The crypto market is very scared right now. The Fear and Greed Index is at 21, and it was even lower at 10 before. Fewer people are searching for Bitcoin on Google, and many investors have become careful after the big crash on October 10.

With interest dropping and ETF flows reversing, everyone is asking, is this just a correction or the start of a real bear market?

According to recent market data , the October 10 crash was the main reason sentiment fell to record lows of 10, triggered by surprise U.S.–China tariff war news.

Following the announced bitcoin price fall from $126,000 to $98,000, wiping out over $19 billion in leveraged trades. Meanwhile, the major altcoins like SOL, XRP, etc, fell more than 40% within hours.

Due to this crash, crypto order books became very thin. Market makers removed liquidity to avoid more losses, ETF inflows turned into outflows, and global demand for digital assets weakened.

With most investors staying cautious, fear has dominated the market for several weeks.

Though markets have stabilized somewhat as the crypto greed & fear index has climbed slightly to 21, but the market is still deep inside the fear zone.

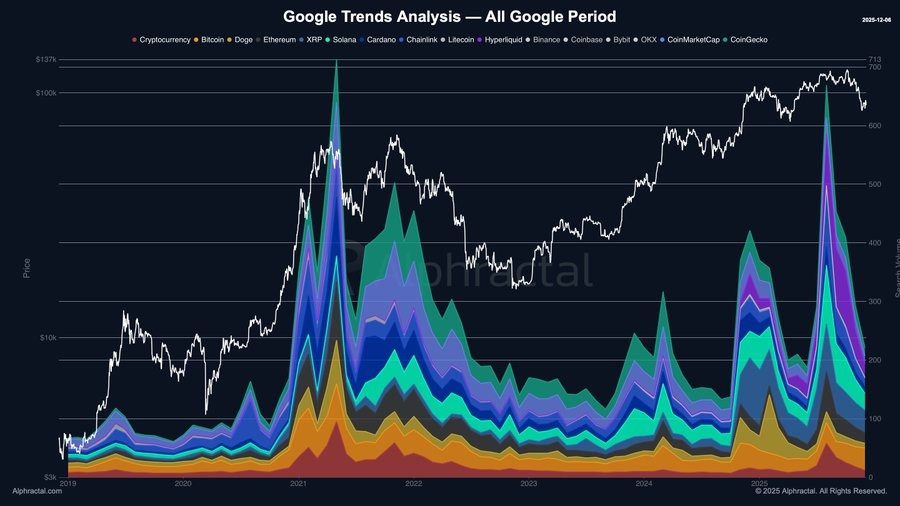

Meanwhile, retail interest around crypto, tracked via global Google Trends for “crypto,” “Bitcoin,” and related searches, has dropped back to levels seen during previous mid-cycle corrections.

According to market traders , such periods of low interest and high fear often mark an accumulation zone, times when savvy investors quietly build positions while the crowd remains pessimistic.

Even with growing panic, analysts are divided. Crypto trader KillaXBT says Bitcoin is still repeating the same pattern it shows after every recent FOMC week. This time, Bitcoin briefly moved above $95,000, then dropped about 5% and is now near $90,000.

He expects the next key move to happen around December 10–11 based on the latest FOMC data.

Despite all the Nasdaq, silver, and S&P 500 all moving higher, bitcoin is heading in the opposite direction, down 3% today, marking the first time since 2014 that the market has dropped while traditional assets climbed.