Bitcoin Mining Survival Threshold: How Miners are Adapting to a 35% Profit Plunge

Bitcoin Price Drop, Mining Difficulty and Costs Rise, Pushing Many Miners Near Breakeven Point, Forcing Them to Rely on HODLing and External Financing to Sustain Operations

Original Title: The Miners's Mirage

Original Author: Prathik Desai, Token Dispatch

Original Translation: Chopper, ForesightNews

The financial logic of Bitcoin miners is quite simple: they rely on a fixed protocol reward for their survival but have to deal with fluctuating real-world expenses. When the market is volatile, they are the first to feel the pressure on their balance sheets. Miners' revenue comes from selling the mined Bitcoins, while the operational costs mainly consist of electricity for running the heavy-duty computers for mining.

This week, I tracked some key data of Bitcoin miners: the network's reward to miners, the cost of earning this income, the remaining profit after deducting cash expenses, and the final net profit after accounting.

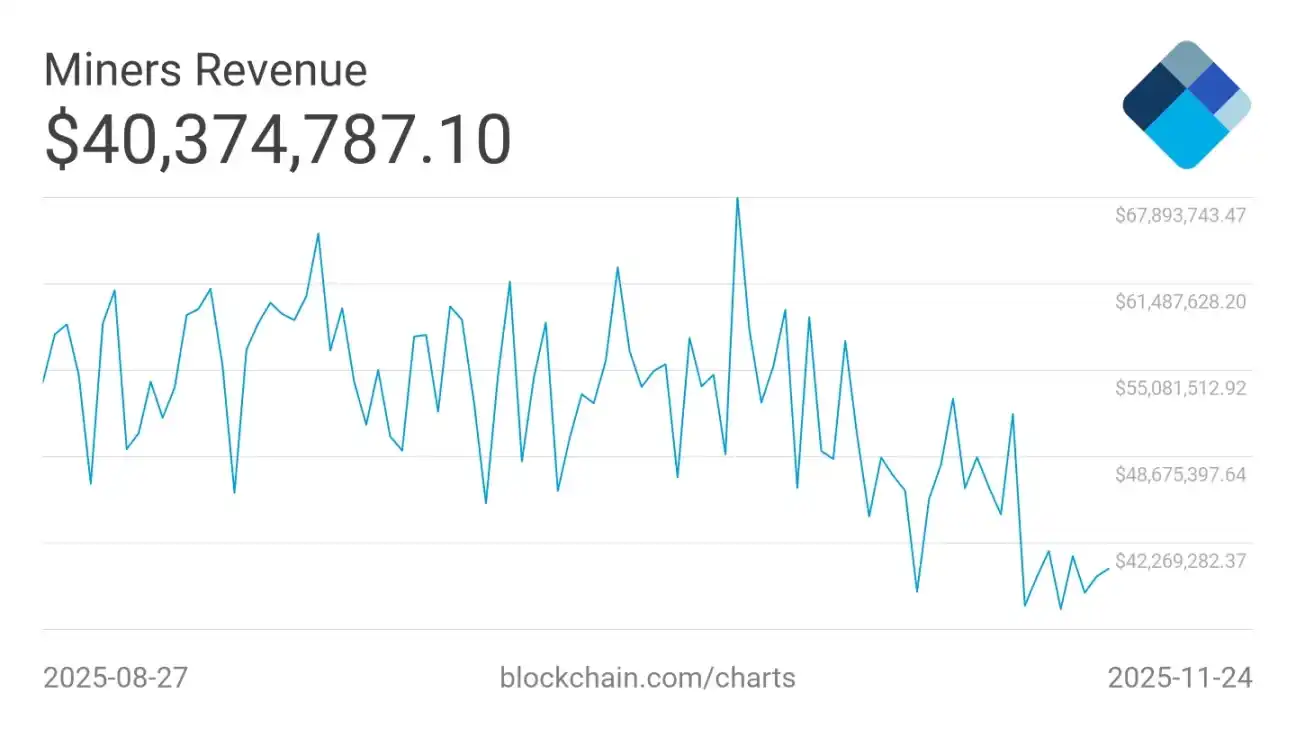

At the current Bitcoin price below $90,000, miners are in distress. Over the past two months, the 7-day average miner revenue has dropped by 35% from $60 million to $40 million.

