3 Crypto Narratives Surge in December 2025—Top Picks for 2026?

Three fast-emerging narratives are surging in December’s crypto outlook, setting the pace for the rest of the year and potentially a new tone for 2026. Web3 spending has hit record highs, Washington is pivoting to robotics, and prediction markets are roaring back, suggesting potential areas of interest for investors. A Record Month for Crypto Cards

Three fast-emerging narratives are surging in December’s crypto outlook, setting the pace for the rest of the year and potentially a new tone for 2026.

Web3 spending has hit record highs, Washington is pivoting to robotics, and prediction markets are roaring back, suggesting potential areas of interest for investors.

A Record Month for Crypto Cards

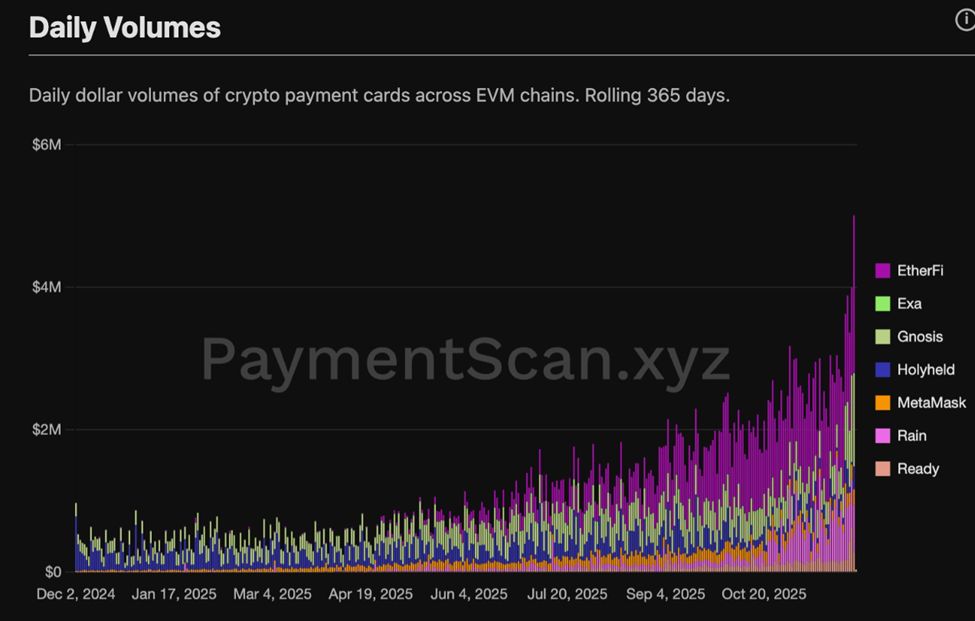

Crypto card payments quietly exploded in November, signaling what may be the strongest confirmation yet that Web3 neobanking is becoming a real consumer trend.

According to independent researcher Stacy Muur, crypto card volume hit $406 million in November, the highest on record. Rain led with $240 million, followed by RedotPay at $91 million and ether.fi Cash at $36 million.

Growth leaders included Rain (+22%), Ready (formerly Argent) (+58%), and Ether.fi (+9%). Meanwhile, MetaMask fell 30%, signaling a shift in user preferences toward newer, more utility-focused card products.

💳 Crypto cards reached $406M in volume in November.The leaders in terms of volume were:@raincards ($240M), @RedotPay ($91M), and @ether_fi Cash ($36M).The leaders in terms of rapid growth were:@raincards $196M → $240M (+22%)@ready_co $3.3M → $5.2M (+58%)@ether_fi $33M… pic.twitter.com/3XKxcL4qC8

— Stacy Muur (@stacy_muur) December 3, 2025

Data dashboards platform paymentscan confirmed the momentum, reporting the first-ever $5 million single-day volume for crypto cards alongside rising user activity.

Crypto Cards Daily Volumes. Source:

PaymentScan.xyz

Crypto Cards Daily Volumes. Source:

PaymentScan.xyz

The surge validates a growing market theme that Web3 neobanking is gaining real traction.

It aligns with a recent BeInCrypto report, which showed low-cap neobank tokens, including AVICI, CYPR, and MACHINES, are drawing analyst attention for their blend of real-world spending, self-custody, and yield-bearing crypto accounts.

These early-stage altcoins may be undervalued in relation to their usage growth across the sector.

Robotics x Crypto: Washington Lights a Fuse

A second narrative accelerated this week as the Trump administration shifted its technology focus from AI to robotics. Politico reported that Commerce Secretary Howard Lutnick is “all in” on expanding the US robotics sector, following high-level meetings with robotics CEOs.

TRUMP ADMINISTRATION SHIFTS FOCUS TO ROBOTICSPolitico reports that after its AI push, the Trump administration is now turning attention to robotics. Commerce Secretary Howard Lutnick has been meeting with robotics CEOs and is “all in” on accelerating the sector’s development,…

— *Walter Bloomberg (@DeItaone) December 3, 2025

Market participants immediately connected the dots. Crypto analyst HK wrote that they initiated a new position in robotics-linked tokens. Highlighting PEAQ, they argued that many assets may now be attractive for dollar-cost averaging.

