Economic Truth: AI Drives Growth Solo, Cryptocurrency Emerges as Geopolitical Asset

The market is no longer driven by fundamentals.

Original Article Title: The REAL state that we are in

Original Article Author: arndxt, Cryptocurrency Analyst

Original Article Translation: Chopper, Foresight News

If you have read my previous article on macro trends, you may already have a glimpse. In this article, I will break down for you the true state of the current economy: the only engine driving GDP growth is Artificial Intelligence (AI); all other areas such as the labor market, household finances, affordability, asset accessibility, etc., are on a downward trend; and everyone is waiting for a "cyclical turning point," but there is no longer such a thing as a "cycle."

The truth is:

· The market is no longer driven by fundamentals

· AI capital spending is the sole pillar to avoid a technological decline

· A liquidity tsunami will hit in 2026, and the market consensus has not even begun to price this in

· Wealth inequality has become a macro resistance forcing policy adjustments

· The bottleneck for AI is not GPUs but energy

· Cryptocurrency is becoming the only asset class with real upward potential for the younger generation, making it politically significant

Do not underestimate the risk of this transformation and miss out on opportunities.

Market Dynamics Decoupled from Fundamentals

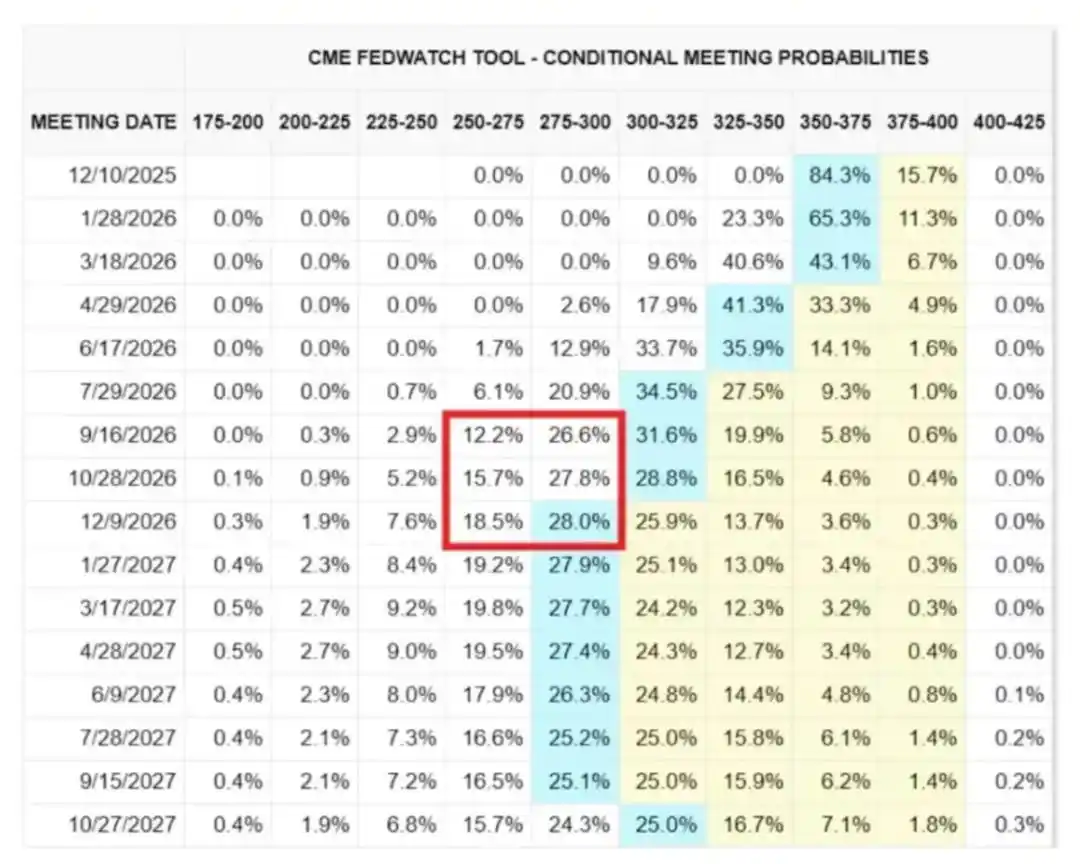

The price fluctuations of the past month had no support from new economic data but were caused by intense turbulence due to the Fed's change in stance.

Solely influenced by individual Fed officials' remarks, the probability of a rate cut switched back and forth from 80% to 30% to 80%. This phenomenon confirms the core feature of the current market: the influence of systematic fund flows far exceeds active macro views.

Here is evidence at the microstructural level:

1) Volatility-targeting funds mechanically reduce leverage when volatility spikes and increase leverage when volatility decreases.

These funds do not care about the "economy" as they adjust their investment exposure based on a single variable: the market's volatility.

When market volatility intensifies, they reduce risk by selling; when volatility decreases, they increase risk by buying. This results in automatic selling during market weakness and automatic buying during market strength, thereby amplifying two-way volatility.

