Institutions Join the Rush as Zcash Becomes the New Treasury Favorite

Two publicly traded companies increased their exposure to Zcash (ZEC) in November, signaling a shift as institutions increasingly bet on privacy-focused cryptocurrencies. The moves reflect rising confidence in privacy assets as viable treasury tools, at a time when ZEC has defied the broader market downtrend and outperformed major cryptocurrencies with notable gains. Corporate Treasuries Turn

Two publicly traded companies increased their exposure to Zcash (ZEC) in November, signaling a shift as institutions increasingly bet on privacy-focused cryptocurrencies.

The moves reflect rising confidence in privacy assets as viable treasury tools, at a time when ZEC has defied the broader market downtrend and outperformed major cryptocurrencies with notable gains.

Corporate Treasuries Turn to Privacy Assets

In a recent press release, Reliance Global Group, a Nasdaq-listed insurance technology firm, announced that it executed a major strategic shift in its Digital Asset Treasury (DAT). The firm liquidated all previous crypto holdings and reallocated entirely into ZEC.

This follows a comprehensive strategic review led by the company and Blake Janover, Chairman of the Crypto Advisory Board. They concluded that Zcash is the “most compelling opportunity for a long term DAT strategy.”

“Bitcoin introduced the world to decentralized digital money, but Zcash advances that foundation by delivering optional privacy in a way that we believe is both technologically superior and fundamentally aligned with institutional requirements,” Board member Moshe Fishman stated.

The company cited several reasons why ZEC emerged as its preferred asset, starting with its exceptional price rally. Reliance noted that Zcash delivered a sharp upside move and held up strongly during a challenging period for the broader cryptocurrency market.

According to the firm, this strength signals the beginning of a much larger adoption phase, especially as Zcash’s privacy-focused technology andcompliance-ready features gain increasing interest from enterprises and financial institutions.

Reliance Global also highlighted ZEC’s Bitcoin-based architecture, enhanced with advanced zero-knowledge cryptography, its flexible transaction model, leadership in zk-SNARK innovation, selective disclosure tools for auditors and regulators, and strong confidentiality features. These factors together position ZEC as a compelling, institution-ready digital asset.

Cypherpunk Adds $18 Million in ZEC, Now Controlling 1.43% of Total Supply

In addition to Reliance Global, Cypherpunk Technologies also expanded its ZEC holdings. Last week, the digital-asset treasury firm backed by the Winklevoss twins announced that it had purchased an additional 29,869.29 ZEC for $18 million.

This brings its total holdings to 233,644.56 ZEC, representing roughly 1.43% of Zcash’s total supply. The firm acquired its position at an average cost of $291.04 per coin.

“In a world where privacy is scarce, privacy becomes the most valuable commodity. Cypherpunk sees Zcash as digital privacy in asset form, the same way Bitcoin has proven to be digital gold. Zcash also represents an important hedge against the transparency of Bitcoin and the existing financial infrastructure in an AI-abundant future,” the press release read.

According to the latest data from CoinGecko, the firm is currently sitting on an unrealized profit of $43.7 million. This stands in sharp contrast with BTC-and ETH-holding firms, many of which are currently sitting on paper losses.

For instance, BitMine’s unrealized losses reached $4 billion last week and have since narrowed to $3.7 billion. Meanwhile, Metaplanet’s unrealized losses have climbed to roughly $609 million.

