On December 3, the price of bitcoin briefly surpassed the $93,000 mark, with a 24-hour increase of over 6%, and its market capitalization returned to above $1.8 trillion. This surge was not accidental, but rather the result of multiple favorable factors converging. Against the backdrop of increasing global economic uncertainty, Vanguard lifting its crypto ETF ban, BlackRock’s IBIT ETF seeing explosive trading volumes, support for crypto assets from the U.S. banking system, MicroStrategy’s steadfast holding strategy, and optimistic predictions of new highs from industry leaders are together reshaping market confidence. These events have not only stimulated short-term trading enthusiasm but also provided institutional support for anchoring bitcoin’s long-term value.

Vanguard’s Policy Shift

As the world’s second-largest asset management company, Vanguard manages over $11 trillion in assets, and its stance on crypto assets has long been seen as an industry bellwether. On December 1, 2025, Vanguard announced a major policy reversal: starting December 2, its brokerage platform would allow clients to trade ETFs and mutual funds holding mainstream cryptocurrencies such as bitcoin, ethereum, XRP, and solana. This marks the end of Vanguard’s nearly two-year “crypto ban”; previously, the company had explicitly prohibited clients from purchasing such products through its platform, even when spot bitcoin ETFs were approved in January 2024.

The background to this shift is the continued surge in institutional demand. Since the launch of bitcoin ETFs, these products have attracted hundreds of billions of dollars in cumulative inflows. Vanguard’s concession is not isolated, but a response to the calls from both retail and institutional investors—among its more than 50 million brokerage clients, many have expressed interest in digital assets through other channels. After the policy adjustment, Vanguard emphasized that it would only support crypto funds that meet regulatory standards and would treat them as “non-core asset classes.”

Vanguard’s entry is highly significant. It not only provides conservative investors with a low-threshold channel for bitcoin exposure but may also trigger a domino effect. Analysts point out that Vanguard’s client base is mainly composed of the middle class and retirement funds, and opening its platform will further bridge traditional finance and the crypto world. It is expected that by 2026, at least $50 billion in new funds will flow into bitcoin ETFs as a result. This event highlights the increasingly friendly regulatory environment: from the SEC’s ETF approvals to the current inclusiveness of major platforms, bitcoin is transitioning from a fringe asset to a mainstream reserve.

Institutional Capital Floods In

BlackRock’s iShares Bitcoin Trust (IBIT) ETF witnessed a historic moment: within just 30 minutes of opening, trading volume soared to $1 billion. This figure is more than double IBIT’s usual full-day trading volume and directly fueled the rebound in bitcoin’s price. As the world’s largest bitcoin ETF, IBIT has accumulated over $70 billion in assets since its launch in January 2024, with an average daily trading volume exceeding 76 million shares.

This explosive trading volume was no coincidence, but an immediate response to Vanguard lifting its ban. Bloomberg ETF analyst Eric Balchunas commented: “Vanguard’s clients were clearly eager—they were even more ‘adventurous’ than we imagined.” Previously, IBIT’s trading peak occurred after Trump’s victory in November 2024, when $1 billion was traded in just 20 minutes, but this event is even more symbolic—it marks the leap of bitcoin ETFs from “high-risk toys” to “standard investment tools.” Data shows that on December 2, IBIT traded nearly 32 million shares, worth over $1.04 billion, far surpassing other bitcoin ETFs such as Fidelity’s FBTC ($464 million).

