$15 Billion Options Expiry Set to Shake Bitcoin and Ethereum Markets Today

More than $16 billion in Bitcoin and Ethereum options are set to expire on October 31, 2025, at 8:00 UTC on Deribit. This marks one of the largest monthly crypto derivatives events of the year. This expiry surpasses last week’s $6 billion event due to the monthly rollover of October contracts. Traders and investors should

More than $16 billion in Bitcoin and Ethereum options are set to expire on October 31, 2025, at 8:00 UTC on Deribit. This marks one of the largest monthly crypto derivatives events of the year.

This expiry surpasses last week’s $6 billion event due to the monthly rollover of October contracts. Traders and investors should closely watch max pain levels and positioning, both of which could impact short-term price action.

Bitcoin Options Market Shows Bullish Positioning

Today’s expiring options are for the month, which makes them significantly higher than the $4 billion seen last week.

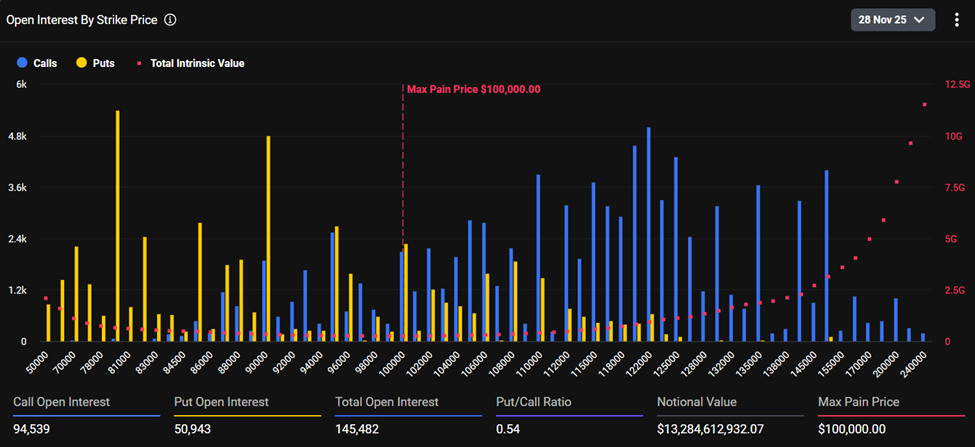

Bitcoin is trading at $91,389 as of this writing, heading into expiry, while the maximum pain point sits at $100,000, suggesting the market is heavily skewed toward the upside despite recent turbulence. At this strike price, option holders will experience the most losses.

Historically, Bitcoin’s price tends to move toward the max pain zone as expiry nears, a result of market makers hedging their positions. During this expiry, 145,482 contracts worth $13.28 billion will close.

The put-to-call ratio is 0.54, signaling more traders are betting on gains than on losses. Nevertheless, Deribit data shows that the call open interest of 94,539 contracts exceeds put open interest at 50,943.

Expiring Bitcoin Options. Source:

Deribit

Expiring Bitcoin Options. Source:

Deribit

According to analysts at Deribit, the recent market pullback played a critical role in shaping positioning. They say traders who were long puts took profit (TPd) when Bitcoin hit the $81,000 to $82,000.

“After a 35% plunge from $126,000, Put longs TPd vs $81,000-82k while still keeping cautious protection v long Spot BTC with 80-85k Strikes. But the dominant trade of the week was a bullish EoY Dec 100-106-112-118k Call Condor initially 12k, ~$6.5m premium, looking for a Santa rally,” wrote Deribit analysts.

This large call condor, an options structure designed to capture upside within a defined range, has been the standout trade both in size and sentiment.

2) Initially buying started v 865xx, and up to 88k for the original 12k blocks, with follow-on copycat and buybacks adding 2.5k volume in the same strategy.If running to expiry, the buyer targets 100k+ by Dec26, with an ideal final settle between 106-112k, with 10:1 max payoff. pic.twitter.com/cR2e9Yvpho

— Deribit Insights (@DeribitInsights) November 27, 2025

Such aggressive end-of-year positioning suggests that, even after the correction from all-time highs, a subset of traders is still betting on a strong rebound in December.

At the same time, other market participants have been actively capping upside through overwriting strategies.

“Hidden beneath the Call condor volume were persistent and familiar Call over-writers on the Dec100k and Jan 100-105k Calls. These and the general relaxation of downside fear have dampened IVs, but with RV still performing and 2-way Put (+spread) action, much is inconclusive,” the analysts wrote.

Overall, BTC’s options board shows a tension between long-dated bullish conviction and near-term caution. These conditions often set the stage for heightened volatility in the settlement window, which is 08:00 UTC on Deribit.

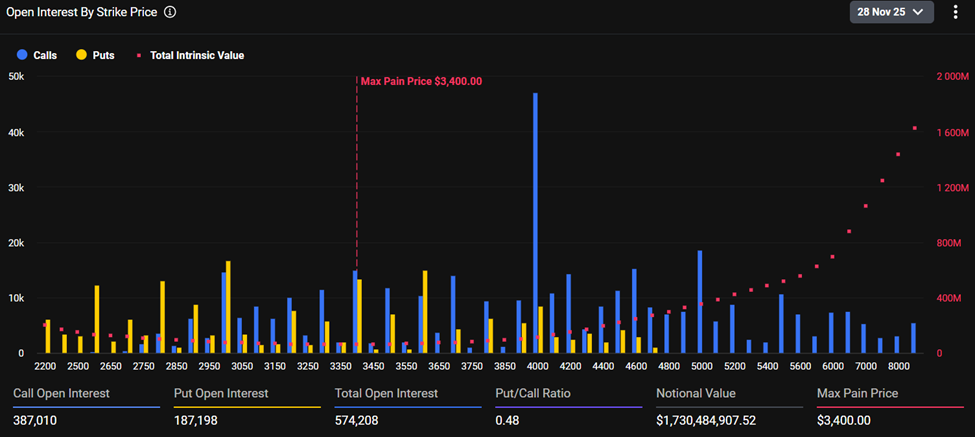

Ethereum Faces $1.7 Billion Expiry With Moderate Skew

Ethereum is trading at $3,014, with a max pain level of $3,400 for today’s expiry. The asset has 387,010 calls open versus 187,198 puts, totaling 574,208 contracts and a put–call ratio of 0.48. ETH options account for $1.73 billion in notional value, making it the second-largest component of today’s expiry.

Expiring Ethereum Options. Source:

Deribit

Expiring Ethereum Options. Source:

Deribit

Unlike Bitcoin, ETH’s positioning is less extreme. The downside skew is lighter, and open interest is more evenly distributed across major strikes.

With traders watching ETH’s consolidation relative to BTC, much of today’s influence may come from whether Bitcoin volatility spills over into the broader market.

With billions in open interest unwinding, liquidity conditions could shift quickly across both BTC and ETH.

If spot prices drift toward max pain levels, market makers may exert dampening effects; if volatility spikes, these expiries could act as accelerants.

Either way, today’s settlement arrives at a pivotal moment, with traders split between defensive hedging and bold year-end bullish bets.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

S&P 500 futures rose 0.2%.

Bitwise BSOL Solana ETF increased its holdings by 93,167 SOL tokens in the past hour.

Spot silver hits record high

BNB breaks $900