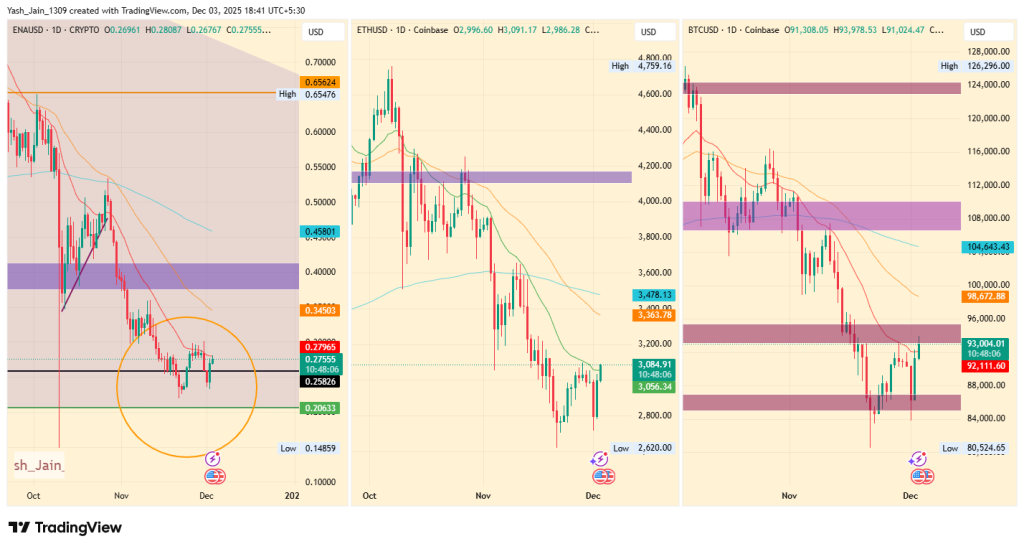

ENA price is once again reacting strongly to its historically proven demand zone between $0.20–$0.25, a region that previously triggered two major rallies. With improved market sentiment, Ethereum’s latest upgrade, and a new Ethena ETP (EENA) launch, the token is showing renewed upside potential. If momentum sustains, ENA price prediction December 2025 suggest a 150% rise could be possible.

The major key insight from this ENA price analysis is that its price has a deep technical relationship with the $0.20–$0.25 zone, as this region acted as a powerful launchpad twice.

In Q4 2024, ENA/USD surged over 500%, jumping from this support to hit $1.30 and in Q3 2025 same zone triggered a 290% rally to $0.87.

Notably, both rallies formed a descending triangle on the weekly chart, matching the current Q4 2025 would be predicted to end in this zone, as well. Because ENA price today sits near $0.27, analysts anticipate that if the token breaches $0.40, a continuation toward $0.65 would mark a 150% rise, this becomes a realistic near-term target because it aligns with the pattern’s resisting downward upper trendline.

- Also Read :

- Crypto ETF News: SEC Stops 3x and 5x Crypto ETFs to Protect Market Stability

- ,

Further strengthening this bullish case is improved broader market sentiment, led by the recent surge in Bitcoin and Ethereum. The BTC price USD has climbed from $92,950, gaining nearly 11% since December 1st.

Meanwhile, ETH surged 13%, breaking above $3,075, supported by two major catalysts.

First, Bitcoin’s momentum revived the entire altcoin sector. Second, Ethereum’s network saw another significant upgrade, which is the Fusaka rollout on December 3rd . Building upon Pectra, Fusaka introduces peer data availability sampling, targeting 40%–60% lower Layer-2 fees.

Since Ethena runs on Ethereum, this upgrade has indirectly supported ENA crypto’s latest demand surge, too.

As a result, ENA price USD jumped 18% intraday, lifting its market capitalization to $2.04 billion.

Adding to the momentum, 21Shares announced the launch of the 21Shares Ethena ETP (EENA) on December 3rd, alongside the Morpho ETP. These products push their new fully physically backed ETP lineup to 16 in 2025, strengthening institutional access to ENA.

The debut of the ENA ETP enhances liquidity pathways for ENA crypto, increasing exposure among traditional investors and potentially supporting the broader ENA price forecast for December.