Bitcoin News Update: Blockrise Leverages MiCA Framework: Introducing Institutional Bitcoin Lending in the EU

- Blockrise, a Dutch Bitcoin startup, became the first EU firm to secure a MiCA regulatory license, enabling fully compliant Bitcoin services across Europe. - The company offers custody, trading, and asset management, plus Bitcoin-backed loans for businesses, with an 8% interest rate and monthly reviews. - MiCA currently excludes lending but provides compliance foundations, with CEO Jos Lazet anticipating future expansion to cover loans and mining. - Blockrise’s semi-custodial wallet model balances securit

Blockrise, a Bitcoin-focused startup based in the Netherlands, has achieved a milestone by becoming the first to obtain a regulatory license under the European Union’s Markets in Crypto-Assets (MiCA) regulations,

Blockrise is pushing boundaries beyond standard custody solutions. The company now offers a Bitcoin-collateralized lending product for businesses, with loan amounts starting at 20,000 euros ($23,150). Companies can use their Bitcoin as collateral to access financing, with an initial interest rate set at 8%,

MiCA, which will be fully enforced by late 2024, governs crypto issuance and trading but does not yet address lending, DeFi, or mining activities. Lazet remains hopeful about future developments. “MiCA hasn’t covered every aspect yet, but it’s anticipated to broaden in the future to include lending, mining, payments, and more,” he commented. This outlook fits with the EU’s broader goal of encouraging innovation while safeguarding consumers.

Blockrise’s business model utilizes a “semi-custodial wallet structure,” allowing users to maintain control via a digital key instead of a traditional private key. The company uses hardware security modules to create Bitcoin wallets, and

The company’s progress under MiCA demonstrates the EU’s increasing acceptance of crypto innovation. At the same time, other ventures such as Pi Network are also using MiCA compliance to expand into European markets.

Blockrise’s achievement sets an example for startups navigating complex regulations to grow their services. By prioritizing compliance and innovation, the company is well-positioned to benefit from the EU’s growing crypto sector, and its lending product addresses a key need in institutional finance.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto News Today: Why Is the Crypto Market Down Today?

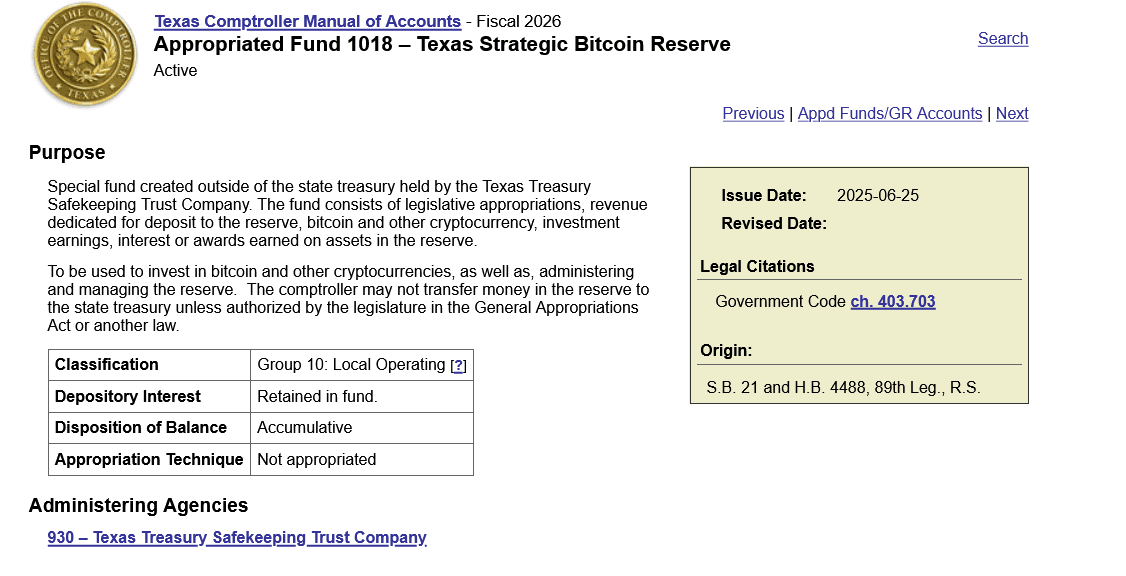

Texas Spends $5 Million on Bitcoin. Here’s Why

Bitcoin News Update: Institutions Take the Lead or Decentralization Prevails? The $13 Billion Dilemma in Crypto

- Deribit's $13B Bitcoin options expiry highlights institutional crypto dynamics, with ETF flows, self-custody shifts, and regulatory moves shaping market volatility. - Bitcoin ETFs show mixed trends: BlackRock's IBIT faces $1.425B outflows but sees $60.6M inflows as Texas buys $10M in strategic Bitcoin reserves. - Ethereum ETFs gain $96.67M net inflows after outflow streak, while BlackRock's staked Ethereum ETF filing sparks debates over decentralization risks. - Market eyes expiry outcomes as Fed rate-cu

Bitcoin Updates: While Bitcoin Falters, Altcoins Resist the Slump Amid $226M Crypto Market Turmoil

- $226M crypto liquidations triggered by ETF outflows, thin liquidity, and leveraged unwinds reshaped trading dynamics. - Bitcoin and Ethereum suffered major losses while XRP and ZEC rebounded amid oversold conditions and buyer exhaustion. - Market cap dipped below $3T as $1.91B in leveraged positions closed, including $929M in Bitcoin longs and $36.78M in Hyperliquid losses. - Altcoin rallies and stablecoin liquidity contraction highlighted fragile market structure requiring $1B/week inflows for Bitcoin r