Ethereum Price Signals Bearish Reversal as 1K–10K ETH Wallets Keep Selling

- An evening star candle pattern at the resistance trendline of the falling wedge pattern signals a potential downswing in Ethereum price.

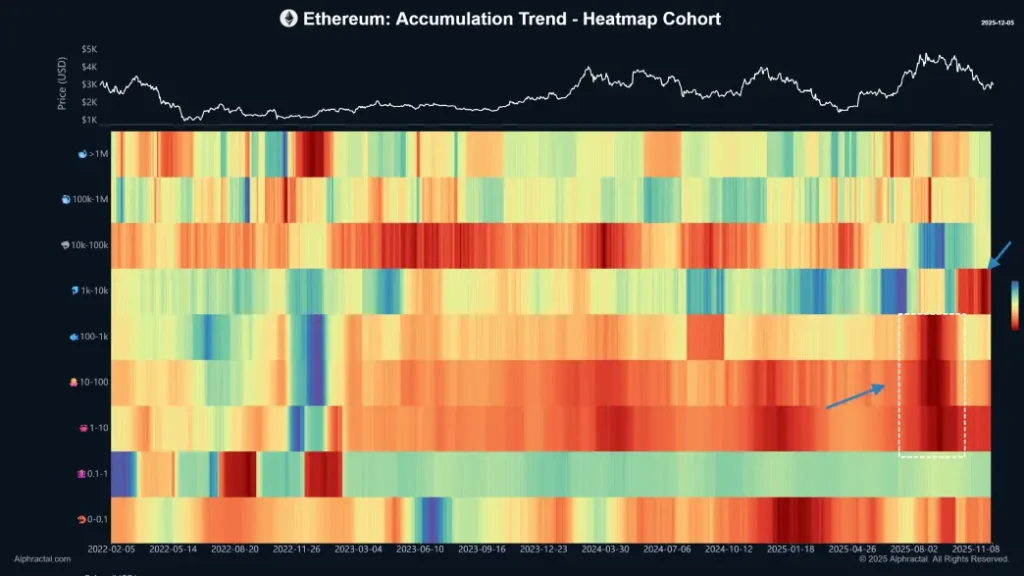

- The 1,000–10,000 ETH cohort made the heaviest selling at the peak and continues to distribute coins at the current market.

- A potential death crossover between 100-and 200-day EMA slopes could accelerate the market selling pressure.

ETH, the native cryptocurrency of the Ethereum blockchain, slips over 3.5% during Friday’s U.S. market hours to trade just above $2,000. The broader crypto market shows a similar downtick, as it seems that the early weeks recuperated the exhausted bearish momentum. However, the Ethereum price faced additional selling pressure as mid-size whales (1K–10K ETH) carried out heavy distribution. Will the top altcoin lose $3,000 again?

Middle-Tier Ethereum Whales Drive Post-Peak Selling Pressure

Over the past three months, the Ethereum price has witnessed a steady downtrend from its $4,955 all-time high (ATH) to its current trading value of $3,040, registering a 39% loss.

On-chain data of Ethereum’s supply distribution indicates that holders with balances between 1,000 and 10,000 ETH made the bulk of sales at the recent ATH. This cohort sold off positions aggressively at the peak of the price while there was widespread optimism among other market participants, celebrating the new highs.

The same bracket keeps on shrinking the holdings in the present moment, creating more persistent downward pressure despite the price trying to stabilize above $4,000. Daily net outflows from these addresses are still higher than pre-rally levels.

On the other hand, addresses with control over 10,000 ETH have shown much lower activity. Their collective balance has only decreased slightly since the top, with no indication of acceleration in selling or the accumulation of much. Transfers between the largest wallets remain within normal ranges, suggesting a wait-and-see approach rather than active repositioning.

Smaller holders below 1000 ETH have exhibited mixed behavior, with some cohorts adding tokens on dips and others trimming positions, although their combined impact is dwarfed by the middle-tier group.

The divergence can be seen in real-time supply measures: the 1,000-10,000 ETH tier has lost around 4-6% of its total supply since the local peak; the 10,000+ tier has lost less than 0.5% over the same period. This imbalance points out which segment currently controls the short-term direction of price action.

Ethereum Price Risks $2,500 Breakdown With this Reversal

In the last two days, the Ethereum price has shown a bearish pullback from $3,240 to its current trading value of $3,022, registering a 4.74% loss. This downtick displays an evening star bearish candle pattern at the resistance line of a falling wedge pattern.

The chart setup is characterized by two converging trendlines, which provide dynamic resistance and support to coin traders. Their downsloping nature drives the current price correction while maintaining a sell-the-bounce sentiment.

As the ETH price dives below the 20-day exponential moving average slope, the sellers could strengthen their group over this asset for a prolonged period. The post-reversal fall could push the price another 29% to seek the wedge pattern support at $2,115.

The current price position below the key EMAs (20, 50, 100, and 200) accentuates that the path of least resistance is down.

On the contrary, if the buyers flipped the overhead resistance into a potential support, ETH could recoup its bullish momentum for a sustainable price recovery. The post-breakout rally could face key resistance at $3,466, followed by $4,250.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Evaluating the Influence of MMT on Market Fluctuations in 2025

- Modern Monetary Theory (MMT) drives 2025 fiscal expansion, reshaping global markets through deficit-financed AI and infrastructure investments. - U.S. equity markets benefit from MMT-aligned stimulus, while emerging markets show resilience via fiscal reforms and commodity-linked growth. - Commodity volatility rises as MMT-fueled demand clashes with supply constraints, amplified by dollar strength and climate disruptions. - IMF advocates "credible frameworks" to balance MMT's growth potential with inflati

COAI Experiences Sharp Decline in Share Value: Regulatory Oversight and Changing Investor Attitudes Impact India's Cryptocurrency Industry

- India's 2025 crypto crackdown triggered COAI's sharp share price drop as FIU-IND targeted 25 offshore exchanges for AML violations. - SEBI banned finfluencer Avadhut Sathe for ₹601 crore in unregistered investment advice, exposing systemic risks in influencer-driven trading. - Regulatory uncertainty and 30% crypto tax dampened investor confidence, with COAI's decline linked to both enforcement actions and $5.6B forex reserve losses. - Experts warn India's punitive approach risks stifling innovation despi

The Impact of New Technologies on Improving Educational Programs and Boosting Institutional Effectiveness

- Global EdTech and STEM markets are transforming via AI, cybersecurity, and VR/AR integration, driving curricular innovation and institutional scalability. - Farmingdale State College exemplifies this shift, boosting enrollment 40% through AI/cybersecurity programs and securing $75M for a new tech-focused campus center. - AI-in-education market alone is projected to grow from $5.88B in 2024 to $32.27B by 2030, with EdTech overall expected to reach $738.6B by 2029 at 14.13% CAGR. - Government funding and i

Navigating the Fluctuations of the Cryptocurrency Market: Smart Entry Strategies for Individual Investors

- KITE token's 2025 price surge highlights retail-driven volatility, with 72% trading volume from individual investors. - FDV ($929M) far exceeding initial market cap ($167M) fueled FOMO and panic selling amid rapid 38.75% gains followed by 16% corrections. - Strategic approaches like DCA and stop-loss orders are critical for managing risks in speculative crypto markets dominated by emotional trading behavior.