Let me break down the key logic in detail.

Bitcoin's revenue mechanism is fixed and coded into the protocol. The mining reward for each block is 3.125 Bitcoins, with an average block time of 10 minutes, producing approximately 144 blocks per day, equivalent to a daily total network mining output of about 450 Bitcoins. Calculated over 30 days, global Bitcoin miners collectively mine 13,500 Bitcoins, valued at about $1.2 billion at the current $88,000 Bitcoin price. However, if this income is distributed among the record 1078 EH/s (exahashes) of hash rate, the final income per TH/s (terahash) of hash rate per day is only 3.6 cents, supporting the entire economic foundation of this $1.7 trillion network security. (Note: 1 EH/s = 10^18 H/s; 1 TH/s = 10^12 H/s)

In terms of costs, electricity is the most critical variable, with its cost depending on the mining location and machine efficiency.

If modern mining machines of the S21 class are used (power consumption of 17 joules per terahash) and access to cheap electricity is available, miners can still achieve cash profitability. However, if the mining operation relies on older equipment or has to pay high electricity prices, each hash calculation will increase the cost. At the current hash price (influenced by network difficulty, Bitcoin price, block subsidy, and transaction fees), an S19 miner, if using electricity priced at $0.06 per kWh, can barely break even. Once the network difficulty increases, Bitcoin price slightly drops, or electricity prices surge, its economic viability will further deteriorate.

Let me analyze this with some specific data.

