FARTCOIN Rebounds 100% After Crash — Are Whales Preparing the Next Big Move?

Over the last three months, FARTCOIN plunged from $1 to below $0.3. Most retail investors panicked and sold off heavily, while whales quietly accumulated with conviction. FARTCOIN has now unexpectedly rebounded nearly 100% in the final week of November. The key question is how long this recovery can last. Whales Accumulate Over 230 Million FARTCOIN

Over the last three months, FARTCOIN plunged from $1 to below $0.3. Most retail investors panicked and sold off heavily, while whales quietly accumulated with conviction.

FARTCOIN has now unexpectedly rebounded nearly 100% in the final week of November. The key question is how long this recovery can last.

Whales Accumulate Over 230 Million FARTCOIN as On-Chain Activity Surges

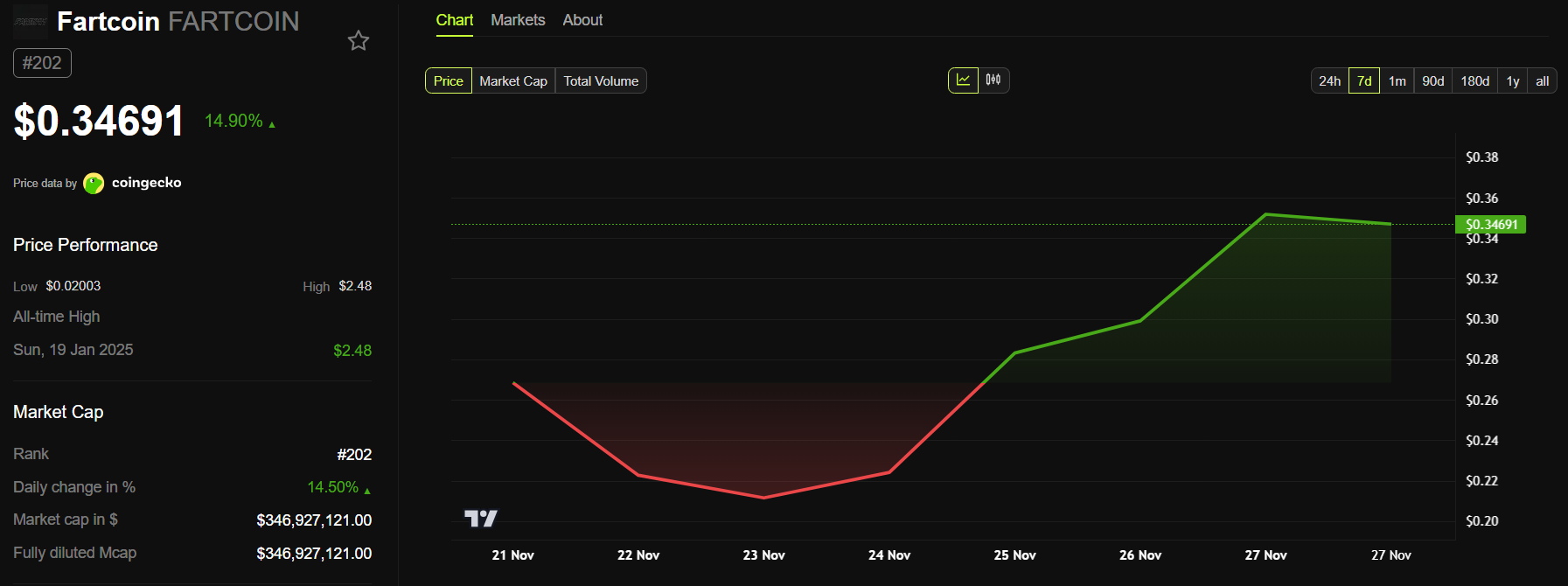

BeInCrypto data shows that FARTCOIN surged from below $0.2 to $0.34 in the final week of November. From the monthly low of $0.18, the Solana meme coin nearly doubled.

Fartcoin Price Performance. Source:

Fartcoin Price Performance. Source:

This rally did not happen by chance. On-chain metrics reveal early signs of accumulation.

Nansen reports that the top 100 wallets of this Solana meme coin currently hold 689.62 million FARTCOIN — almost 69% of the total supply. The figure has increased by more than 55% over the last 90 days.

