What is EigenLayer's awkward concept of intersubjective forking?

Eigenlayer has abstracted a new category of facts (intersubjective) that cannot be solved by previous solutions (ETH Restaking), so a new solution has been proposed.

So what exactly is a huge disagreement over an “intersubjective fact”?

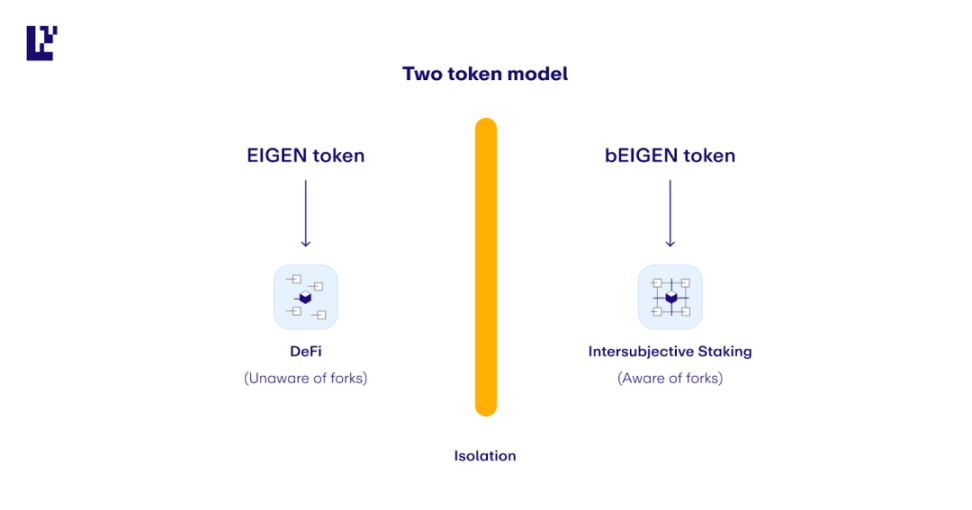

Before this matter was settled, there were certainly many people who firmly believed Trump was the real 46th president, and they had no subjective intent to do evil, and neither side’s supporters could convince the other. Eigenlayer believes that the best solution to this kind of problem is to mutually fork tokens and let time test everything, because eventually one side will gradually lose legitimacy and approach zero. So: 1. In the eyes of Trump supporters (i.e., the Trump version of EIGEN), all Biden supporters’ collateral should be confiscated; 2. From the perspective of Biden supporters (i.e., the Biden version of EIGEN), all Trump supporters’ collateral should be confiscated. We all know the final result: Trump is not the 46th president in the public eye, the Trump version of EIGEN eventually goes to zero, so confiscating Biden supporters’ tokens doesn’t matter—they’re all worth 0 anyway. Conversely, Biden is the 46th president in the public eye, the Biden version of EIGEN becomes the official EIGEN, and Trump supporters whose tokens were previously confiscated have paid the price. This is the problem that intersubjective forking aims to solve. Therefore, these must use the EIGEN token, not ETH. ETH forks are too difficult, and it’s not good for ETH security. Of course, there’s also the self-interest of locking up their own token as much as possible. There’s another small detail: EIGEN uses a dual-token model.

To summarize, Eigenlayer abstracts a new type of fact (intersubjective), which cannot be solved by previous solutions (ETH Restaking), so it proposes a new solution (staking and slashing based on the EIGEN token), i.e., issuing a new work token $EIGEN.

Ebunker, a long-term Ethereum supporter, closely follows Ethereum’s technological development, proposal upgrades, and community changes, sharing research and views on key Ethereum sectors such as Staking, L2, and DeFi.

Currently, Ebunker includes Ebunker Pool (a non-custodial Ethereum staking pool) and Ebunker Venture (Ethereum maximization venture capital), among other businesses.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The real "big player" in gold: "Stablecoin giant" Tether

As of September 30, Tether holds 116 tons of gold, making it the largest single gold holder aside from major central banks.

Paradigm Shift in Ethereum Execution Layer Scaling: From Defensive Conservatism to Empirical Science-Driven Evolution of the 60M Gas Limit

These efforts have enabled the Ethereum mainnet to move from being cautious about increasing the gas limit to now being able to safely raise it all the way up to 60M gas, or even higher.

Devcon Impressions: While the Community Doubts Ethereum Online, the Offline Atmosphere Is Vibrant and Thriving

Ethereum's innovation remains at the forefront, while other chains seem to be merely "replicating" its path, even when it comes to Meme phenomena.

Bitcoin rebounds to $91,000: Can it sustain the rally?

Driven by factors such as the macro environment and expectations of a Federal Reserve rate cut, the cryptocurrency market has temporarily halted its downward trend.