Key Market Information Discrepancy on December 8th - A Must-See! | Alpha Morning Report

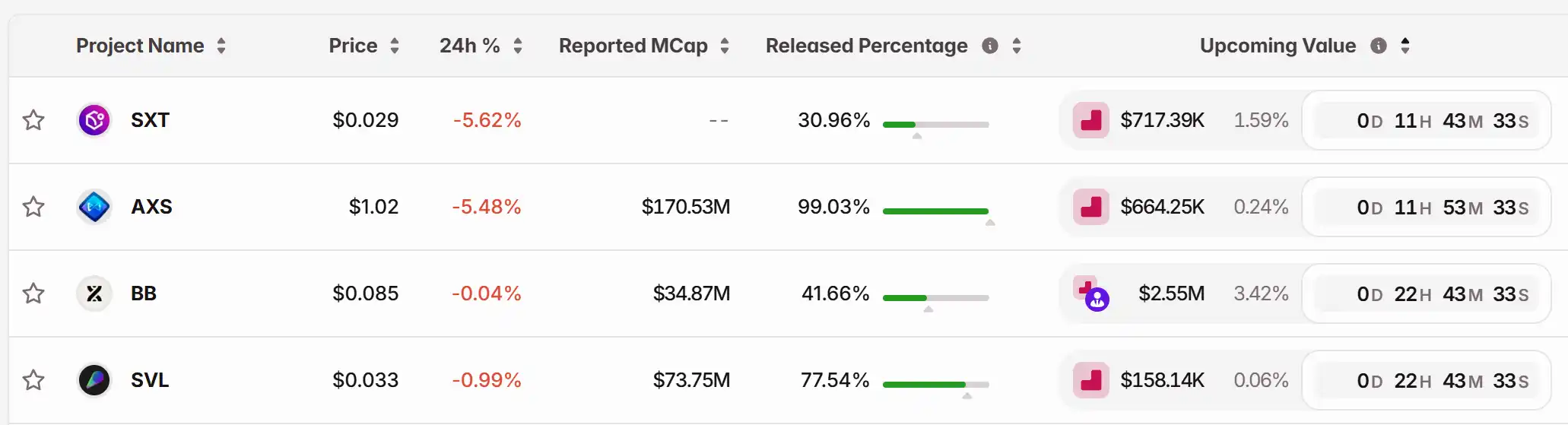

1. Top News: This week APT, CHEEL, LINEA, and other tokens will undergo a one-time large unlock 2. Token Unlock: $SXT, $AXS, $BB, $SVL

Featured News

1.This Week APT, CHEEL, LINEA, and Other Tokens Will See Large One-Time Unlock

2.MOODENG Surges Over 43% in 24 Hours, Market Cap Reaches $1.04 Billion

3.Strategy's Bitcoin Holding Currently Has Unrealized Profits of 19.3%, About $9.35 Billion

4.Paradigm Co-founder Says This Is the Cryptocurrency's 'Netscape or iPhone Moment'

5.Solana Foundation President Urges Kamino and Jupiter to Stop Infighting and Focus on Market Expansion

Articles & Threads

1.《The World Beyond SWIFT: Russia and the Cryptocurrency's Secret Economy》

Moscow's winter mornings always arrive slowly. The subway glides from the gray residential areas into the city center, with the advertising screens in the carriages rolling the usual ruble loan offers, online shopping promotions, and a seemingly normal banner: "Settling Overseas Income? USDT Accepted." It's hard to imagine that in a country surrounded by the Western financial system, the term "stablecoin," originally found only in Silicon Valley whitepapers, has quietly become the infrastructure upon which ordinary people and businesses rely.

2.《The Future of Cryptocurrency: From Speculative Asset to the Internet's Foundation》

Cryptocurrency is heading towards mainstream adoption, but the path may be entirely different from what you imagine. It won't come in the form of Bitcoin, Ethereum, or Solana, nor will it be dominated by NFT art or meme coins. Instead, it will quietly integrate into the underlying infrastructure of digital finance and the internet, becoming a secure communication layer between applications, much like the transition from HTTP to HTTPS.

Market Data

Daily Market Overall Funding Heatmap (as reflected by Funding Rate) and Token Unlocks