Top 100 Fartcoin Addresses Holding. Source:

Top 100 Fartcoin Addresses Holding. Source:

From late August to the present, whale wallets have purchased over 230 million FARTCOIN. Even during persistent price declines, whales continued to buy instead of sell. This behavior reflects a typical smart-money strategy: accumulate when fear is at its peak.

Solscan also records extremely strong trading activity throughout November. Token transfers reached a monthly high, with over 238,000 transfers executed in a single day, worth more than $92 million.

DEX volume also soared — both buy and sell volume surged sharply, especially during the final week of November.

Fartcoin Token Transfer and DEX Volume. Source:

Fartcoin Token Transfer and DEX Volume. Source:

These metrics indicate that liquidity has returned to FARTCOIN even at low prices. Real buying demand appears to be waiting aggressively at current levels.

Another supportive factor comes from Solana’s broader market sentiment. SOL ETFs have recorded 21 consecutive days of positive inflow. When holders prefer not to sell SOL but still seek returns, they often rotate into high-liquidity meme coins within the ecosystem, and FARTCOIN is among the top beneficiaries.

On-chain signals indicate a consistent trend: whales and smart money are accumulating heavily below $1. Technical analysts also expect a trend reversal if FARTCOIN breaks out of the descending wedge pattern that has persisted since July.

Fartcoin Price Structure. Source:

Fartcoin Price Structure. Source:

“The most recent memory many people have of FARTCOIN is how it relentlessly dumped from $1.6 to $0.2 without seemingly catching a break. But many have forgotten that it tends to have its pumps in a similarly aggressive manner,” investor Unipcs said.

As one of the most liquid meme coins in the Solana ecosystem, FARTCOIN is poised to gain significantly as long as sentiment surrounding SOL remains positive.

However, the heavy concentration of supply in top wallets remains a risk. If whales choose to take profit, the price may face strong downward pressure.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Today: Institutional ETFs and Derivatives Indicate a Positive Shift for XRP Above Crucial Support Levels

- XRP rebounds above $2.20 as buyers defend key support, supported by $107.92M in ETF inflows and rising institutional confidence. - Technical analysis highlights a bullish "Staircase to Valhalla" pattern, with $2.26-$2.52 resistance levels and Fibonacci targets signaling potential for $2.69. - Derivatives data shows aggressive long-positioning (OI: $4.11B), with Binance's 2.56 long-short ratio and 57% options OI surge reinforcing bullish momentum. - Institutional ETF conversions (e.g., Grayscale Zcash) an

Why Switzerland's Temporary Halt on Crypto Highlights Worldwide Regulatory Disunity

- Switzerland delays crypto tax data-sharing until 2027, highlighting global regulatory fragmentation amid CARF adoption challenges. - Two-phase approach prioritizes domestic law alignment before reciprocal agreements with key economies like U.S., China, and Saudi Arabia. - 75 CARF signatories progress unevenly, with U.S. and Brazil proposing alternative frameworks, complicating cross-border compliance. - Swiss crypto firms face operational risks during transition, as critics warn of regulatory arbitrage b

Thailand’s Bold No-Crypto-Tax Move: Shaping a Future Southeast Asian Crypto Center

- Thailand imposes 0% capital gains tax on local crypto trading (2025-2029) to boost its digital economy and attract investors. - The policy aligns crypto profits with tax-exempt stock trading, supported by a 2024 Bitcoin ETF and Tourist DigiPay pilot for foreign visitors. - Regulatory caution is evident through biometric data shutdowns and PDPA compliance, balancing innovation with security amid regional competition. - Projected $1B annual economic gains aim to position Thailand as a top Southeast Asian c

The Transformation of Webster, NY: Targeted Property and Infrastructure Initiatives After the Xerox Era

- Webster , NY, secured a $9.8M FAST NY grant to transform the former Xerox campus into a shovel-ready industrial hub, part of Governor Hochul’s upstate revitalization strategy. - Infrastructure upgrades, including road and sewer improvements, aim to attract advanced manufacturing and logistics firms by reducing development risks and costs. - The Xerox campus redevelopment includes mixed-use projects, projected to create 250 jobs and boost property values through residential and commercial integration. - W