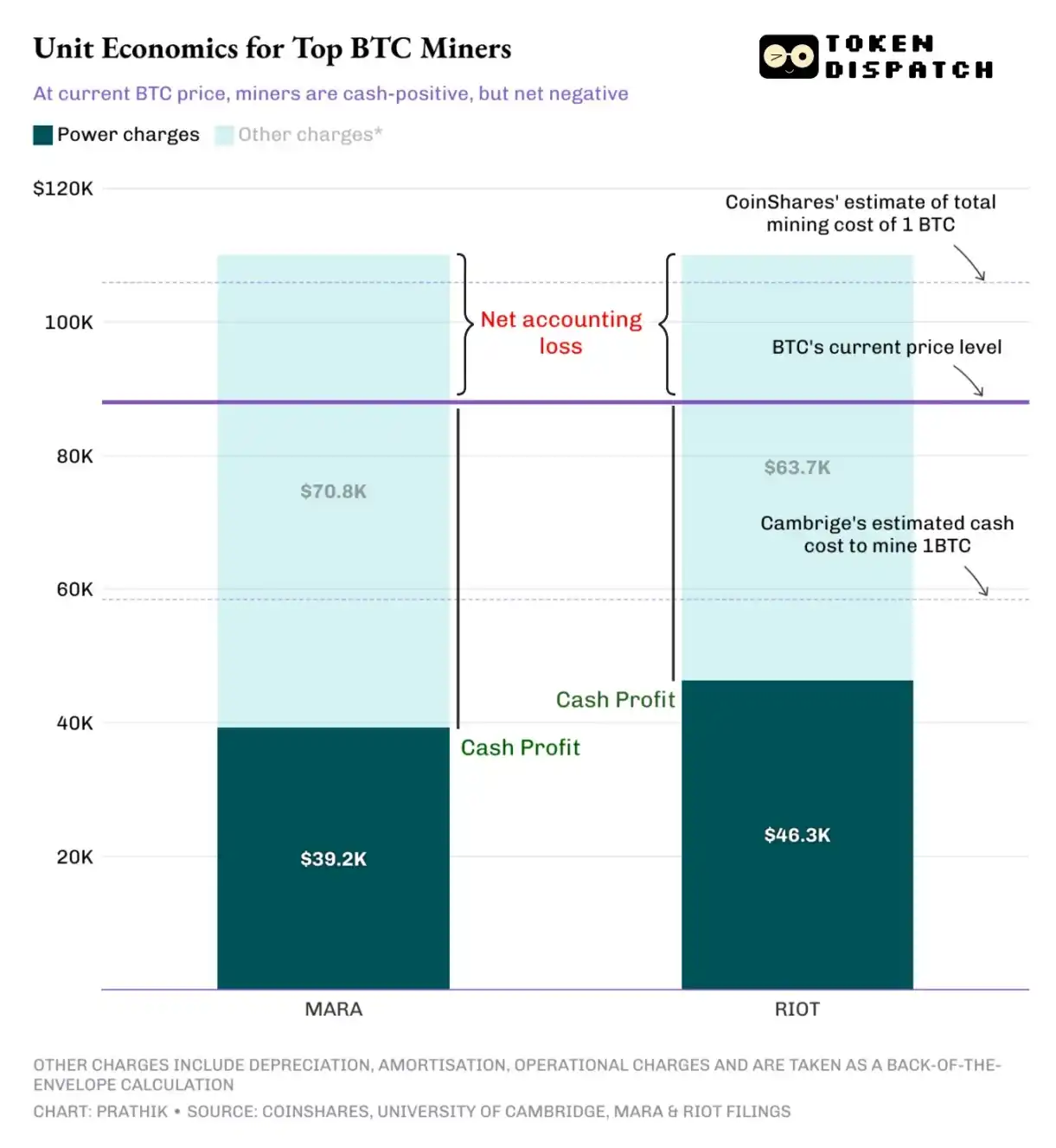

In December 2024, CoinShares estimated that the cash cost for a publicly listed mining company to mine 1 Bitcoin in the third quarter of 2024 was approximately $55,950. Today, the University of Cambridge's estimate has risen to around $58,500. The actual mining costs vary among different miners: Marathon Digital, the world's largest publicly listed Bitcoin mining company (ticker symbol MARA), has an average energy cost of $39,235 per Bitcoin mined in the third quarter of 2025; the second-largest listed mining company, Riot Blockchain (ticker symbol RIOT), has a cost of $46,324. Despite a 30% drop in the Bitcoin price from its peak to $86,000, these mining companies are still profitable. However, this is not the whole truth.

Miners also need to consider non-cash expenses, including depreciation, impairment, and stock option compensation, which collectively make mining a capital-intensive industry. Once these costs are taken into account, the total cost of mining 1 Bitcoin can easily exceed $100,000.

Top Mining Companies Marathon and Riot's Mining Costs

MARA uses both self-owned mining machines and third-party hosted equipment for mining. MARA incurs electricity, depreciation, and hosting costs. A rough calculation shows that its total mining cost per Bitcoin exceeds $110,000. Even CoinShares' estimated total mining cost in December 2024 was approximately $106,000.