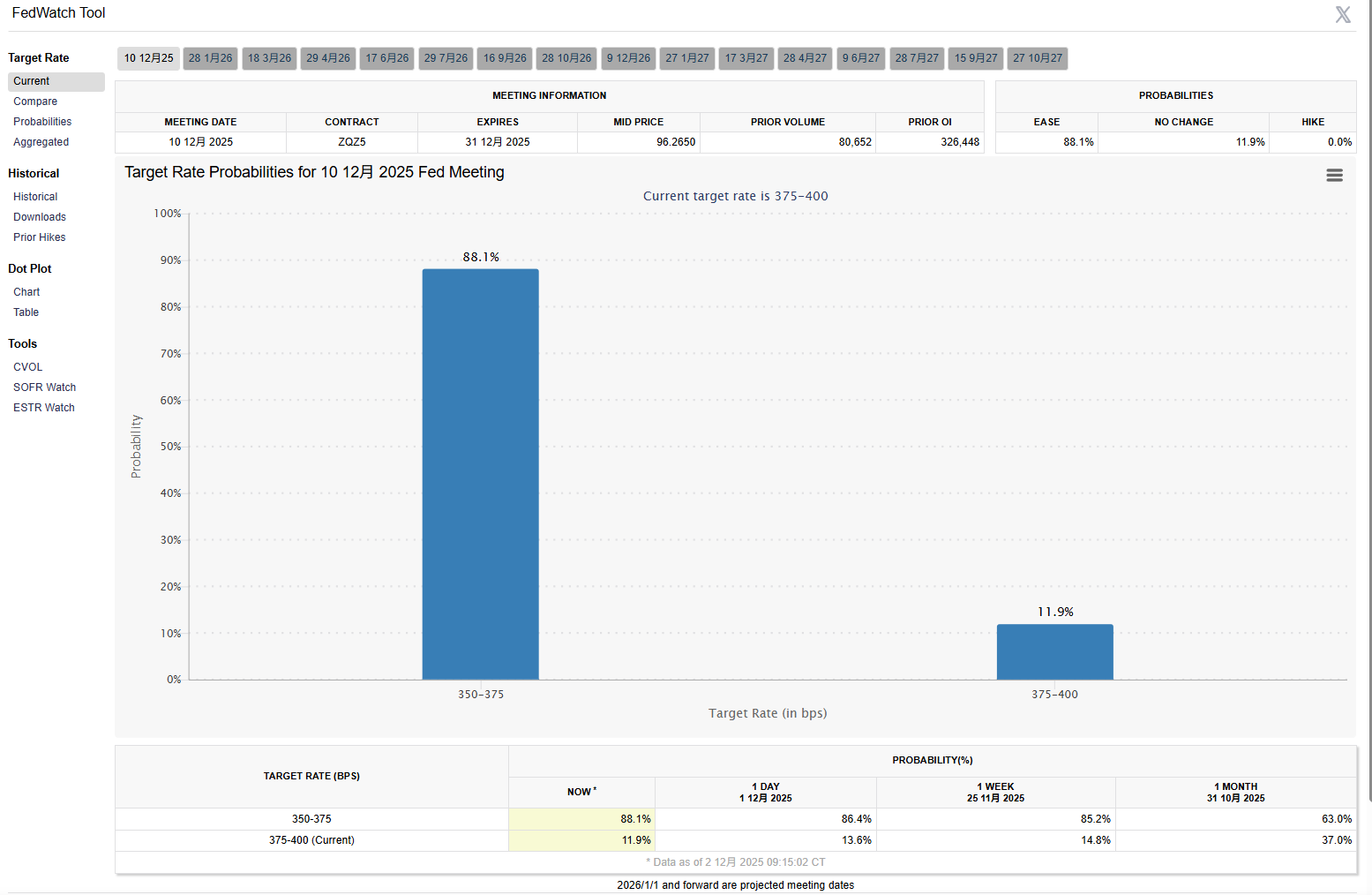

BlackRock CEO Larry Fink has stated that bitcoin ETFs have become the company’s top revenue source, with assets approaching $100 billion. IBIT’s success is not only due to its low fees (0.25% annual fee) and brand effect, but also to the reinforced narrative of bitcoin as “digital gold.” On the eve of the Federal Reserve’s December FOMC meeting, market expectations of further rate cuts are expected to stimulate risk asset allocation.

Regulatory Green Light Illuminates Compliance Path

Another major driver of bitcoin’s rebound is the growing support for crypto assets from the U.S. banking sector. The year 2025 has become a turning point, with multiple regulatory measures providing banks with a clear compliance framework and avoiding the “gray area” risks of the past.

The Office of the Comptroller of the Currency (OCC) issued Interpretive Letter No. 1186 on November 18, clarifying that national banks may hold a certain amount of crypto assets as principals to pay blockchain network fees. This regulation allows banks to retain a “reasonably foreseeable” amount of cryptocurrency on their balance sheets to support transaction processing and platform testing, while emphasizing risk assessment and control requirements. Previously, banks without such holdings faced the risk of service interruptions; now, this “de minimis” exemption paves the way for institutional-level crypto operations.

U.S. Bank restarted its bitcoin custody service on September 3, expanding to bitcoin ETFs and providing secure storage solutions for institutional investment managers. The service is sub-custodied by NYDIG, marking a shift from traditional banks’ wait-and-see approach to proactive deployment.

Bank support has reduced bitcoin’s “illicit asset” image and enhanced its legitimacy as a payment and reserve tool. It is expected that by 2026, U.S. banks’ crypto custody assets will exceed $1 trillion, driving bitcoin’s transformation from speculation to utility.

Enterprise Holdings Forge Pillars of Confidence

MicroStrategy stands out for its aggressive bitcoin holding strategy. The company currently holds 650,000 bitcoins, worth about $59 billion, with an average purchase price of $74,431 per coin and a total cost of over $48 billion.

Founder Michael Saylor regards bitcoin as “digital property,” with a core strategy of accumulating BTC through equity financing and low-interest debt to form a “bitcoin treasury.” Despite bitcoin’s pullback from its October high and MicroStrategy’s market value once falling below its BTC holdings, the company has not wavered. Saylor emphasizes that reserves are an extension of the “digital credit” strategy, aimed at strengthening the company’s position as a bitcoin proxy.

MicroStrategy’s holdings account for 3.1% of bitcoin’s total supply, and each purchase (such as 8,178 coins on November 17) amplifies market signals. In 2025, the company has accumulated over 100,000 BTC, with a return rate of 24.6%. During the rebound, MicroStrategy’s stock price rose in tandem, proving that enterprise holdings have become a “stabilizer” for bitcoin’s price.

The Future: More New Highs in Sight

Although Binance founder CZ has not spoken recently, his long-term view has consistently emphasized bitcoin’s cyclical upside potential, predicting several new highs before the end of 2025, echoing Saylor’s narrative of “$21 million within 21 years.” More broadly, market consensus points to Federal Reserve rate cuts and pro-crypto policies from a Trump administration as drivers that will push bitcoin back above $100,000.