Bitcoin News Today: Bitcoin surges to $90K—Is this a sign of a new cycle or an early warning of another downturn?

- Bitcoin surged past $90,000 amid November's 29% drop from its October $126,000 peak, signaling a tentative recovery. - Ethereum , Solana , and other major cryptos rose 3-5%, while the Crypto Fear & Greed Index improved slightly to 15. - Technical indicators show Bitcoin testing critical levels, with analysts divided on whether $90,000 marks a cyclical bottom or temporary respite. - Institutional flows and on-chain data reveal mixed sentiment, as Fed policy uncertainty and bearish structures persist. - Lo

Bitcoin Climbs Above $90,000 Amid Market Uncertainty

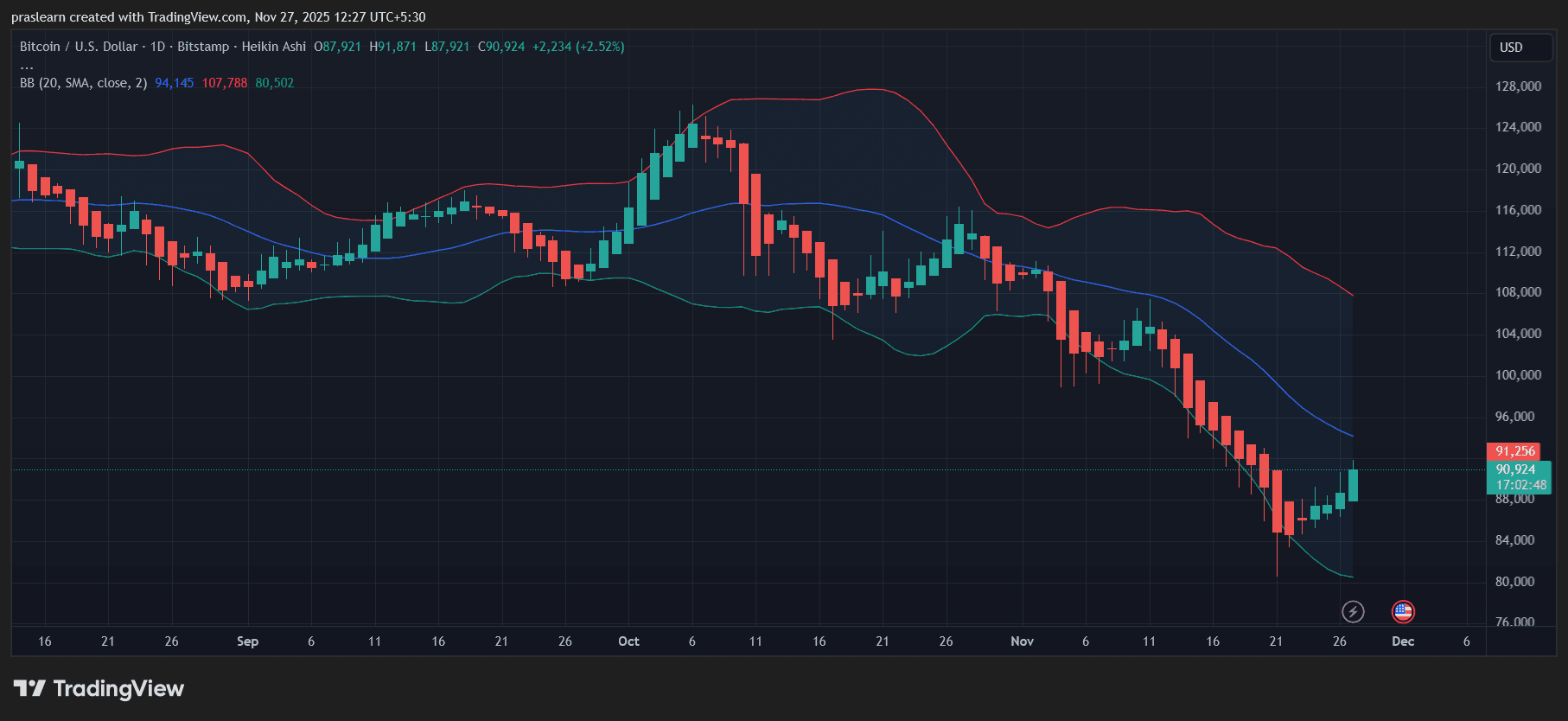

On Wednesday, Bitcoin rallied past the $90,000 mark, providing some relief to investors after a volatile November that wiped out its gains for 2025. This uptick comes after a steep drop from its October high of $126,000—a 29% decline that raised concerns about a potential bear market. Despite a 3% increase over the past day hinting at a possible recovery, experts warn that uncertainty around institutional participation and Federal Reserve policy continues to weigh on the market.

