JPMorgan Offers Capped Upside Notes Tied to Bitcoin ETF Performance

Quick breakdown:

- JPMorgan’s new structured notes link returns to BlackRock’s iShares Bitcoin Trust IBIT, offering at least 16% if the ETF clears preset levels in a year and up to 1.5x BTC upside by 2028.

- Gains are capped, principal is only protected to about a 30% drawdown, and investors take on JPMorgan credit and liquidity risk.

- Buyers are exposed to JPMorgan’s issuer credit risk since the instruments are unsecured obligations, and secondary liquidity is typically limited to over-the-counter dealing.

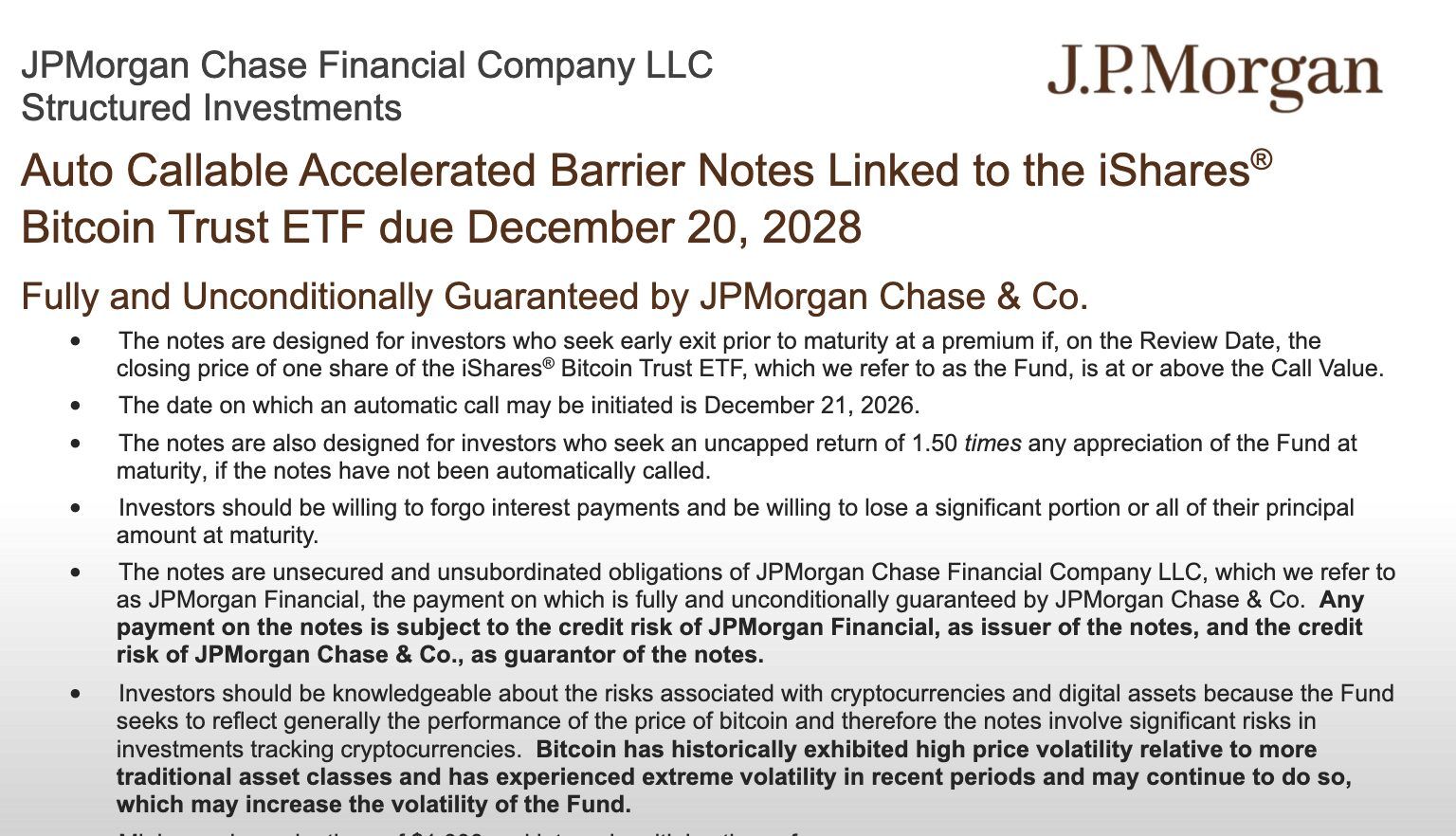

JPMorgan has structured a new batch of Bitcoin-linked notes that could deliver amplified returns if BTC and IBIT rally into 2028, while exposing investors to capped upside, conditional protection, and the bank’s own credit profile. The issuance underscores Wall Street’s push to package Bitcoin exposure into familiar securities instead of direct spot holdings.

