BitMine Stock Pulls Back 7% as Recovery Doubts Grow; Charts Hint at Deeper Weakness

BitMine (BMNR) is trading near $29, down almost 7% after a sharp 15% jump that came around its large Ethereum purchase. The bounce helped stabilise sentiment for a moment, but the latest BitMine price pullback shows the recovery is still fragile. Both big-money flow and trend signals suggest the rally has not earned enough confirmation

BitMine (BMNR) is trading near $29, down almost 7% after a sharp 15% jump that came around its large Ethereum purchase. The bounce helped stabilise sentiment for a moment, but the latest BitMine price pullback shows the recovery is still fragile.

Both big-money flow and trend signals suggest the rally has not earned enough confirmation yet.

Weak Money Flow and Looming Crossovers Limit the Rebound

The Chaikin Money Flow (CMF), which tracks whether large buyers are supporting the price, still trades below zero and under a descending trendline. This means money flowing into BMNR is weak, even though the company continues to buy Ethereum in size.

This is key because every time CMF has approached this trendline and the zero line over the past two months, BMNR has staged a short bounce that later failed. The only time a rally held came in late September, when CMF broke above zero. That move pushed the stock 39% higher.

Big Money Flow Weakens:

TradingView

Big Money Flow Weakens:

TradingView

Right now, CMF is nowhere near repeating that signal. Until it breaks both the trendline and the zero line, recovery hopes remain weak.

Trend pressure is also building. Two bearish crossovers are forming:

- The 50-day EMA is closing in on the 100-day EMA, and

- The 20-day EMA is closing in on the 200-day EMA.

EMA crossovers track average price trends. Similar crossovers on November 3 and November 14 triggered declines of 17% and 29%.

Bearish Crossovers Loom on BMNR:

TradingView

Bearish Crossovers Loom on BMNR:

TradingView

With BMNR also exposed to Ethereum swings due to its heavy ETH holdings, this adds another layer of downside risk. If ETH weakens, it can amplify the impact of these crossovers when they form.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