Major Cryptocurrencies Show Modest Gains

Other leading digital assets also experienced upward movement. Ethereum advanced 3% to reach $3,022, Solana jumped nearly 5% to $143, while XRP and Dogecoin recorded gains of 2% and 3%, respectively. Although the Crypto Fear & Greed Index still reflects "extreme fear," it has edged up from 10 to 15, suggesting a slight improvement in investor sentiment. Over the last 24 hours, liquidations totaled $300 million, with $220 million coming from short positions, indicating a calmer market compared to previous turbulence.

Technical Analysis and Key Levels

Technical signals reveal that Bitcoin is currently testing important support and resistance zones. Analyst Ali Martinez pointed out that the Puell Multiple, which measures miner revenue, is at 0.67—close to levels historically associated with market bottoms when it falls below 0.50. Meanwhile, Michaël van de Poppe noted that if Bitcoin can surpass $92,000 by the end of the month, it may confirm the recent $80,000 low as the cycle’s bottom. However, on-chain data shows Bitcoin is still trading below significant moving averages and faces resistance between $94,000 and $100,000.

Institutional Activity Remains Mixed

Institutional investment flows have been inconsistent. Bitcoin spot ETFs saw $128 million in inflows on Tuesday, following $151 million in outflows the day before. Strategy Inc. (MSTR), a company holding significant Bitcoin reserves, reported that its holdings could cover its convertible debt nearly six times at a Bitcoin price of $74,000, demonstrating resilience even during sharp market corrections.

Macroeconomic Factors and Market Sentiment

The Thanksgiving holiday, which closed U.S. stock markets while crypto trading continued, introduced additional uncertainty. Traders are currently factoring in an 84% probability of a Federal Reserve rate cut in December, though supporting economic data is limited. Analysts, including Nic Puckrin, caution that any upward momentum is fragile and largely dependent on the Fed’s upcoming decisions, which could determine whether the market experiences a year-end rally or further declines.

Outlook: Divergent Predictions for Bitcoin’s Future

Long-term projections for Bitcoin’s trajectory remain split. Some forecasts anticipate a peak of $168,000 in 2025, provided the cryptocurrency can break through the $96,000 resistance and avoid falling below $80,000. On the other hand, a more pessimistic scenario suggests a drop toward $53,489 in early 2026 if support between $70,000 and $75,000 fails to hold.

As the market stands at a crossroads, Bitcoin’s ability to maintain levels above $90,000 will be crucial. With ongoing institutional caution and broader economic factors at play, the coming weeks are likely to determine whether this recent rebound signals a lasting recovery or merely a brief pause in a larger downward trend.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget Wallet Introduces Zero-Fee Feature for Its Crypto Card in Over 50 Markets

Are Big Changes in Store for the Bitcoin Price?

Secure Blockchain, Misleading Agreements: Spoofing Incidents Increase on Monad

- Monad's mainnet faces spoofing attacks as scammers use smart contracts to mimic ERC-20 token transfers, misleading users with fake logs. - Co-founder James Hunsaker clarifies the network remains secure, but external contracts exploit EVM openness to create deceptive transactions. - Over 76,000 wallets claimed MON tokens in airdrop, creating high-traffic conditions that attackers leverage through fabricated swaps and signatures. - Security experts warn users to verify contract sources and avoid urgent pro

Bitcoin Latest Updates: Worldwide Regulatory Changes and Major Investors Propel Bitcoin and Brazil's Markets Upward

- Bitcoin surged to $91,500 amid institutional adoption, Fed rate cut expectations, and post-halving rebound, despite $3.79B ETF outflows and inherent volatility. - Brazil's stock market hit records after tax reforms exempted low-income households, aligning with global redistributive policies and boosting 15 million earners. - Binance delisted BTC pairs like GMT/BTC for regulatory compliance, while on-chain metrics signaled crypto market consolidation and mixed altcoin prospects. - Global macro risks persi