The notes tie their performance to BlackRock’s iShares Bitcoin Trust IBIT, a spot Bitcoin ETF that already holds tens of billions of dollars in assets under management. Investors buy the notes at a fixed price and receive payouts based on IBIT’s level at specific dates rather than traditional coupons.

Source

:

SEC

Source

:

SEC

How the Bitcoin-linked notes work

According to term sheets, the structure typically combines an auto-call feature after about one year with a final maturity in 2028, creating two key decision points for returns.

If IBIT trades at or above a set threshold on the early observation date, the notes get called, and investors receive a mid-teens return, usually around 16% on their principal. If IBIT finishes below that mark, the notes stay in place until 2028 and then track the ETF with an enhanced upside, typically about 1.5x, up to a maximum cap. On the downside, principal is generally protected only as long as IBIT doesn’t drop more than about 30% from its starting level. If it falls beyond that, investors begin taking losses and could see a substantial hit to their capital.

Because the instruments are unsecured obligations, buyers also rely on JPMorgan’s ability to honour payments at maturity, adding issuer credit risk to Bitcoin’s price volatility. Secondary liquidity is typically limited to over-the-counter dealing, which can make exiting the position before maturity difficult or costly.

Who these products target and why they matter

The notes are aimed at investors who expect Bitcoin to grind higher over the next few years but prefer a packaged security linked to a regulated ETF rather than direct crypto custody or derivatives trading. They can fit mandates that allow exposure to bank notes and listed ETFs while still providing a defined payoff profile tied to BTC performance.

At the same time, the design converts a simple asset into a complex payoff that blends options, barriers, and credit, requiring investors to understand scenarios across 2026 and 2028 before allocating capital. The launch adds to a broader shift in which banks use ETF-linked notes to intermediate Bitcoin exposure, signalling that BTC is being treated as a strategic reference asset inside traditional fixed-income and structured-product desks rather than a fringe speculation.

Meanwhile, JPMorgan’s Kinexys unit is piloting JPMD, a permissioned deposit token on the Base Layer 2 network, for institutional clients. This digital representation of commercial bank money offers a regulated, efficient 24/7 on-chain payment alternative to stablecoins. This move signals JPMorgan’s belief that regulated deposit products will be central to the future of digital finance.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum News Today: Ethereum's 60 Million Gas Spike: Major Milestone or Foreshadowing $80,000?

- Ethereum’s gas limit hits 60M, supported by 513K+ validators, boosting scalability ahead of Fusaka. - Vitalik Buterin highlights targeted gas cost hikes for inefficient operations to incentivize smart contract optimization. - zkSync’s Airbender innovation enables faster proof generation, paving the way for future gas limit expansions. - Fusaka upgrade (2025) aims to solidify Ethereum’s economic model, with long-term gas targets up to 150M via EIPs. - Despite $2,859 price, analysts project $80K potential

Australia Connects Conventional and Digital Finance Through Groundbreaking Cryptocurrency Regulations

- Australia introduces 2025 Digital Assets Framework Bill, requiring crypto exchanges and custodians to obtain AFSL and operate under ASIC oversight. - The legislation creates two license types: "digital asset platform" for crypto trading and "tokenized custody platform" for real-world asset tokens, with tailored compliance standards. - Small operators with <$5,000 per customer and <$10M annual volume get lighter requirements, aiming to balance innovation with consumer protection. - Projected to unlock $24

Security Systems Technology and ICP Network Expansion: A Cybersecurity-Focused Path Forward for Decentralized Infrastructure

- ICP's decentralized identity and encryption address cybersecurity gaps, enabling secure financial behavior through blockchain innovations. - Cross-chain interoperability with Bitcoin/Ethereum via Chain Fusion drives DeFi growth, unlocking $B+ liquidity through trustless swaps. - Institutional adoption and 30% 2025 price growth reflect ICP's appeal, bolstered by Azure/Google partnerships and 1.2M active wallets. - Regulatory scrutiny and 11% price volatility highlight risks, though technical resilience an

Why ZEC Is Soaring in Late 2025 and Its Implications for Cryptocurrency Investors

- Zcash (ZEC) surged to $9.24B market cap in late 2025 driven by 1,300% transaction volume spikes and 30% shielded pool adoption. - Institutional investors like Cypherpunk and Reliance allocated significant ZEC holdings, signaling privacy assets' growing institutional acceptance. - Zcash's hybrid privacy model - optional shielded transactions with blockchain compatibility - outperformed Monero as privacy demand rose amid data monetization trends. - Ecosystem expansion through OKX relisting and Solana integ