BlackRock Report: US Debt Growth Will Drive Cryptocurrency Market Expansion

ChainCatcher news, according to CoinDesk, BlackRock, the world's largest asset management company, pointed out in its latest report that U.S. federal debt will swell to over $38 trillion, leading to a fragile economic environment and the failure of traditional hedging tools, which will accelerate the adoption of cryptocurrencies by Wall Street institutions.

The report emphasizes that increased government borrowing "creates vulnerabilities to shocks, such as bond yield spikes related to fiscal concerns or policy tensions between inflation management and debt servicing costs." Samara Cohen, BlackRock's Global Head of Markets, stated that stablecoins "are no longer niche products and are becoming a bridge between traditional finance and digital liquidity." The company's CEO, Larry Fink, described tokenization as the next generation of financial markets, a trend already reflected in BlackRock's $100 billion bitcoin ETF allocation, which has become a major source of its revenue.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Data: ANAP Holdings subsidiary increases holdings by 54.5 bitcoins, total holdings reach 1,200 bitcoins

Data: US XRP spot ETF saw a single-day net inflow of $50.27 million

Trending news

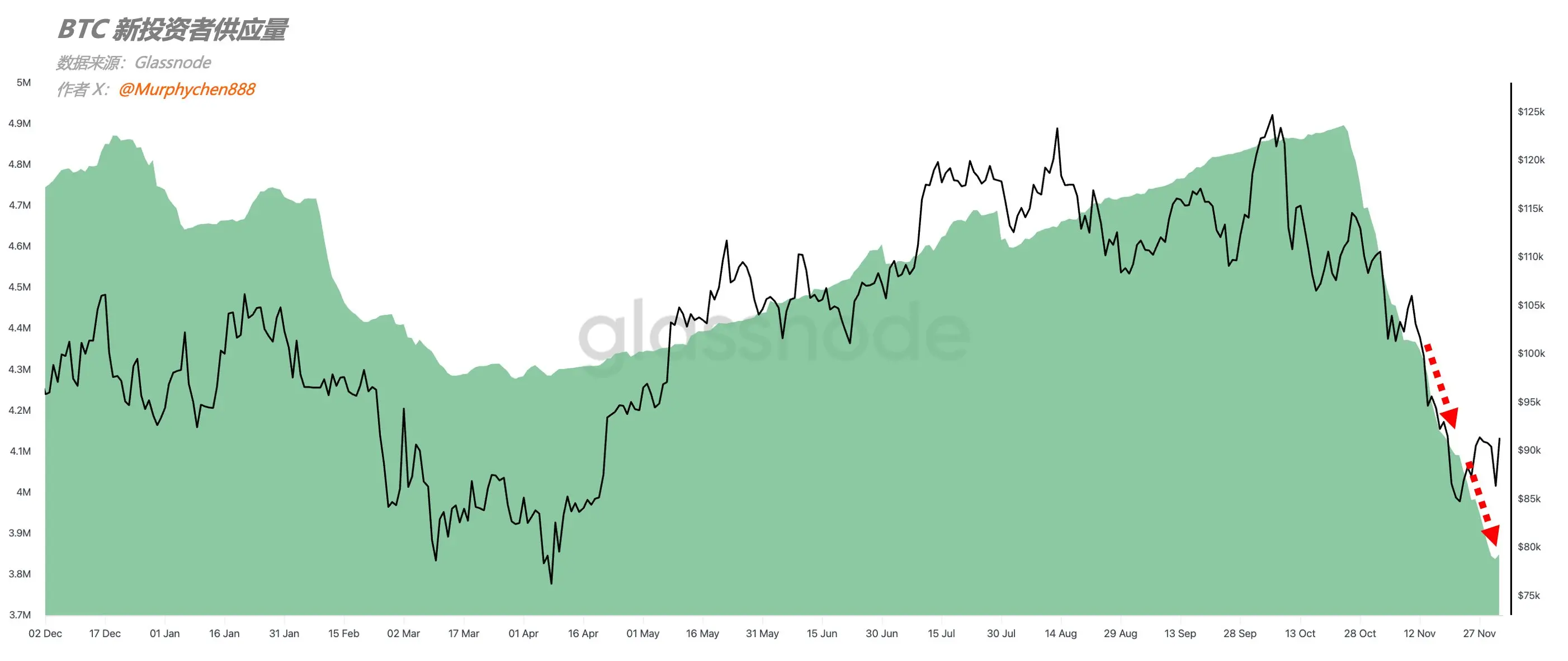

MoreAnalysis: Bitcoin selling pressure is gradually weakening but demand remains lacking; the reasonable expectation for December is stabilization rather than an immediate rebound.

Data: US LINK spot ETF saw a single-day net inflow of $3.84 million, while DOGE spot ETF saw a single-day net inflow of $177,000.