The Growing Investment Potential in Education: Addressing School Counselor Deficits and Policy-Led Revitalization

- U.S. schools face severe counselor shortages, with 60% of districts unable to meet student mental health needs despite rising demand. - Federal grants ($280M in 2025) and state initiatives like New York’s SBHCs aim to expand access through training, staffing, and regionalized resource-sharing models. - The 2025 Mental Health Excellence Act targets workforce gaps by subsidizing graduate training for counselors, aligning with ASCA’s 250:1 student-to-counselor ratio goals. - Investors see long-term opportun

The Crisis in Counselor Availability

The shortage of counselors is severe. Data from KFF shows that in the 2024–2025 school year, just 18% of students accessed mental health support at school, while

Policy-Driven Infrastructure Reforms

New federal and state measures are starting to tackle these issues.

On the state level, initiatives like New York’s school-based health centers (SBHCs) showcase how infrastructure can be leveraged for better outcomes. SBHCs deliver a range of health and behavioral services, especially in rural communities with limited resources. Still,

Federal Funding and Legislative Mandates

The 2025 School-Based Mental Health (SBMH) Services Grant Program highlights the federal government’s dedication to expanding mental health access. These competitive grants are directed at states and districts facing the most severe shortages. For instance, West Virginia’s IMPACT Initiative received $3.03 million-

On the legislative front, the Mental Health Excellence in Schools Act, reintroduced in 2025, seeks to resolve the underlying issue: a shortage of trained mental health professionals.

Long-Term Investment Implications

For investors, the alignment of policy and infrastructure spending marks a fundamental change in the education industry. The need for mental health services is expected to rise as student challenges become more complex.

Additionally, the move toward regional and cooperative strategies points to potential in platforms that support resource sharing. Digital solutions for universal mental health screenings or telehealth services linking rural schools with specialists could see growth thanks to supportive policies. However, the vulnerability of rural infrastructure also presents risks—such as unstable funding—that require thorough evaluation.

Conclusion

The shortage of school counselors has evolved into a widespread challenge with clear policy-driven responses. Federal grants, new laws, and creative infrastructure approaches are coming together to build a more robust educational system. For investors, this is a rare chance to benefit from sustained growth in educational and mental health services, supported by bipartisan backing and a growing understanding that mental health is essential for academic achievement.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto News Today: Why Is the Crypto Market Down Today?

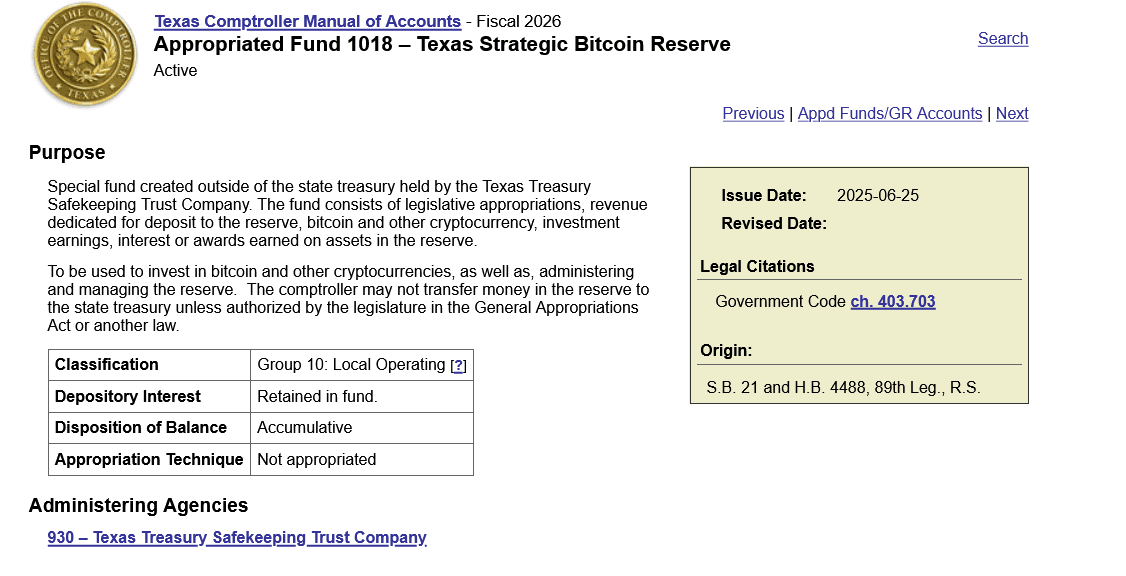

Texas Spends $5 Million on Bitcoin. Here’s Why

Bitcoin News Update: Institutions Take the Lead or Decentralization Prevails? The $13 Billion Dilemma in Crypto

- Deribit's $13B Bitcoin options expiry highlights institutional crypto dynamics, with ETF flows, self-custody shifts, and regulatory moves shaping market volatility. - Bitcoin ETFs show mixed trends: BlackRock's IBIT faces $1.425B outflows but sees $60.6M inflows as Texas buys $10M in strategic Bitcoin reserves. - Ethereum ETFs gain $96.67M net inflows after outflow streak, while BlackRock's staked Ethereum ETF filing sparks debates over decentralization risks. - Market eyes expiry outcomes as Fed rate-cu

Bitcoin Updates: While Bitcoin Falters, Altcoins Resist the Slump Amid $226M Crypto Market Turmoil

- $226M crypto liquidations triggered by ETF outflows, thin liquidity, and leveraged unwinds reshaped trading dynamics. - Bitcoin and Ethereum suffered major losses while XRP and ZEC rebounded amid oversold conditions and buyer exhaustion. - Market cap dipped below $3T as $1.91B in leveraged positions closed, including $929M in Bitcoin longs and $36.78M in Hyperliquid losses. - Altcoin rallies and stablecoin liquidity contraction highlighted fragile market structure requiring $1B/week inflows for Bitcoin r