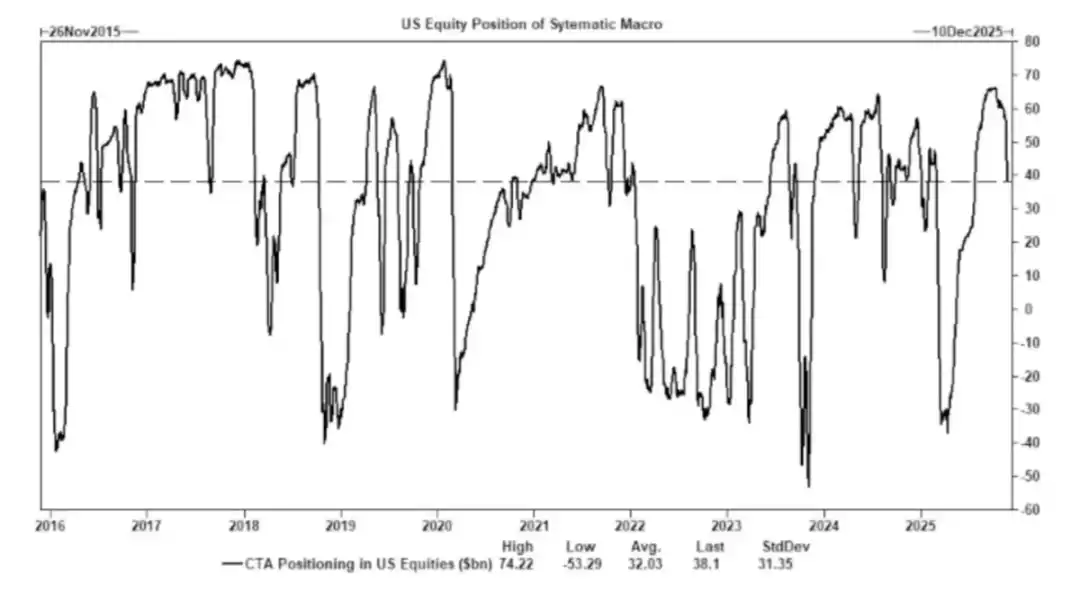

2) Commodity Trading Advisors (CTAs) will switch long and short positions at predefined trend levels, creating forced flows.

CTAs follow strict trend rules, with no subjective "viewpoints," purely mechanical execution: buy when price breaks a certain level, sell when price falls below a certain level.

When a sufficient number of CTAs hit the same threshold at the same time, even if the fundamentals remain unchanged, it can trigger large-scale coordinated buying and selling, even driving the entire index to fluctuate continuously for multiple days.

3) Share buyback windows remain the largest source of net equity demand.

Corporate stock buybacks are the largest net buyers in the stock market, larger than retail investors, hedge funds, and pension funds.

During the open buyback window, companies inject billions of dollars into the market every week, leading to:

· Intrinsic upward pressure during buyback season

· Market weakening noticeably after the buyback window closes

· Structural buying unrelated to macro data

This is also why, even in a downtrodden market sentiment, the stock market may still rise.

4) The Volatility Index (VIX) inversion curve reflects short-term hedging imbalances, not "panic."

Normally, the long-term volatility (3-month VIX) is higher than the short-term volatility (1-month VIX). When this relationship reverses, people often assume "rising panic sentiment," but today, this phenomenon is mainly driven by the following factors:

· Short-term hedging demand

· Option market maker position adjustments

· Weekly option fund inflows

· Systematic strategies rebalancing at month-end

This means: VIX soaring ≠ panic, but rather the result of hedge fund flows.

This distinction is crucial; volatility is now driven by trading behavior, not narrative logic.

The current market environment is more sensitive to sentiment and fund flows: economic data has become a lagging indicator of asset prices, and the Federal Reserve's communication has become the main driver of volatility. Liquidity, positioning structure, and policy tone are replacing fundamentals as the key drivers of price discovery.

AI is Key to Avoiding a Full-Blown Recession

AI has become a stabilizer of the macroeconomy: it effectively replaces cyclical hiring demand, supports corporate profitability, and maintains GDP growth even with a soft labor force foundation.

This means that the U.S. economy's reliance on AI capital expenditure far exceeds what policymakers publicly acknowledge.

· Artificial intelligence is suppressing the labor demand of the one-third of the workforce with the lowest skills and the highest susceptibility to replacement. This is typically where signs of a cyclical economic downturn first appear.

· Productivity gains have masked what would otherwise be a pervasive deterioration in the labor market. Output remains steady as machines take over work previously done by entry-level labor.

· Reduced headcounts, increased corporate profit margins, and households bearing the socio-economic burden have shifted income from labor to capital— a typical recession dynamic.

· AI-related capital formation artificially maintains GDP resilience. Without capital expenditure in the field of artificial intelligence, overall GDP data would be significantly weaker.

Regulators and policymakers will inevitably support AI capital expenditure through industrial policies, credit expansion, or strategic incentive measures because the alternative is an economic recession.