“Decided to start a position in Robotics x Crypto … Many have dipped since the pump … late October … Might be a good time to DCA … Added PEAQ,” wrote analyst HK in a post.

If robotics becomes a 2025 policy priority, blockchain projects tied to automation, machine coordination, and machine identity could see renewed attention.

That storyline mirrors 2023–2024’s AI-token boom, but with a more industrial, hardware-driven twist.

Prediction Markets: A Volume War Breaks Out

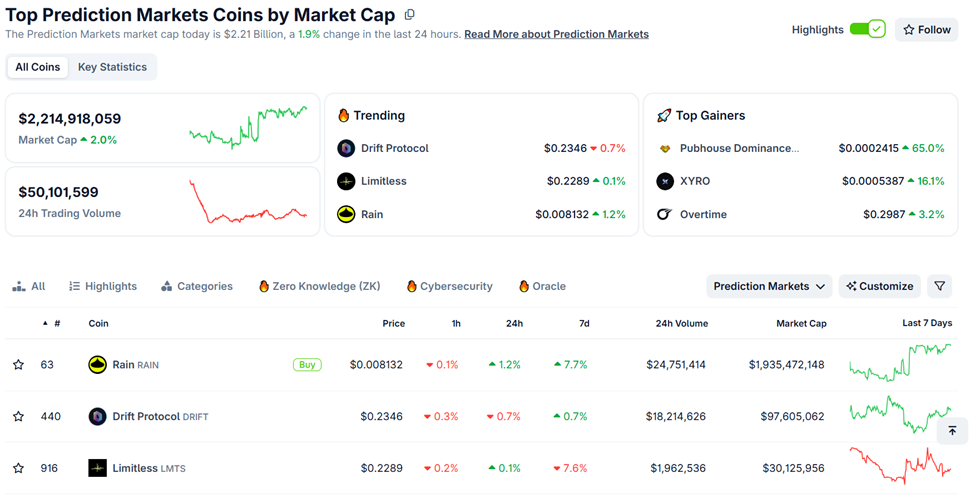

The strongest December breakout may be in prediction markets. A recent BeInCrypto report showed Opinion.Trade hit $1.5 billion in weekly volume, averaging $132.5 million per day. With this, the prediction market briefly surpassed its rivals, Kalshi and Polymarket, with a 40.4% market share.

Two catalysts propel that growth:

- AI-powered forecasting models

- Low-fee BNB Chain infrastructure, strengthened by October’s Polymarket integration and the launch of Opinion Labs’ mainnet

At the same time, CZ re-entered the sector, unveiling a YZiLabs-backed prediction platform on BNB Chain. Trust Wallet followed by integrating prediction tools for its 220 million users, partnering with Kalshi, Polymarket, and Myriad.

CoinGecko data shows the category reaching a $2.23 billion market cap, with $49.2 million in 24-hour trading volume. Trending assets include Limitless, Drift Protocol, and Rain, among others.

Top Prediction Market Coins By Market Cap. Source:

CoinGecko

Top Prediction Market Coins By Market Cap. Source:

CoinGecko

Many remain under the radar, creating a discovery environment similar to the early 2021 DeFi cycle.

With crypto cards setting records, Washington’s robotics pivot opening a new narrative lane, and prediction markets entering a high-volume arms race, December is shaping up as a turning point.

Investors now watching for Q1 2026 milestones, including regulatory updates, new card integrations, and major prediction market listings, may find these three narratives defining early-year momentum across the market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Assessing How the TGE of MMT Token Influences the Cryptocurrency Ecosystem

- Momentum Finance's MMT token TGE on Sui blockchain highlights innovative DeFi tokenomics with 42.72% community allocation and ve(3,3) governance model. - Post-TGE volatility (4,000% surge followed by 70% correction) reflects market dynamics, but technical indicators and buybacks suggest long-term resilience. - MMT's $250-350M FDV target and Sui integration demonstrate strategic benchmarks, offering lessons for balancing innovation, sustainability, and institutional trust in emerging blockchain projects.

Momentum (MMT) and the Rising Popularity Among Retail Investors: Insights from Behavioral Finance

- Momentum (MMT) price surges mirror 2021 GameStop dynamics, driven by social media sentiment and behavioral biases like overconfidence and herd behavior. - Retail-driven speculation distorts market efficiency, with 21% trading volume reflecting emotional decision-making over fundamentals, as shown by Bitget and academic studies. - Institutional investors exploit these anomalies through contrarian strategies, while regulators scrutinize social media's role in destabilizing traditional market models. - The

Timeless Strategies for Investing in Today's World

- McNeel and Buffett's value investing principles remain vital in today's volatile crypto markets. - Crypto surges driven by FOMO and hype, like MMT's 2025 rise, highlight risks of ignoring these strategies. - Buffett's focus on fundamentals and emotional discipline offers a structured approach to avoid speculative traps. - Case studies show adherence to these principles can mitigate losses during market corrections. - Timeless tenets of patience and intrinsic value are essential for long-term success in u