BNB holds the line: Price pauses, usage climbs, traders take a breather

BNB is trading at a level that previously marked a breakout in 2024, according to market data. After pulling back from its recent peak, the cryptocurrency is testing a former resistance level now functioning as support.

- BNB has retraced to the upper boundary of an ascending channel that capped its 2024–2025 rally.

- BNB Chain’s active addresses have steadily increased in 2025, rising from under 1 million daily users early in the year to peaks near 3.5 million/

- Futures open interest has declined from September highs, suggesting traders are waiting for clearer directional cues.

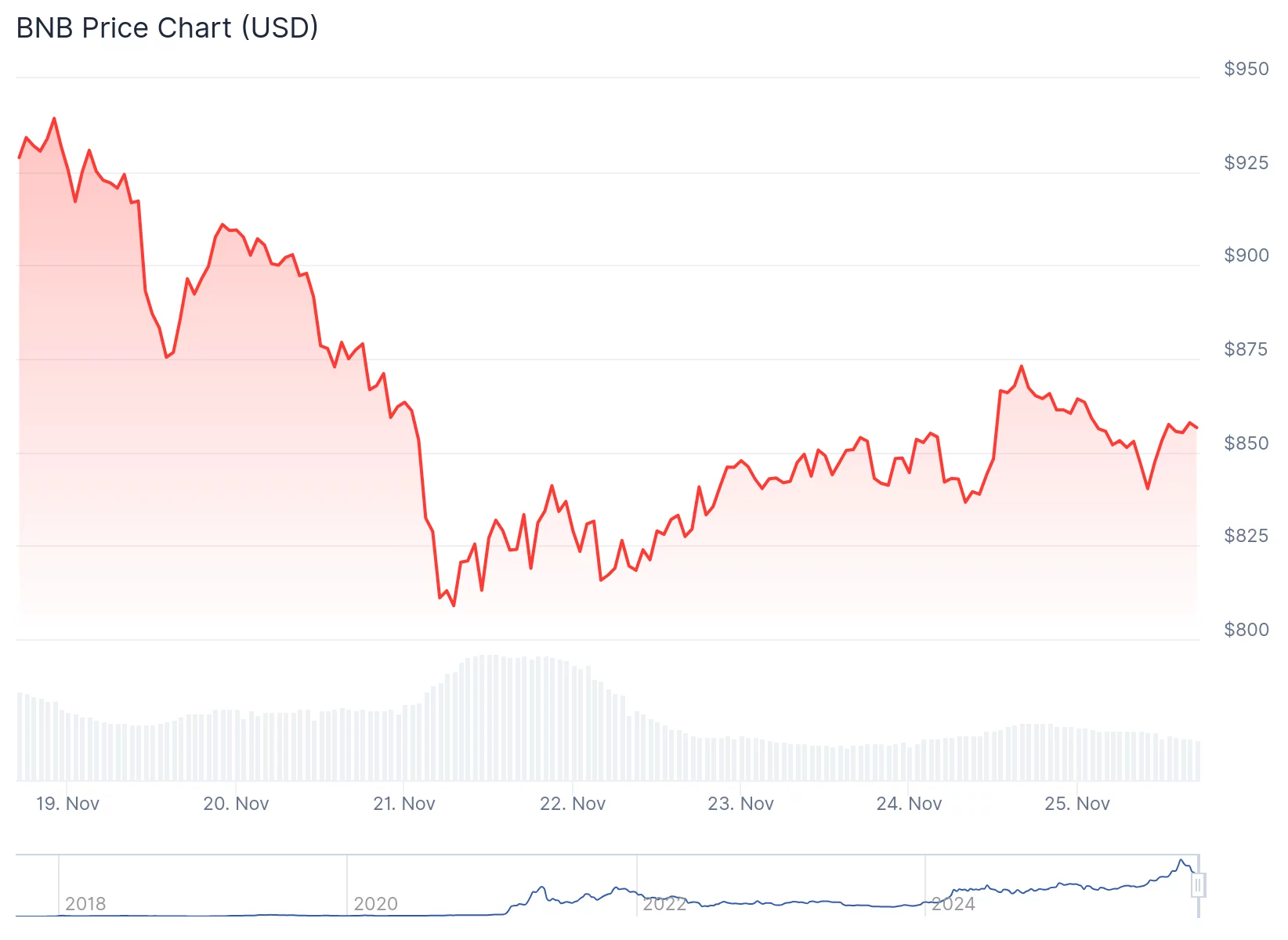

The digital asset declined over the week, according to price data. See below.

