HBAR Price Needs A Near 40% Rally To Recover November Losses

Hedera (HBAR) has been trading sideways for several days, with the altcoin struggling to gather enough momentum to stage a meaningful recovery. After a steep drop this month, HBAR is waiting for a decisive catalyst to break its stagnation. However, the support needed to drive that recovery appears limited, and the broader market’s uncertainty is

Hedera (HBAR) has been trading sideways for several days, with the altcoin struggling to gather enough momentum to stage a meaningful recovery. After a steep drop this month, HBAR is waiting for a decisive catalyst to break its stagnation.

However, the support needed to drive that recovery appears limited, and the broader market’s uncertainty is not helping its case.

Hedera Traders Are Placing Shorts

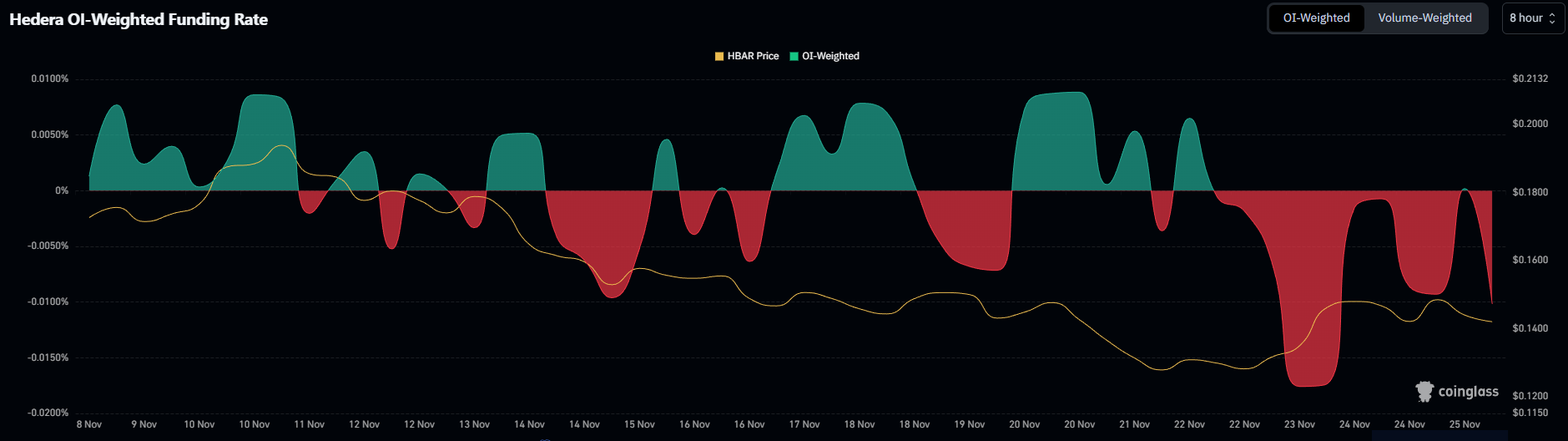

Funding rates across major exchanges indicate that traders remain hesitant. The current negative funding rate suggests that market participants expect more downside and are opening short positions to profit from a potential decline. This type of sentiment often emerges during extended consolidation phases, where traders lose confidence in the asset’s ability to rebound.

However, funding rates are highly reactive and can shift quickly. Their frequent fluctuations signal volatility and uncertainty rather than a firmly bearish trend. If sentiment flips and traders begin to unwind shorts, HBAR could benefit from a sudden surge in buying pressure, helping it regain lost ground.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

HBAR Funding Rate. Source:

Coinglass

HBAR Funding Rate. Source:

