Bitcoin Updates: Abu Dhabi's Investment in Bitcoin Grows Threefold as the UAE Adopts a Digital Gold Approach

- Abu Dhabi's ADIC triples Bitcoin ETF stake to $518M, positioning UAE as top sovereign holder via U.S. ETFs. - Strategic shift from oil revenue to "digital gold" coincides with BTC's $86,600 level and $238M ETF inflow reversal. - Analysts flag $88,000 as critical resistance for bullish momentum, while XRP traders profit from November rebounds. - Institutional/retail dynamics shape BTC's outlook, with 4-year cycle risks and $90,000 threshold defining near-term direction.

Bitcoin's latest price movements have sparked fresh interest as both institutional investors and market experts assess its direction in an unpredictable environment. During the third quarter of 2025, the Abu Dhabi Investment Council (ADIC) increased its holdings in BlackRock's

These ETF investments have occurred as Bitcoin attempts to overcome significant resistance points.

Institutional trust in digital assets is not limited to ETFs.

The dynamic between institutional and retail participants is influencing Bitcoin's short-term prospects. While ETF inflows and the S&P 500's current position—just 2% below its all-time high—point to market strength, there are still risks to the downside.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto News Today: Why Is the Crypto Market Down Today?

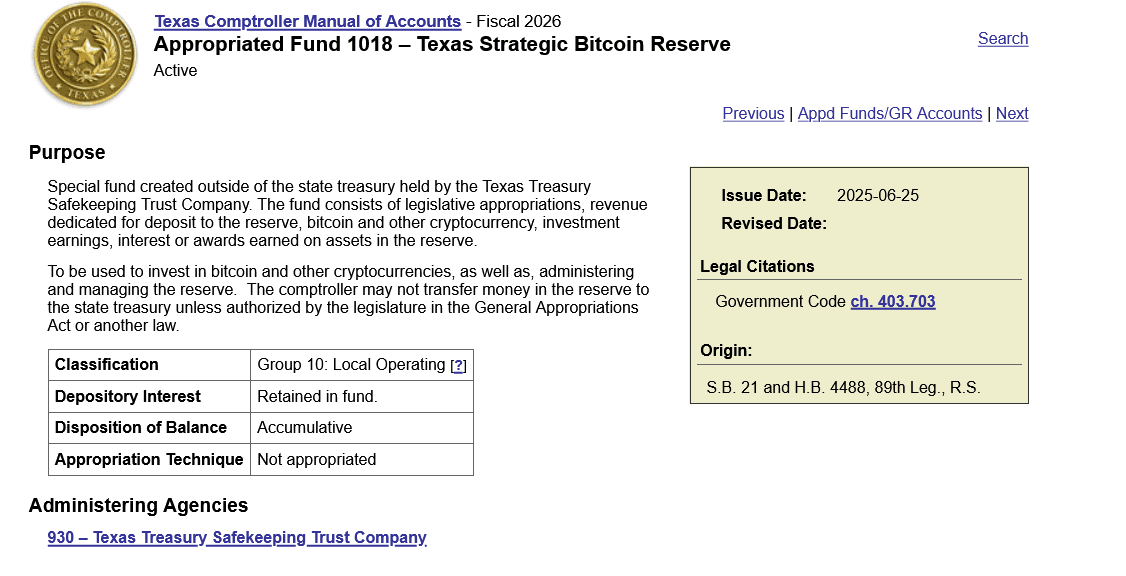

Texas Spends $5 Million on Bitcoin. Here’s Why

Bitcoin News Update: Institutions Take the Lead or Decentralization Prevails? The $13 Billion Dilemma in Crypto

- Deribit's $13B Bitcoin options expiry highlights institutional crypto dynamics, with ETF flows, self-custody shifts, and regulatory moves shaping market volatility. - Bitcoin ETFs show mixed trends: BlackRock's IBIT faces $1.425B outflows but sees $60.6M inflows as Texas buys $10M in strategic Bitcoin reserves. - Ethereum ETFs gain $96.67M net inflows after outflow streak, while BlackRock's staked Ethereum ETF filing sparks debates over decentralization risks. - Market eyes expiry outcomes as Fed rate-cu

Bitcoin Updates: While Bitcoin Falters, Altcoins Resist the Slump Amid $226M Crypto Market Turmoil

- $226M crypto liquidations triggered by ETF outflows, thin liquidity, and leveraged unwinds reshaped trading dynamics. - Bitcoin and Ethereum suffered major losses while XRP and ZEC rebounded amid oversold conditions and buyer exhaustion. - Market cap dipped below $3T as $1.91B in leveraged positions closed, including $929M in Bitcoin longs and $36.78M in Hyperliquid losses. - Altcoin rallies and stablecoin liquidity contraction highlighted fragile market structure requiring $1B/week inflows for Bitcoin r