Polymarket may be tapping market making help in shift to boost liquidity

Polymarket is recruiting an in-house team of traders and market makers, preparing for the growth of predictions. The addition of market makers may boost Polymarket after a record month of activity in November.

Polymarket has grown its team, reportedly adding internal market makers that could trade against customers. The prediction platform is seeking to boost liquidity, so far mostly relying on whales to hold a selection of positions.

The market maker feature has previously faced criticism, as it could skew the market by trading against retailers.

The hiring announcements arrive at a time when rumors of Wintermute and other market makers joining Polymarket are making the rounds. The platform is also closely watched for high-profile whales and accounts with long winning streaks.

Polymarket whales retain outsized influence

While Polymarket is growing, there are concerns that the presence of whales may skew the predictions, which are now depending on retail and the knowledge of the general social media user.

Polymarket explorers also discovered accounts with connections to the wallets of Wintermute. The platform has grown enough to the point of specialization, as traders seek arbitrage, niche expert knowledge, and ways to be the first to know the real odds.

Crypto market maker Jump Trading joined Kalshi in the past few months, opening the door to the assistance of market makers.

According to Bloomberg, Polymarket has reached out to traders, including those with professional sports betting track record, about joining the in-house trading team, based on unnamed sources familiar with the matter.

Market makers challenge Polymarket’s neutrality

During its rise to fame in 2024, Polymarket was presented as an engine for truth discovery, based on distributed trader opinions. However, Kalshi has taken a different approach, applying an in-house team that often trades against users.

This approach may copy the usual sportsbook betting, where the platform sets the odds and benefits from customers’ losses. A market maker, however, may serve to take up less popular positions, ensuring specific markets are kept liquid.

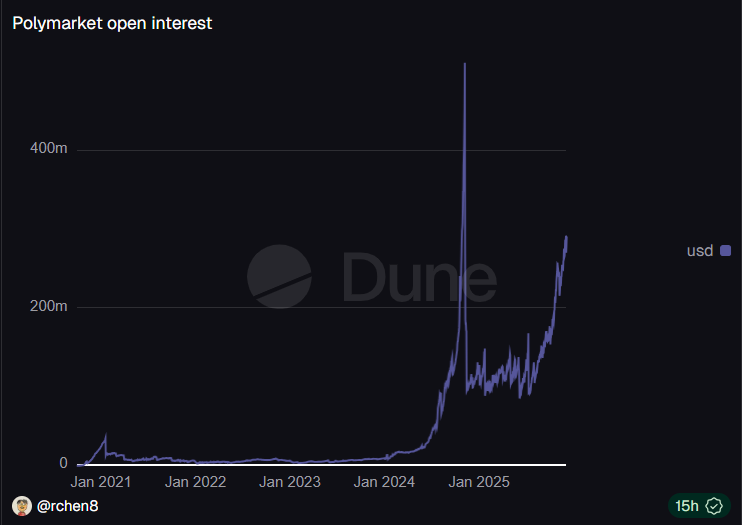

The in-house team was mentioned just as Polymarket prepares to launch on the US market, by starting a closed beta on its iOS app. The app is already gaining popularity and promising mainstream adoption. The platform carried over $286M in open interest, growing vertically in the past two months.

Polymarket is yet to pass its open interest record from late 2024, but is on track for rapid growth.

Polymarket has already become one of the key venues for trading, recently expanding its volumes to pass Solana’s meme token trenches. Predictions are also gaining influence ahead of perpetual futures markets, offering more simplicity and no technical or trading knowledge.

Polymarket also turned more attractive as it lacked the rapid liquidations and losses of other crypto markets. In November, Polymarket reached a record with over 494K active traders.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ZEC Value Rises 5.73% as Short Sellers Adjust Positions During Market Fluctuations

- ZEC surged 5.73% in 24 hours to $385.59, defying 9.19% weekly/monthly declines but rising 590.63% annually amid market turbulence. - "Calm Long King" trader increased ZEC short positions to $2.51M (10x leverage) with a $20K unrealized gain, contrasting losses in BTC and SOL shorts. - The trader's $17.29M ZEC short exposure reflects volatile market dynamics, with leveraged positions showing mixed gains/losses as crypto prices swing sharply. - ZEC's 24-hour rebound highlights risks for short sellers in a m

ZEC Rises 4.77% Amid Increased Short Positions and Market Rebound

- ZEC surged 4.77% in 24 hours to $386.31, with a 584.4% annual gain despite recent declines. - A prominent trader increased ZEC short positions to $17.29M, showing a $20k gain but larger losses in BTC and SOL. - Market recovery and short-position adjustments highlight ZEC’s volatility, with analysts warning of potential downward pressure if prices rise further.

ALGO Falls 1.01% While Investors Anticipate Crucial U.S. Inflation Report

- Algorand (ALGO) fell 1.01% in 24 hours to $0.1372, but rose 0.44% weekly/monthly amid market uncertainty. - Investors focus on U.S. inflation data and Fed policy, with Chair Powell signaling cautious rate-cut approach for 2026. - Earnings reports from Airbnb , Coca-Cola , and Coinbase will shape sector sentiment, while unrelated lawsuits impact PRGO and ALVO. - Global volatility in travel/aviation sectors and India's IndiGo disruptions highlight broader market risks unrelated to crypto.

BCH has increased by 32.06% over the past year as the market remains steady

- Bitcoin Cash (BCH) fell 0.19% in 24 hours but rose 32.06% annually, reflecting strong long-term demand and institutional interest. - Analysts highlight BCH's resilience amid stable trading ranges, driven by cross-border transactions and micropayments adoption. - Sustained 6.1% gains over 30 days and 7-day periods underscore BCH's role as a high-utility altcoin in diversified portfolios. - Market stability and growing mainstream recognition position BCH for continued performance amid broader crypto sustai