BitMine Price Levels Show Why the Bounce Remains Fragile

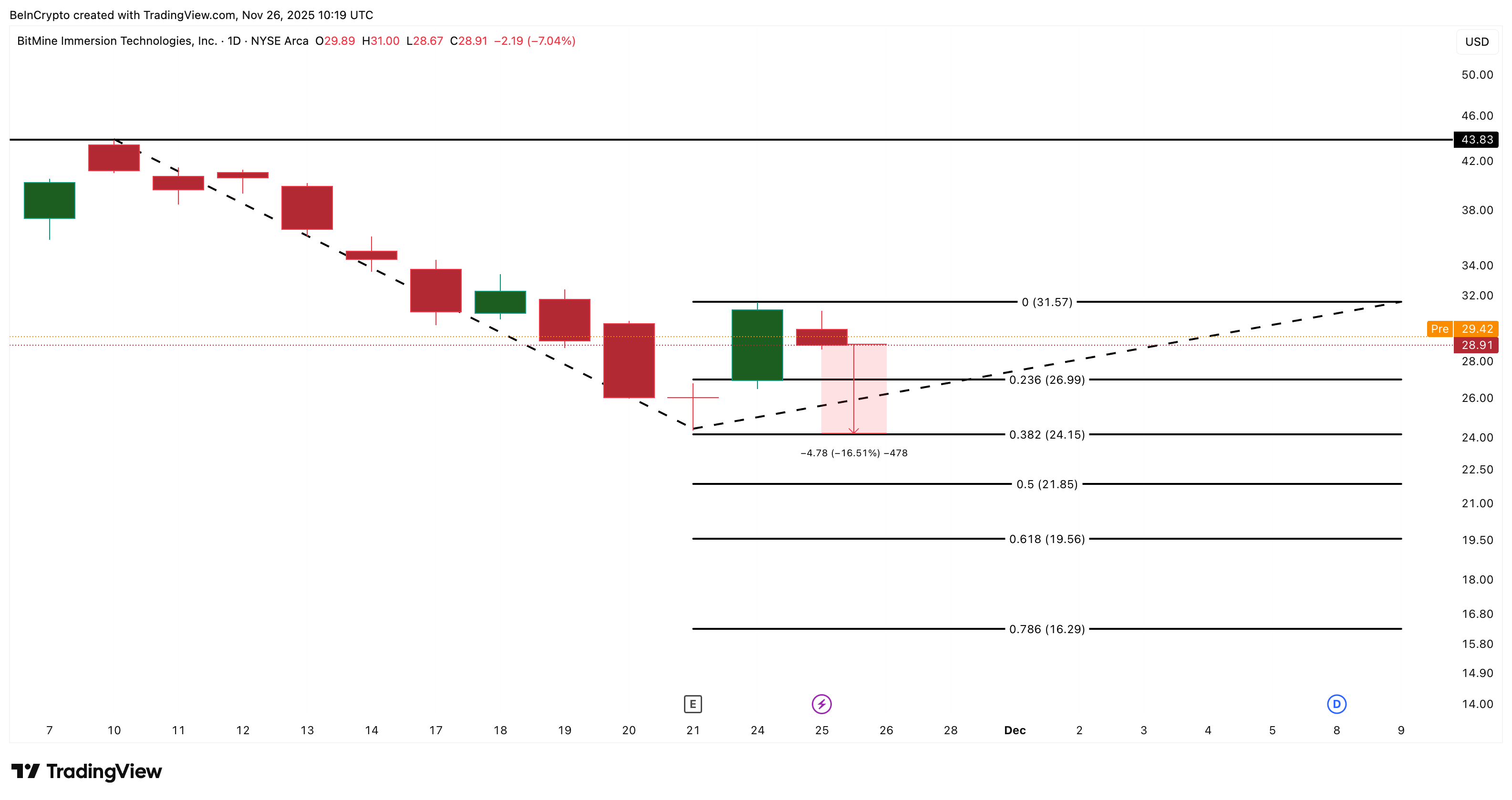

On the price chart, the BMNR price failed to reclaim $31.57, a similar level highlighted earlier as the first sign of real strength. The BitMine price moved close but could not close above it, reinforcing that buyers are not in control.

As long as BMNR stays below $31.57, the bearish scenario stays active.

Key downside levels now sit at:

- $26.99 (23.6% Fib)

- $24.15 (38.2% Fib, stronger support)

If both these levels break, the BitMine price might even head towards $16.29.

BitMine Price Analysis:

TradingView

BitMine Price Analysis:

TradingView

These supports show why the recovery remains uncertain. Without a CMF breakout and a close above $31.57, BitMine’s bounce will continue to face resistance, and the charts leave room for a deeper pullback.

However, a clean close above $31.57 can invalidate the bearish case for now and can even push the BitMine price towards $43.83. But that would require Ethereum to show strength as well.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Today: Xapo's Enhanced Bitcoin Fund Signals Growing Institutional Confidence in Digital Assets

- Xapo Bank expanded its Byzantine BTC Credit Fund after $100M in institutional allocations, reflecting growing demand for Bitcoin-backed yield products. - The fund uses Hilbert Group's institutional-grade lending process to generate low-risk returns for Bitcoin holders through collateralized loans. - Xapo's expansion follows 2022 lending sector collapse, leveraging regulatory compliance in Gibraltar/Cayman to rebuild institutional trust in Bitcoin collateral. - The product differentiates from ETFs/stablec

Bitcoin News Update: Movements of Investors' USDT Indicate Bitcoin Highs and Periods of Profit Realization

- Bitcoin's price inversely correlates with USDT outflows, as investors shift liquidity between assets during market cycles. - S&P Global downgraded USDT's stability rating to "weak" due to 5.6% Bitcoin allocation and opaque reserves amid U.S. regulatory reforms. - The GENIUS Act and EU's MiCA framework are reshaping stablecoin markets, forcing Tether and Circle to launch jurisdiction-specific, cash-backed alternatives. - Institutional ETF activity, including Texas's Bitcoin purchases and fragmented inflow

The New Prospects for Economic Growth Infrastructure in Webster, NY

- Webster , NY, leverages $9.8M FAST NY grants and PPPs to transform Xerox campus into a high-tech industrial hub. - Infrastructure upgrades including roads, sewers, and electrical systems aim to attract advanced manufacturing and renewable energy firms. - Governor Hochul's strategy drives $51M in upstate investments, creating 250+ jobs via projects like the $650M fairlife® dairy plant. - Redevelopment boosts industrial land availability and residential property values by 10.1%, with mixed-use zoning enhan

The Impact of Artificial Intelligence on Contemporary Portfolio Management: Potential Benefits and Challenges

- AI redefines portfolio management with real-time analytics and dynamic asset allocation, shifting from static human-driven strategies to data-centric systems. - Generative AI tools like ChatGPT automate financial workflows, enabling hyper-personalized strategies and boosting business outcomes through optimized digital presence. - Risk modeling evolves via AI's pattern detection, but challenges persist in transparency and bias, requiring explainable AI frameworks and human oversight. - Institutions integr