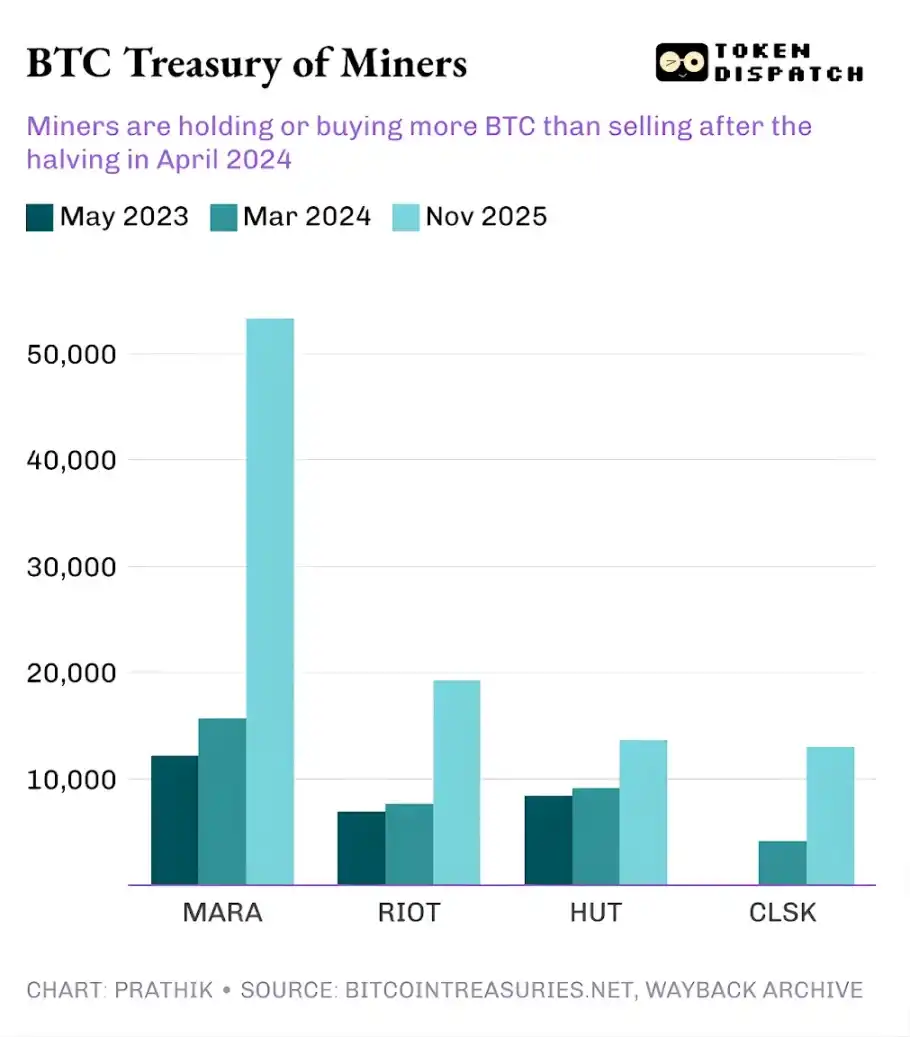

At first glance, the Bitcoin mining industry appears robust. The cash profit margin is high, accounting profitability is achievable, and the operating scale is large enough to easily raise funds. However, upon deeper analysis, you will understand why more and more miners are choosing to hold the mined Bitcoins, or even accumulate more Bitcoins from the market, rather than selling immediately.

Top Mining Companies' Bitcoin Reserves

Strong mining companies like MARA can cover their costs because they have ancillary businesses and access to the capital markets. However, many other mining companies may face losses as soon as the network difficulty increases again.

Overall, the mining industry has two coexisting profit and loss equilibrium scenarios:

The first is large-scale industrial miners, who have efficient mining machines, cheap electricity, and a strong balance sheet. For them, the daily cash flow turns negative only when the Bitcoin price drops from $86,000 to $50,000. Currently, their cash profit per mined Bitcoin exceeds $40,000, but whether they can achieve accounting profitability at the current price level varies by miner.

The second is the rest of the mining community, who will struggle to maintain a profit and loss equilibrium once depreciation, impairment, and stock option expenses are taken into account.

Even with a conservative estimate of the total cost per Bitcoin ranging from $90,000 to $110,000, many miners have already fallen below the economic breakeven point. They continue mining because the cash cost has not been breached, but the accounting cost is exceeding the threshold. This may lead more miners to choose to hold Bitcoin rather than sell at current prices.

As long as the cash flow remains positive, miners will continue to mine. At a price level of $88,000, the entire system appears stable, but this is predicated on miners not selling Bitcoin. If the price of Bitcoin further drops or miners are forced to liquidate their holdings, they will approach the breakeven point.

Therefore, although a price crash will continue to impact retail and trading groups, it is currently less likely to hurt miners. However, if miners' financing channels become more restricted, the situation could deteriorate, leading to a breakdown of the growth flywheel, forcing miners to increase investment in ancillary businesses to sustain operations.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

S&P Global: Downgrades USDT's ability to be pegged to the US dollar to the lowest rating.

Cryptocurrency market maker Portofino Technologies faces another wave of employee departures.

McKinsey: Artificial intelligence spending may limit the Fed's rate cuts in 2026