Source: CoinGecko

Source: CoinGecko

Over the course of two weeks, BNB reached the upper boundary of an ascending channel, a level that capped price action for most of 2024 and early 2025. After breaking out and achieving higher levels, the asset has retraced to retest that trendline.

The area aligns with the previous resistance-turned-support and sits in the middle of the prior rally range. Volume has not shown signs of major selling, according to trading data.

On the monthly timeframe, BNB has returned to a key trendline that has held since 2024. According to Cryptocium, another market observer, BNB has not closed a monthly candle below this line with strong downside momentum.

BNB back to a major bullish trendline

As November’s monthly close approaches, market participants are monitoring whether the level will hold.

BNB Chain’s network activity has grown steadily in 2025, according to data. Recall last month when it edged past TRON to become the most active network for stablecoin transactions, fueled by surging DEX volume and spillover from Binance’s trading incentives.

Charts shared by TCC show a rising trend in active addresses. From under one million daily users in early 2025, the chain has maintained levels above 1.5 million since July, occasionally reaching near 3.5 million. “BNB Chain is quietly climbing,” TCC posted, pointing to stronger usage despite the recent price decline.

Data from YZi Labs indicates that more BNB is being stored in self-custody, with exchange balances dropping as users move tokens to private wallets.

Open interest on futures has fallen below the September high, according to market data.

Both price and open interest have trended lower since that peak, indicating reduced speculative activity in recent weeks. Futures interest remains subdued, suggesting traders are awaiting stronger directional signals.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana News Today: "November's Investor Challenge: Support Struggling Solana or Chase Profits with Mutuum's Surge?"

- November 2025 crypto markets show Solana (SOL) down 22% amid macroeconomic uncertainty, while Mutuum Finance (MUTM) raises $18.9M in presale with 18,200 holders. - Solana faces declining confidence ($134 price, $7.3B flat open interest) as Fed rate uncertainty and bearish derivatives sentiment weaken its position. - Mutuum's Phase 6 presale (95% sold at $0.035) gains momentum through direct debit access, security audits, and a 20% price jump to $0.06 in Phase 7. - Analysts highlight Mutuum's dual DeFi mo

XRP News Today: XRP ETFs Draw $58M Investments During Price Fluctuations, Prompting Concerns

- Canary Capital’s XRPC ETF sees $26.5M inflows, contrasting Bitcoin ETF outflows. - Franklin Templeton/Bitwise XRP ETFs launch Nov 18-20, signaling institutional interest. - XRP stabilizes near $2 support but faces pressure from mixed technical indicators. - $15.8M ETF inflow amid volatility highlights uncertain market dynamics for altcoins.

PENGU Token's Technical Surge and Changing Market Sentiment: An In-Depth Analysis of Altcoin Trends Amid Market Volatility

- PENGU Token shows conflicting technical signals: bullish liquidity clusters and bearish RSI amid volatile price swings. - Market context reveals ETF-driven inflows favoring XRP over Solana , highlighting institutional preference for regulatory clarity. - PENGU faces structural risks including regulatory uncertainties, USDT dependency, and whale outflows despite short-term accumulation. - Technical analysis remains a double-edged sword, requiring balanced evaluation of momentum indicators and broader mark

PENGU USDT Sell Alert: Is This a Strategic Withdrawal or Just a Market Pullback?

- PENGU USDT's November 2025 sell signal sparked debate over market correction vs. strategic exits amid liquidity imbalances and regulatory risks. - Team wallet outflows ($66.6M) contrasted with retail inflows, creating fragile equilibrium as investors anticipated liquidity crunches. - AI-driven stablecoin tools accelerated PENGU-to-USDT conversions, reflecting risk mitigation amid volatile markets and looming regulations. - Regulatory pressures (GENIUS Act, MiCA) and PENGU's NFT-based model vulnerabilitie