The Wealth Gap has Become a Macro Constraint

Mike Green's proposition that the "poverty line ≈ $130,000 - $150,000" sparked strong reactions, highlighting the deep resonance of this issue.

Core truths include:

· Parenting costs exceed rent/mortgage

· Housing has structurally become unaffordable

· Baby boomers dominate asset ownership

· Younger generations hold only income, no capital accumulation

· Asset inflation widens the wealth gap year by year

The wealth gap will force adjustments in fiscal policy, regulatory stance, and asset market interventions. Cryptocurrency, as a tool for the younger generation to participate in capital growth, will increasingly show its political significance, prompting policymakers to adjust their attitudes accordingly.

The Bottleneck of AI Scaling is Energy, Not Compute Power

Energy is set to become the new central narrative: The scalable development of the AI economy relies on the synchronous expansion of energy infrastructure.

The discussion around GPUs overlooks a more critical bottleneck: power supply, grid capacity, nuclear and natural gas power plant construction, cooling infrastructure, copper and key minerals, and data center location constraints.

Energy is becoming a limiting factor in AI development. In the next decade, the energy sector (especially nuclear power, natural gas, and grid modernization) will be one of the highest leverage areas for investment and policy.

A Bifurcated Economy Emerges with a Widening Gap

The U.S. economy is splitting into two major blocs: the capital-driven AI sector and the labor-dependent traditional sector, with little overlap between them and increasingly divergent incentive structures.

The AI economy continues to expand:

· High productivity

· High-profit margins

· Low labor dependency

· Strategically protected

· Attracts capital inflow

The real economy continues to shrink:

· Weak labor absorption capacity

· Consumer pressure

· Declining liquidity

· Asset centralization

· Inflation pressure

In the next decade, the most valuable companies will be those that can reconcile or take advantage of this structural divergence.

Future Outlook

· AI will receive policy backing as the alternative is stagnation

· Treasury-led liquidity will replace quantitative easing (QE) as the primary policy channel

· Cryptocurrency will become a political asset class tied to intergenerational equity

· The real bottleneck for AI is energy, not compute power

· Over the next 12-18 months, the market will still be driven by sentiment and fund flows

· Wealth inequality will increasingly shape policy decisions

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Matrixport Market Watch: Rebound Recovery or Trend Reversal?

After a rapid decline earlier, the crypto market experienced a periodical recovery this week.

Will Bitcoin falling to $80,000 break the Strategy model?

The key issue lies in how the company accumulates its assets and manages risks during increased market volatility.

RootData Dubai "Integration, Growth, and the New Crypto Cycle" Forum Highlights: Industry Leaders Discuss the New Crypto Cycle

This forum not only brought together cutting-edge insights across multiple dimensions such as investment, infrastructure, data services, and asset issuance, but also clearly conveyed a consensus: transparency, compliant innovation, and user-centric trust building will be the core pillars guiding the crypto industry through cycles and achieving sustainable growth.

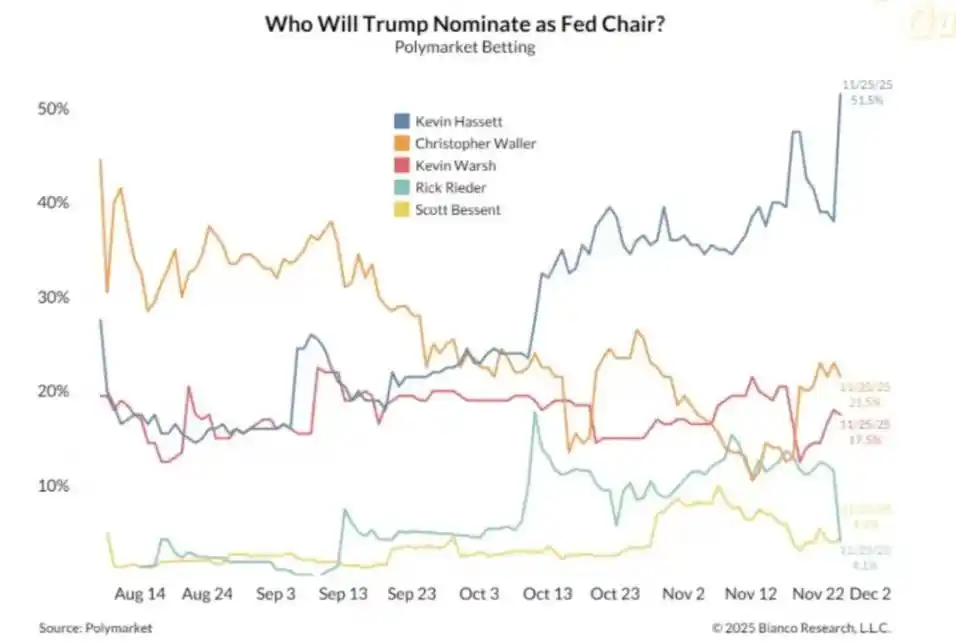

The new Federal Reserve chairman could bring the possibility of a wild bull market

Accelerating rate cuts and resuming QE?