Investing in Educational Facilities: The Overlooked Driver of Sustainable Economic Expansion

- Education infrastructure emerges as a high-impact, undervalued investment, addressing social inequities while driving measurable economic growth through workforce readiness and GDP gains. - U.S. student-counselor ratios (385:1) highlight systemic underfunding, with improved access correlating to 90% graduation rates and long-term economic benefits like reduced social service reliance. - EdTech's $146B→$549.6B market growth (2023–2033) and AI-driven innovations position it as a core infrastructure subset,

The Strain on Student Support and Its Broader Economic Effects

In the United States, the ratio of students to school counselors remains a significant concern, with

The benefits of investing in school counseling go beyond just graduation statistics.

EdTech: A Rapidly Expanding Segment of Education Infrastructure

Educational technology, or EdTech, has become a fundamental part of today’s infrastructure, with the worldwide market

Those interested in tapping into this growth may look at the Global X Education ETF (EDUT), which follows companies engaged in digital education and content. Although EDUT does not directly invest in grant-based initiatives, its emphasis on scalable EdTech aligns with major policy directions, such as the

Investing Through Policy: Grants and Infrastructure Funds

Government policies at both federal and state levels are transforming the landscape of education infrastructure, opening doors for investors interested in public-private collaborations. The Education Innovation and Research (EIR) program, for example,

For those seeking indirect access to global education markets, policy-driven options like the Global Partnership for Education (GPE) are available. GPE is aiming to raise $5 billion for 2021–2025 to enhance education in low-income nations, leveraging both domestic resources and private-sector involvement. In the U.S., state-level efforts—such as Tennessee’s initiative to align academic programs with labor market needs—demonstrate the potential of regional education infrastructure funds.

Why Education Infrastructure Is a Smart Long-Term Bet

The attractiveness of education infrastructure lies in its ability to both reduce social disparities and generate financial gains. For instance, the One Big Beautiful Bill Act (OBBB) connects school counseling with workforce development by making Workforce Pell Grants available for vocational education. This approach not only improves student success but also helps build a skilled workforce, directly contributing to higher productivity and economic output.

Additionally, the increasing involvement of private equity in education highlights the sector’s durability. With the global education industry

Conclusion: Education Infrastructure as a Strategic Investment Priority

Education infrastructure represents more than just a social initiative—it serves as a driver of economic advancement. By supporting the expansion of school counseling, fostering EdTech breakthroughs, and investing in policy-aligned funds, investors can benefit from a sector on the verge of major change. As the U.S. faces counselor shortages and the conclusion of pandemic relief, and as the global need for skilled workers intensifies, education infrastructure stands out for its unique combination of social impact and financial opportunity. For proactive investors, the potential rewards are significant—and the moment to act is now.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto News Today: Why Is the Crypto Market Down Today?

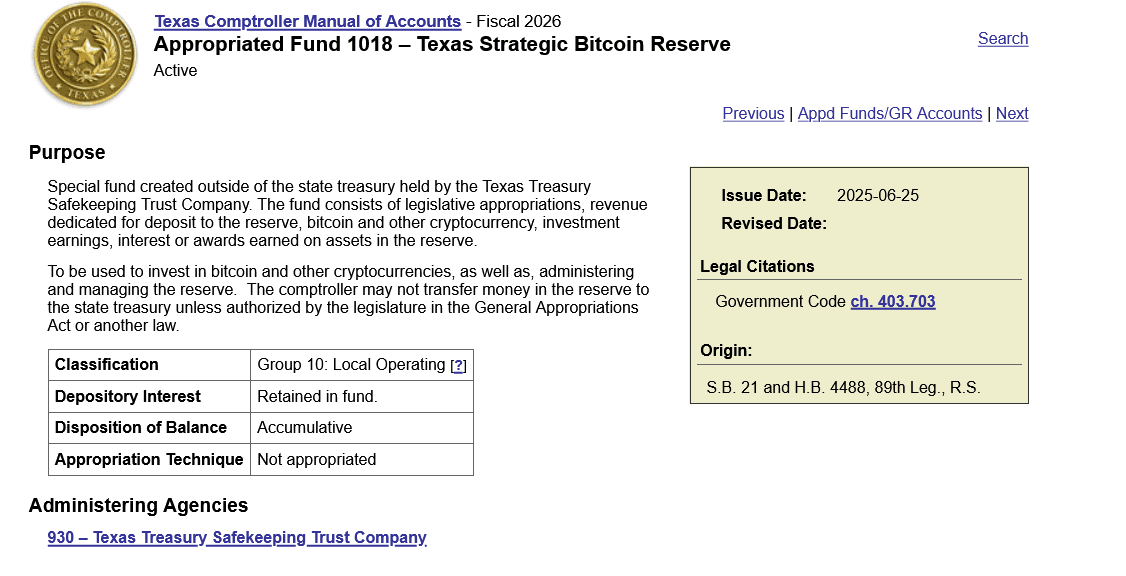

Texas Spends $5 Million on Bitcoin. Here’s Why

Bitcoin News Update: Institutions Take the Lead or Decentralization Prevails? The $13 Billion Dilemma in Crypto

- Deribit's $13B Bitcoin options expiry highlights institutional crypto dynamics, with ETF flows, self-custody shifts, and regulatory moves shaping market volatility. - Bitcoin ETFs show mixed trends: BlackRock's IBIT faces $1.425B outflows but sees $60.6M inflows as Texas buys $10M in strategic Bitcoin reserves. - Ethereum ETFs gain $96.67M net inflows after outflow streak, while BlackRock's staked Ethereum ETF filing sparks debates over decentralization risks. - Market eyes expiry outcomes as Fed rate-cu

Bitcoin Updates: While Bitcoin Falters, Altcoins Resist the Slump Amid $226M Crypto Market Turmoil

- $226M crypto liquidations triggered by ETF outflows, thin liquidity, and leveraged unwinds reshaped trading dynamics. - Bitcoin and Ethereum suffered major losses while XRP and ZEC rebounded amid oversold conditions and buyer exhaustion. - Market cap dipped below $3T as $1.91B in leveraged positions closed, including $929M in Bitcoin longs and $36.78M in Hyperliquid losses. - Altcoin rallies and stablecoin liquidity contraction highlighted fragile market structure requiring $1B/week inflows for Bitcoin r