How much longer can the currency premium narrative of L1 be sustained?

Author: @AvgJoesCrypto, Messari

Translation: AididiaoJP, Foresight News

Original Title: Bottom-Fishing Choices: BTC VS ETH, Which Has the More Attractive Potential Return?

Cryptocurrencies are the driving force of the industry

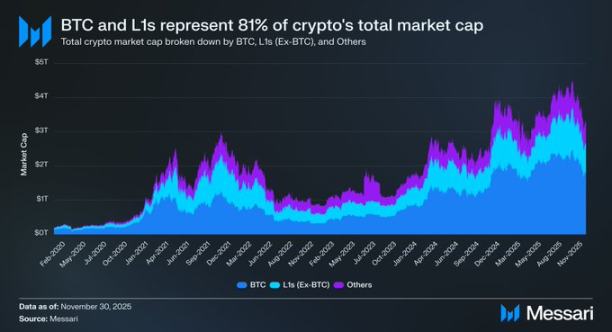

Refocusing discussions on cryptocurrencies is crucial, as this is essentially the ultimate goal for most capital allocation within the industry. The current total market capitalization of cryptocurrencies is about $3.26 trillions. Of this, Bitcoin (BTC) accounts for $1.80 trillions (about 55%). Of the remaining $1.45 trillions, about $0.83 trillions are concentrated in various "alternative Layer 1 blockchains" (L1).

In summary, about $2.63 trillions (81% of the total crypto capital) is allocated to assets that the market already regards as currency, or believes can accumulate a "monetary premium".

Therefore, whether you are a trader, investor, capital allocator, or ecosystem builder, understanding how the market assigns or withdraws this "monetary premium" is crucial. In the crypto world, nothing drives valuation changes more than whether the market is willing to treat an asset as money. For this reason, predicting where future "monetary premium" will accumulate can be said to be the most important consideration when building a crypto portfolio.

Previously, we mainly focused on Bitcoin, but it is also worth discussing the other $0.83 trillions, assets that lie between "currency" and "non-currency". As mentioned earlier, we expect Bitcoin to continue to take market share from gold and other non-sovereign stores of wealth in the coming years. So what about the situation for L1s? Will it be a "rising tide lifts all boats" scenario, or will Bitcoin fill the gap with gold by siphoning off the monetary premium from L1s?

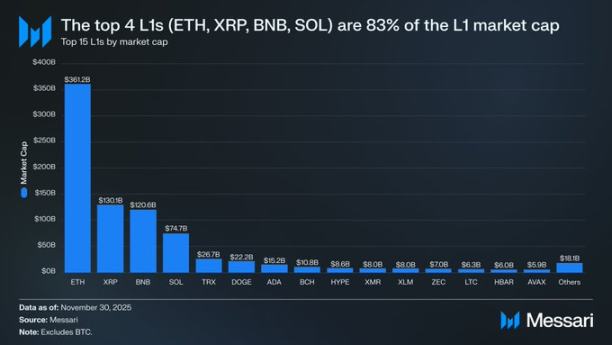

First, it is helpful to examine the current valuation status of L1s. The top four L1s—Ethereum (ETH, $361.15 billions), XRP ($130.11 billions), BNB ($120.64 billions), and Solana (SOL, $74.68 billions)—have a combined market cap of $686.58 billions, accounting for 83% of the entire alternative L1 sector.

After the big four, valuations drop sharply (TRON TRX is $26.67 billions), but interestingly, the "long tail" still has considerable scale. L1 projects ranked outside the top 15 have a total market cap of $18.06 billions, accounting for 2% of the entire alternative L1 market cap.

It should be clarified that the market cap of L1s does not purely reflect their implied "monetary premium". There are three main valuation frameworks for L1s:

-

Monetary premium

-

Real economic value

-

Demand for economic security

Therefore, the market cap of a project does not fully equate to the market treating it as money.

What drives L1 valuation is monetary premium, not revenue

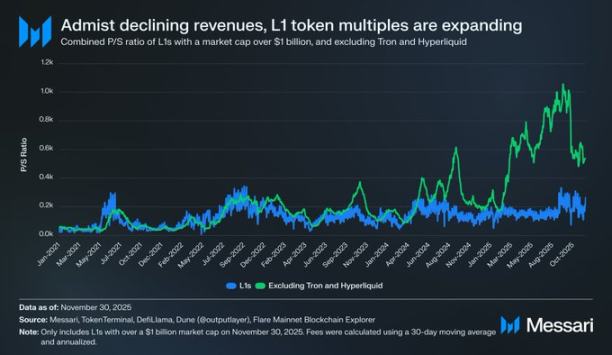

Although there are multiple valuation frameworks, the market is increasingly inclined to assess L1s from the perspective of "monetary premium" rather than "revenue-driven". Over the past few years, the overall price-to-sales ratio (P/S) for all L1 projects with a market cap over $1 billion has remained relatively stable, roughly between 150 and 200 times. However, this overall figure is misleading because it includes TRON and Hyperliquid. In the past 30 days, TRX and HYPE contributed 70% of the group's revenue, but their market cap accounted for only 4%.

After excluding these two outliers, the real situation becomes clear: as revenue declines, L1 valuations are rising. The adjusted price-to-sales ratio continues to climb:

-

November 30, 2021: 40x

-

November 30, 2022: 212x

-

November 30, 2023: 137x

-

November 30, 2024: 205x

-

November 30, 2025: 536x

If interpreted from the perspective of real economic value, one might think the market is simply pricing in future revenue growth. But this explanation does not hold up. In the same basket of L1s (still excluding TRON and Hyperliquid), except for one year, revenue has declined year after year:

-

2021: $12.33 billions

-

2022: $4.89 billions (down 60% year-on-year)

-

2023: $2.72 billions (down 44% year-on-year)

-

2024: $3.55 billions (up 31% year-on-year)

-

2025 (annualized): $1.70 billions (down 52% year-on-year)

In our view, the simplest and most direct explanation is: what drives these valuations is "monetary premium", not current or future revenue.