Coinglass

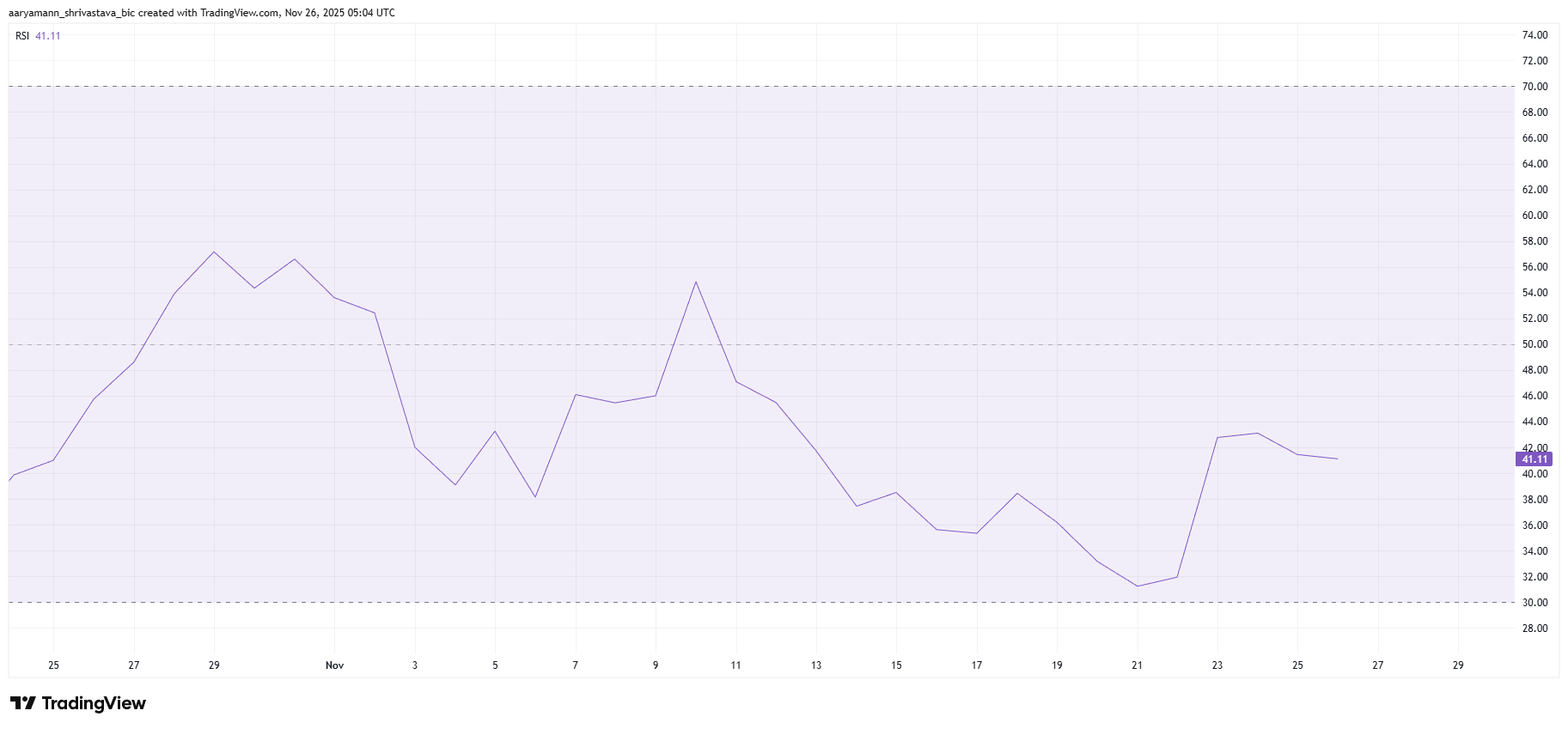

The broader momentum picture remains weak. Hedera’s relative strength index is sitting below the neutral 50.0 level, firmly in bearish territory. This positioning reflects ongoing market pressure and a lack of strong bullish conviction. When the RSI holds in the negative zone, price action often struggles to form higher highs or generate sustainable rallies.

The persistent market-wide caution also weighs on HBAR’s ability to mount a recovery. Unless momentum indicators shift upward, the altcoin could remain stuck in its current range.

HBAR RSI. Source:

TradingView

HBAR RSI. Source:

TradingView

HBAR Price Has A Long Way To Go

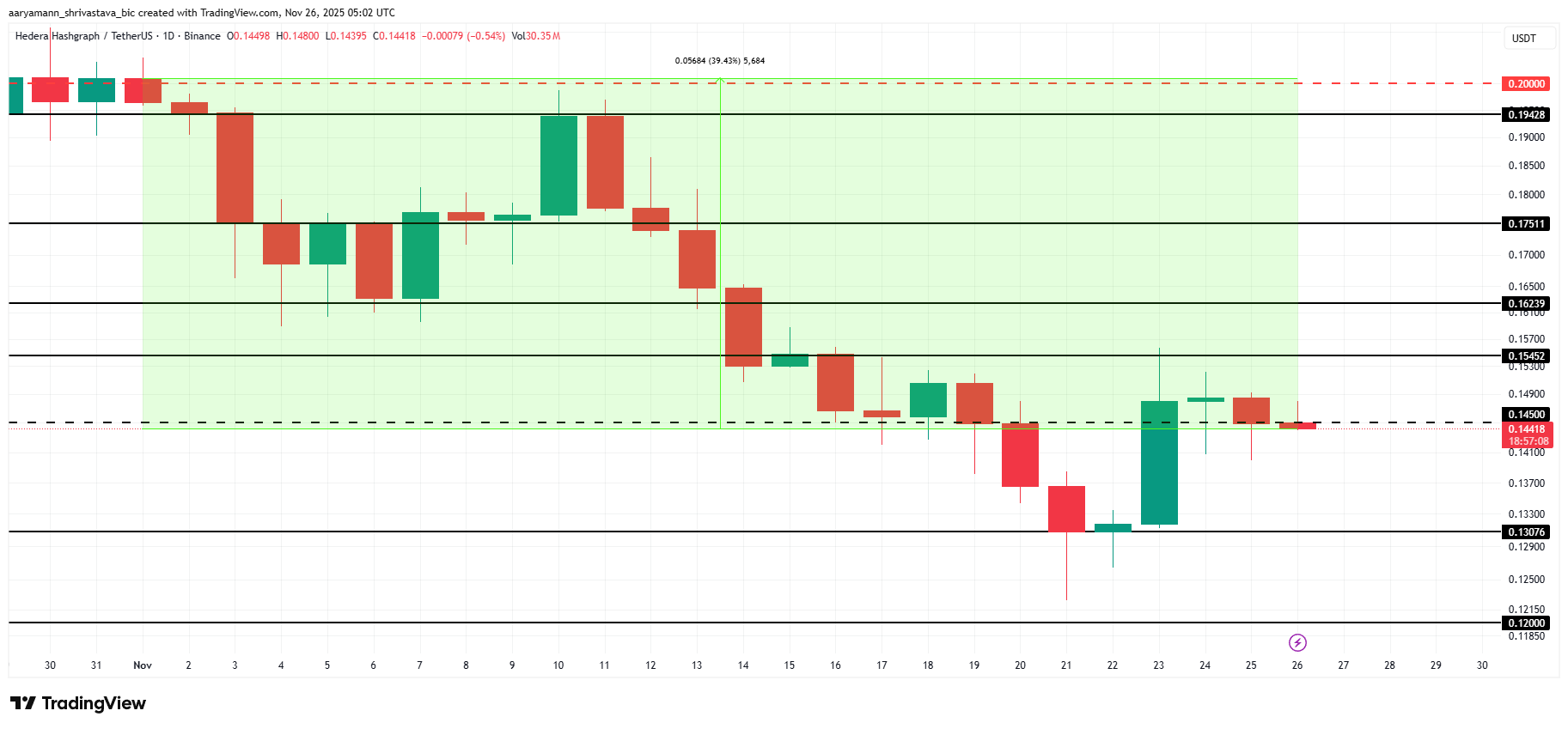

HBAR is trading at $0.144, sitting just under the important $0.145 resistance level. To begin a meaningful climb, the altcoin must flip this resistance into support. This would allow it to move toward $0.154 — a level that has previously acted as a ceiling.

Based on current indicators, HBAR may continue consolidating between $0.154 and $0.130. Bearish sentiment and weak macro signals suggest the altcoin could remain trapped in this zone unless a strong catalyst emerges.

HBAR Price Analysis. Source:

TradingView

HBAR Price Analysis. Source:

TradingView

To recover its November losses, HBAR needs roughly a 40% rally, pushing it toward the $0.200 region. This requires breaking through several resistance levels, starting with $0.154. If HBAR can reclaim that barrier, a move to $0.162 and higher becomes possible, giving the altcoin a chance to invalidate the bearish thesis.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Uniswap News Today: Addressing DeFi's Value Gap: Uniswap's Debated Fee Restructuring

- Uniswap's UNIfication proposal redirects trading fees to a "token jar," enabling UNI holders to burn tokens for assets, aiming to align protocol growth with token value. - The plan includes a 100M UNI retroactive burn (16% of supply) and Layer-2 integration to sustain supply reduction, addressing DeFi's historic disconnect between usage and token valuation. - Critics warn liquidity providers may lose earnings, while a UK whale's $10M short positions highlight market skepticism despite community debates o

Ethereum Updates: ETF Investments Surge Amid Falling Prices and Shrinking Crypto Liquidity

- Fundstrat's Tom Lee warns October liquidations have crippled crypto liquidity, worsening volatility and investor uncertainty amid Ethereum's mixed ETF inflows and price declines. - Ethereum spot ETFs (e.g., ETHA, FETH) gained $175M in November despite 30% price drops, highlighting fragmented liquidity between institutional inflows and bearish on-chain metrics. - Macroeconomic risks (Fed policy, fiscal uncertainty) and $5B+ crypto outflows amplify pressure on Ethereum, which struggles to reclaim $3,000 am

Institutions Balance Innovation and Regulatory Demands as Crypto Market Grows by $11.2B

- Bitmine Immersion's $11.2B crypto-cash portfolio surge and 3.85% pre-market share rise signal institutional confidence in multichain innovation and volatility hedging. - Coinbase's DeFi expansion via Vector acquisition and token sales platform contrasts with 8.92% weekly stock decline amid Bitcoin ETF revenue concerns and stablecoin commercialization debates. - DWF Labs' $75M institutional-grade DeFi fund targeting $120B TVL and projects like Lumint's AI-staking hybrid model highlight infrastructure inno

Zcash News Today: Zcash's Privacy Features Thrive Despite Regulatory Challenges

- Zcash (ZEC) sees 560% surge in transaction fees to $47.5M, ranking fourth in layer-one blockchain revenue. - Price jumps 40% in Nov 2025, market cap grows from $1B to $7B as privacy demand outpaces regulatory crackdowns. - Grayscale files Zcash ETF (ZCSH) proposal, mirroring Bitcoin strategy to institutionalize privacy-focused crypto. - EU/2027 privacy coin phaseout and exchange restrictions on ZEC/XMR/DASH heighten liquidity risks amid legal uncertainties. - Analysts debate Zcash's rally as either "resp