Philippine Digital Asset Exchange: The tokenized asset market could reach $60 billion by 2030

According to a report by Jinse Finance, based on the white paper "Project Bayani: The Asset Tokenization Opportunity in the Philippines" released today by the Philippine Digital Asset Exchange (PDAX), Saison Capital, and Onigiri Capital, the tokenized asset market in the Philippines could reach $60 billion by 2030. Public equities ($26 billion), government bonds ($24 billion), and mutual funds ($6 billion) are expected to dominate the market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

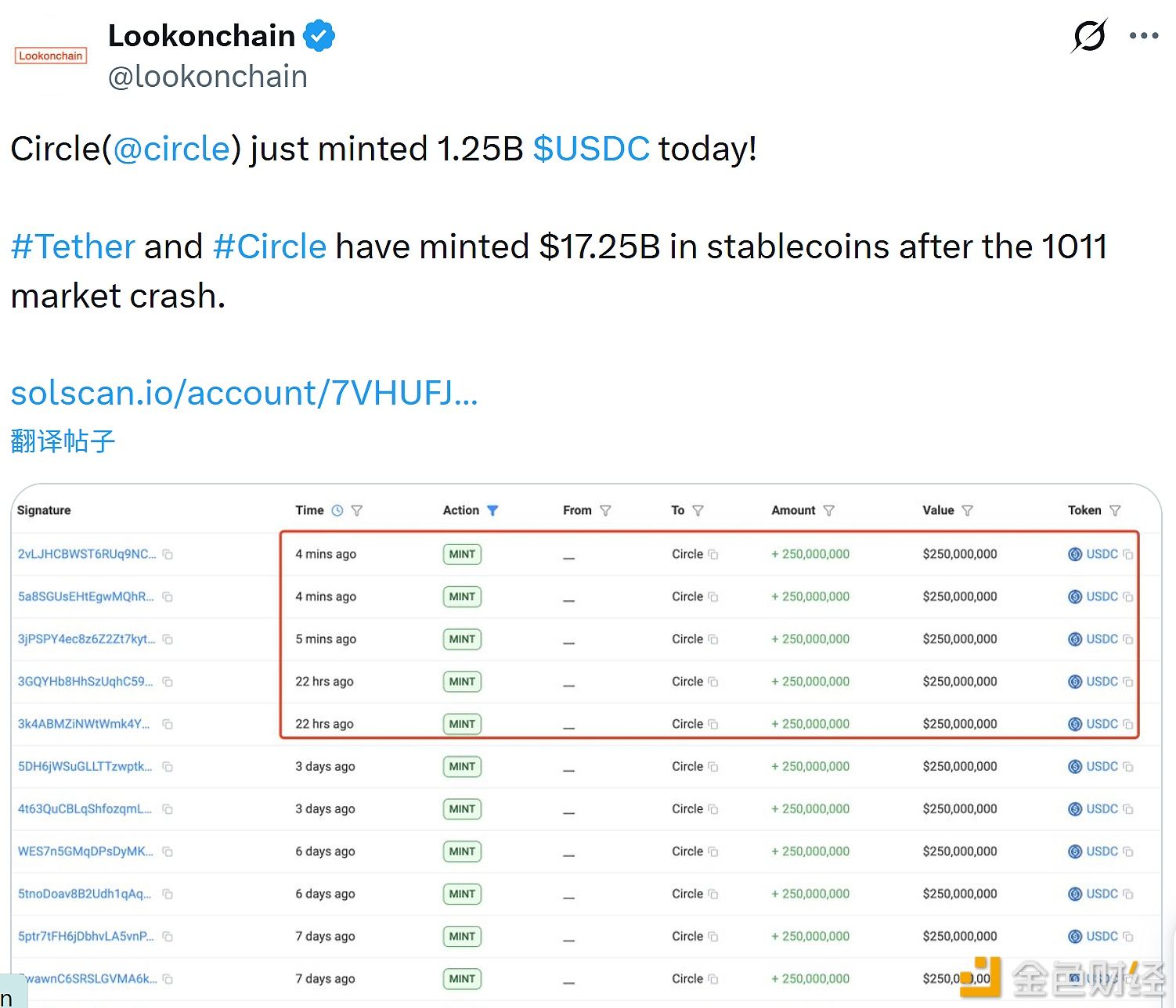

Tether and Circle have cumulatively issued stablecoins worth $17.25 billions.

USDC Treasury minted an additional 500 million USDC on the Solana chain

Ethereum's market cap surpasses LVMH, rising back to 40th place among global assets