Data Source: Coinglass, TokenUnlocks

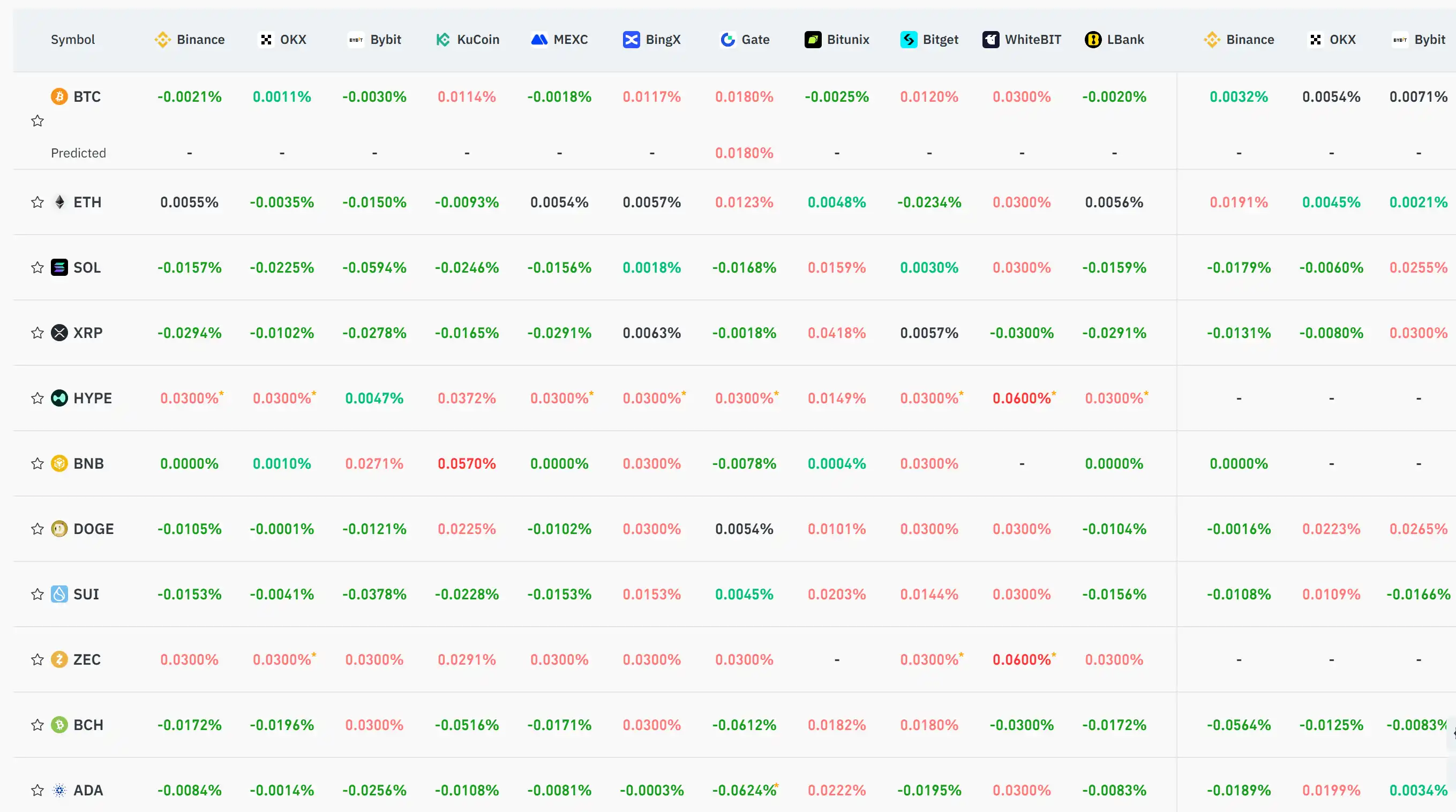

Funding Rate

Token Unlocks

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Grasping the Factors Leading to Solana's Recent 50% Decline in Value

- Solana's 50% price drop in early 2025 stemmed from token unlocks, declining network activity, and the Libra meme token collapse. - Network metrics like active addresses (-40%) and TVL ($2.87B loss) revealed weakening ecosystem trust and liquidity. - Broader crypto market declines (Bitcoin to $86K) and macroeconomic risks accelerated Solana's sell-off amid rising trade war fears. - $500M liquidity migration to Ethereum and institutional ETF launches signaled cautious optimism despite ongoing volatility. -

Evaluating Solana’s Recent Price Fluctuations in Response to Network Enhancements and Changing Market Sentiment

- Solana's 2025 upgrades (Firedancer, Alpenglow) enhanced throughput, decentralization, and block finality, supporting mainstream financial operations. - Price volatility (19% drop to $132) reflected market fear, but whale accumulation and ETF launches signaled institutional confidence in long-term potential. - Macroeconomic pressures and regulatory scrutiny tempered speculative demand, while on-chain metrics showed diverging NVT ratios and declining retail participation. - Investors face a cautious opport

Bitcoin Leverage Liquidation: Unseen Dangers Amid Crypto Market Fluctuations

- Q3 2025 saw $19B in Bitcoin leveraged trading liquidations, driven by cascading ADL mechanisms on major exchanges. - Overleveraged retail investors and DATCos amplified volatility through forced selling, exposing systemic fragility in crypto markets. - Behavioral biases like herd mentality and overconfidence worsened instability, with social media fueling impulsive trading decisions. - Institutions adopted risk-mitigation strategies while regulators tightened oversight, but gaps persist in monitoring opa

SHIB Eyes a Major Lift as the 2026 Privacy Upgrade Approaches