L1s continue to underperform Bitcoin

If L1 valuations are driven by expectations of monetary premium, the next step is to explore what factors shape these expectations. A simple test is to compare their price performance with Bitcoin. If monetary premium expectations are merely a reflection of Bitcoin's trend, then these assets should perform similarly to Bitcoin's beta returns (i.e., highly correlated, moving with the market). Conversely, if expectations are driven by unique factors of each L1, their correlation with Bitcoin should be weaker, and their performance more independent.

We took the top ten L1 tokens by market cap (excluding HYPE) as representatives of the L1 sector and examined their performance relative to Bitcoin since December 1, 2022. These ten assets account for about 94% of the total L1 market cap, enough to represent the entire sector. During this period:

-

Eight L1s underperformed Bitcoin in absolute returns.

-

Six of them lagged behind Bitcoin by more than 40%.

-

Only two assets outperformed: XRP and SOL.

-

XRP only outperformed by 3% (considering its history of being mainly driven by retail funds, this slight lead is not significant).

-

The only asset with significant excess returns is SOL, outperforming Bitcoin by 87%.

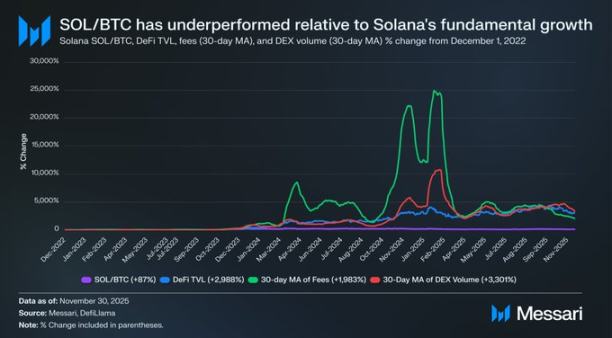

However, a deeper analysis of SOL's outstanding performance reveals that it may actually be "underperforming". During the same period that SOL outperformed Bitcoin by 87%, the fundamentals of the Solana ecosystem grew exponentially: DeFi total value locked increased by 2,988%, fee revenue grew by 1,983%, and DEX trading volume grew by 3,301%. By any reasonable standard, since the end of 2022, the Solana ecosystem has grown 20 to 30 times in scale. But the asset SOL, which is designed to capture this growth, only outperformed Bitcoin by 87%.

This means that for an L1 to achieve meaningful excess returns over Bitcoin, it does not need its ecosystem to grow by 200-300%, but rather by an astonishing 2,000-3,000%—just to achieve less than a twofold excess return.

Based on the above analysis, we believe: although L1 valuations are still pinned on expectations of future monetary premium, market confidence in these expectations is quietly eroding. Meanwhile, the market's belief in Bitcoin's monetary premium remains unshaken; in fact, Bitcoin's lead over L1s is widening.

Outlook

Looking ahead, we do not believe this trend will reverse in 2026 or in the coming years. With very few possible exceptions, we expect alternative L1s to continue to cede market share to Bitcoin. L1 valuations, mainly driven by expectations of future monetary premium, will continue to be compressed as the market increasingly recognizes the reality that "Bitcoin is the asset with the strongest monetary properties in crypto".

Admittedly, Bitcoin will also face challenges in the future, but these challenges are too distant and full of unknown variables to provide strong support for the monetary premium of other competing L1 assets at present.

For L1s, compared to Bitcoin, their narrative is no longer as compelling, nor can they rely on general market enthusiasm to indefinitely support their valuations. The narrative of "we may one day become money", which once supported trillion-dollar dreams, is gradually closing.

Investors now have ten years of data to prove: the monetary premium of L1s is only maintained during very short periods of explosive platform growth. For the vast majority of the time outside of this, L1s continue to underperform Bitcoin; and when the growth dividend fades, their monetary premium begins to dissipate as well.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

"If you're afraid, buy bitcoin": BlackRock CEO calls bitcoin a "panic asset", says sovereign funds have quietly increased their holdings

BlackRock CEO Larry Fink defines Bitcoin not as a "hope asset," but as a "panic asset."

Stablecoin Legislation Booms Globally, Why Is China Taking the Opposite Approach? An Article to Understand the Real National Strategic Choices

Amid the global surge in stablecoin legislation, China has chosen to firmly curb stablecoins and other virtual currencies, while accelerating the development of the digital yuan to safeguard national security and monetary sovereignty. Summary generated by Mars AI. This summary is produced by the Mars AI model and its accuracy and completeness are still being iteratively improved.

Liquidity migration begins! Japan becomes the Fed's "reservoir," 120 billions in carry trade returns set to ignite the December crypto market

The Federal Reserve has stopped quantitative tightening and may cut interest rates, while the Bank of Japan plans to raise rates, changing the global liquidity landscape and impacting carry trades and asset pricing. Summary generated by Mars AI. This summary is produced by the Mars AI model, and the accuracy and completeness of its content are still under iterative improvement.

Weekly Hot Picks: Bank of Japan Sends Strongest Rate Hike Signal! Is the Copper Market Entering a Supercycle Rehearsal?

The leading candidate for Federal Reserve Chair is being questioned for potentially "accommodative rate cuts." Copper prices have reached a historic high, and a five-hour meeting between the United States and Russia ended without results. Expectations for a Japanese interest rate hike in December have surged, and Moore Threads' stock soared more than fivefold on its first day... What market moves did you miss this week?