Is it the right moment to reinvent your startup?

When One Founding Isn’t Enough

Launching a startup once may not always satisfy ambitious founders.

This trend is evident in companies such as Airtable, Handshake, and Opendoor, all of which have recently declared they are undergoing a process they call “refounding.” According to The New York Times, these announcements often coincide with shifts in business strategy or the introduction of innovative AI-driven products.

Airtable’s Approach to Refounding

In June, Airtable revealed that rather than simply integrating additional AI features into their current platform, they viewed this as an opportunity to fundamentally reinvent the company.

Howie Liu, Airtable’s co-founder and CEO, explained to the NYT that this move isn’t a traditional pivot, since it doesn’t stem from correcting past mistakes. While they considered terms like “relaunch” or “transformation,” they ultimately settled on “founding” language because the stakes felt just as high as when the company first began.

Reviving Startup Spirit at Handshake

Katherine Kelly, Handshake’s chief marketing officer, shared that their goal is to reintroduce the energy and mindset of a startup into their established organization. This renewed focus also brings increased expectations—Handshake has asked employees to return to the office full-time, emphasizing a work pace and commitment level necessary to achieve ambitious targets.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget Releases Major Upgrades to GetAgent With Smarter Responses and Free Access for All Users

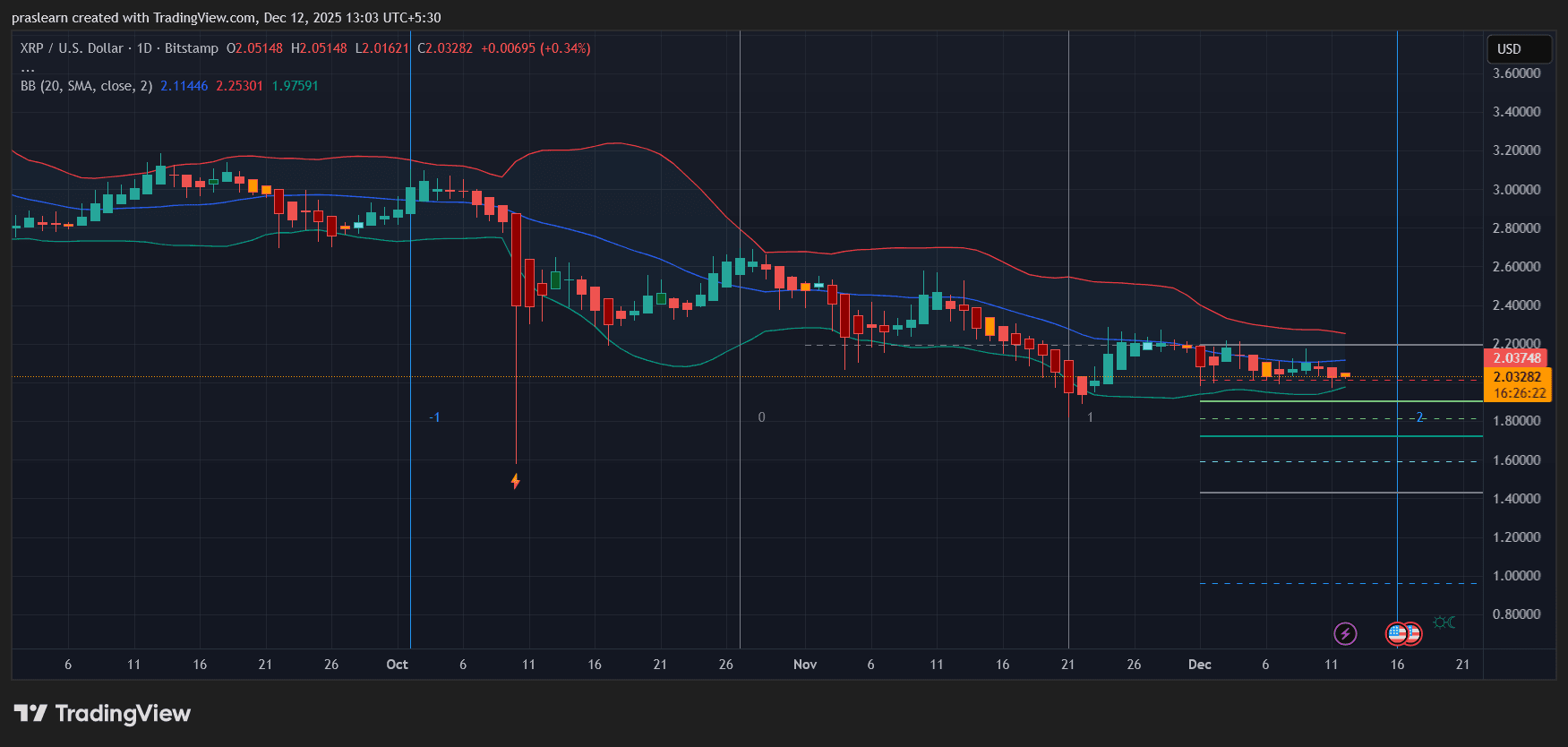

Will Fed Uncertainty Cap XRP’s Upside in 2026?

They already knew the TGA Game of the Year in advance, earning tens of thousands of dollars.

Violating history, yet persisting.

The Convergence of Social Justice and Renewable Energy Implementation in Developing Economies

- IEA data shows emerging markets need $45B/year by 2030 to achieve universal clean energy access, with Africa and Asia facing the greatest demand. - Renewable projects in low-income regions demonstrate nonlinear ESG impacts, with solar microgrids directly reducing energy poverty for 600M+ Africans. - PIDG's $27M guarantees mobilized $270M in African renewables, proving blended finance models can de-risk investments while creating 200-300MW capacity. - Kenya's M-KOPA and Indonesia's JETP showcase scalable