission” is a federal initiative aiming to centralize American scientific resources to stimulate advances in artificial intelligence (AI). Led by the Department of Energy, the decree signed by Donald Trump foresees the creation of a digital platform integrating:

- supercomputers;

- federal data sets;

- research infrastructures.

The objective is clear: accelerate discoveries in strategic fields such as energy, national security, and semiconductors.

To achieve this, the Trump administration relies on partnerships with tech giants. Nvidia, AMD, and AWS have already announced massive investments, such as Amazon’s $50 billion commitment for AI-dedicated data centers. This public-private collaboration recalls great federal programs of the past, like the Manhattan Project or the space race.

The platform, named “American Science and Security Platform“, must demonstrate operational capability within nine months. It will allow researchers to access advanced modeling tools and unprecedented computing resources. All this while ensuring the protection of sensitive data.

AI and crypto: a winning duo for the US economy?

The alliance between AI and blockchain could become a pillar of technological innovation in the United States. Indeed, the “Genesis Mission” decree signed by Donald Trump emphasizes areas where blockchain can play a key role. Notably, data security and process automation. Smart contracts, for example, could optimize energy resource management, while decentralized ledgers would ensure research traceability.

For the crypto sector, this synergy represents an opportunity. Projects integrating AI tools, such as Fetch.ai or SingularityNET, could benefit from increased visibility and federal support. Growing AI adoption in government infrastructures could also encourage more favorable regulation for cryptocurrencies, strengthening their legitimacy. However, this dynamic will depend on the crypto players’ ability to meet federal requirements, especially regarding cybersecurity and compliance.

The dangers of the “Genesis Mission”: is Trump turning his back on bitcoin?

The “ Genesis Mission ” could propel AI cryptos to the forefront, relegating bitcoin to a secondary role. Projects combining blockchain and artificial intelligence align better with federal priorities than BTC, which is often seen as a simple store of value. Massive investments in AI, like those by AWS, could marginalize the crypto queen, less integrated into government initiatives.

However, bitcoin retains major assets: its status as a safe haven asset and increasing adoption by institutions (ETFs, state reserves) could limit its decline. Lastly, this initiative raises questions about the centralization of infrastructures, contrary to the decentralized ethos of cryptos, and about the environmental impact of data centers.

Donald Trump’s “Genesis Mission” could redefine technological and economic balances in the United States. While it offers unprecedented opportunities for AI cryptos, it also poses challenges in terms of regulation and environmental impact… A ticking time bomb for the climate . In your opinion, will this strategy manage to reconcile innovation and decentralized principles?

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

U.S. Banks Finally Secure Approval to Hold Ethereum as Crypto Demand Surges

Quick Take Summary is AI generated, newsroom reviewed. Regulators approved US banks holding Ethereum, marking a major shift in digital asset integration. Client demand for regulated crypto custody continues to rise across major banks. The approval boosts institutional crypto adoption and expands investment opportunities. Ethereum gains long-term strength as Ethereum market demand grows with banking involvement.References BULLISH: 🇺🇸 U.S. banks now have permission to hold Ethereum!

XRP News Today: Institutional Confidence Meets Market Uncertainty as XRP ETFs Undergo Key Evaluation

- U.S. spot XRP ETFs from Bitwise, 21Shares, Franklin Templeton, and Grayscale mark regulatory progress but face mixed market reactions amid price declines. - XRP dropped 7% below $2 post-launch, driven by whale selling (200M XRP sold in 48 hours) and broader crypto weakness, testing critical support levels. - ETFs aim to bridge traditional and crypto markets with 0.34%-0.5% fees, yet volatility persists as 41.5% of XRP supply now in loss positions. - Analysts highlight $2.195 as a key technical threshold;

Cardano Latest Updates: Partition Issue and Derivatives Market Tension Raise Concerns Over Sudden Price Drop

- Cardano's partition bug disrupted block production, forcing node upgrades and triggering ADA's 3% drop below $0.40 amid network instability fears. - Derivatives markets show $91M in short leverage vs. $11.5M longs, raising flash crash risks to $0.31 as ADA slippage costs a whale $6M during swaps. - Bitcoin's ETF outflows and hedge fund shorting amplify crypto fragility, with daily liquidations hitting $400–500M and ADA's $0.40 threshold under critical pressure. - IOG's disaster recovery protocols aim to

Bitcoin News Update: Institutions Take Advantage of Bitcoin Pullbacks as Selling Pressure Wanes

- Bitcoin's 35% price plunge triggered $900M+ daily losses for short-term holders, marking a record capitulation event since the 2022 FTX collapse. - Macroeconomic uncertainty and Fed rate cut speculation (69% priced in derivatives) intensified volatility amid $3.79B ETF outflows in November. - On-chain data shows exhausted selling pressure, with stabilization above $85,204 support and analysts noting 91% probability of avoiding further declines. - Institutional buyers like Harvard and Japan's Metaplanet a