ZEC Surges 300% as BTC and ETH Slide Into Double-Digit Losses

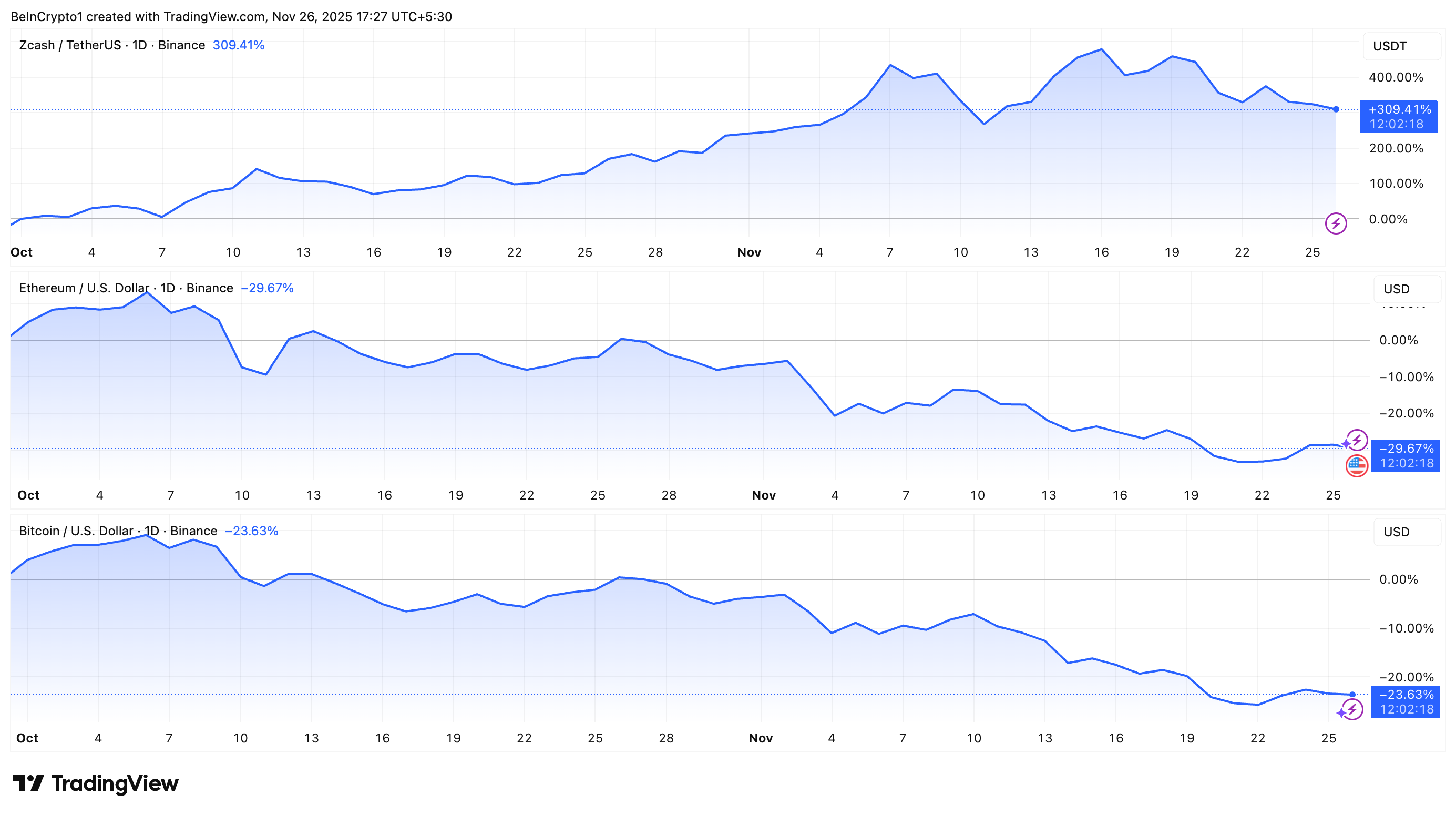

This divergence is attributed to the price performance of the underlying assets. Since October, ZEC’s price has appreciated by over 300%. At the same time, BTC has dipped 23.6% and ETH has posted an even steeper loss of 29.6%

Price Performance of ZEC, ETH, and BTC Since October. Source:

TradingView

Price Performance of ZEC, ETH, and BTC Since October. Source:

TradingView

While ZEC has faced pressure recently, shedding around 20% of its gains over the past week, the broader outlook still appears constructive. BeInCrypto’s technical analysis shows that Zcash is trading inside an ascending triangle.

This pattern often signals a potential continuation of upward momentum. Additionally, the Relative Strength Index (RSI) is showing a hidden bullish divergence. This is again a bullish continuation signal.

Overall, the indicators point to a positive outlook for ZEC, but confirmation will depend on market behavior in the next few sessions.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: S&P Rating Drop Highlights Tether’s Risky Asset Holdings and Lack of Transparency

- S&P downgrades Tether's USDT to "5 (weak)" due to high-risk reserves and transparency gaps. - Tether's 5.6% BTC exposure exceeds overcollateralization margins, risking undercollateralization if prices drop. - CEO dismisses critique as traditional finance bias, claiming no "toxic" assets in reserves. - Regulators intensify scrutiny as stablecoin centralization risks emerge amid $184B USDT circulation. - S&P urges Tether to reduce risky assets and enhance reserve disclosure to rebuild trust.

Dogecoin Latest Updates: Is a Repeat Performance on the Horizon? Holding $0.15 May Signal a 611% Rally for Dogecoin

- Dogecoin (DOGE) stabilized near $0.15 support, triggering historical 611% rally potential to $1 by 2026. - Grayscale's GDOG ETF and pending Bitwise BWOW ETF mark institutional adoption, though initial inflows remain muted. - Technical indicators show mixed momentum with RSI near oversold levels and key resistance at $0.16. - Market remains divided as ETF-driven liquidity and on-chain infrastructure contrast with macroeconomic and regulatory risks.

Turkmenistan’s Approach to Cryptocurrency: Centralized Oversight Amidst a Decentralized Age

- Turkmenistan legalizes crypto trading under strict 2026 regulations, granting state control over exchanges, mining , and custodial services. - Law mandates KYC/AML compliance, bans traditional banks from crypto services, and classifies digital assets into "backed" and "unbacked" categories. - Central bank gains authority to operate state-monitored distributed ledgers, contrasting with decentralized approaches in South Korea and Bhutan. - Framework aims to balance innovation with oversight, testing Turkme

Bitcoin News Update: Has $162 Billion Left Crypto Due to Institutional Buying or a Broader Market Pullback?

- BlackRock deposited 4,198 BTC and 43,237 ETH into Coinbase amid crypto sell-offs, despite $355.5M Bitcoin ETF outflows. - A 1.8M BTC ($162B) overnight exchange withdrawal sparks speculation about institutional accumulation or portfolio rebalancing. - $40B in BTC/ETH exchange inflows and record $51.1B Binance stablecoin reserves highlight institutional demand for regulated crypto products. - On-chain data shows 45% of large deposits (≥100 BTC) and 1.8M BTC withdrawals, indicating mixed market sentiment ah