New Token Launches on Pump.fun Surge in Early December – Is Meme Season Back?

The meme coin market is showing clearer signs of recovery in December. Pump.fun — the leading platform for launching meme coins — is reporting a renewed increase in newly created tokens. Analysts also note that investor sentiment is shifting toward a higher risk appetite as the year draws to a close. How Is Pump.fun Reflecting

The meme coin market is showing clearer signs of recovery in December. Pump.fun — the leading platform for launching meme coins — is reporting a renewed increase in newly created tokens.

Analysts also note that investor sentiment is shifting toward a higher risk appetite as the year draws to a close.

How Is Pump.fun Reflecting December’s Increased Risk Appetite?

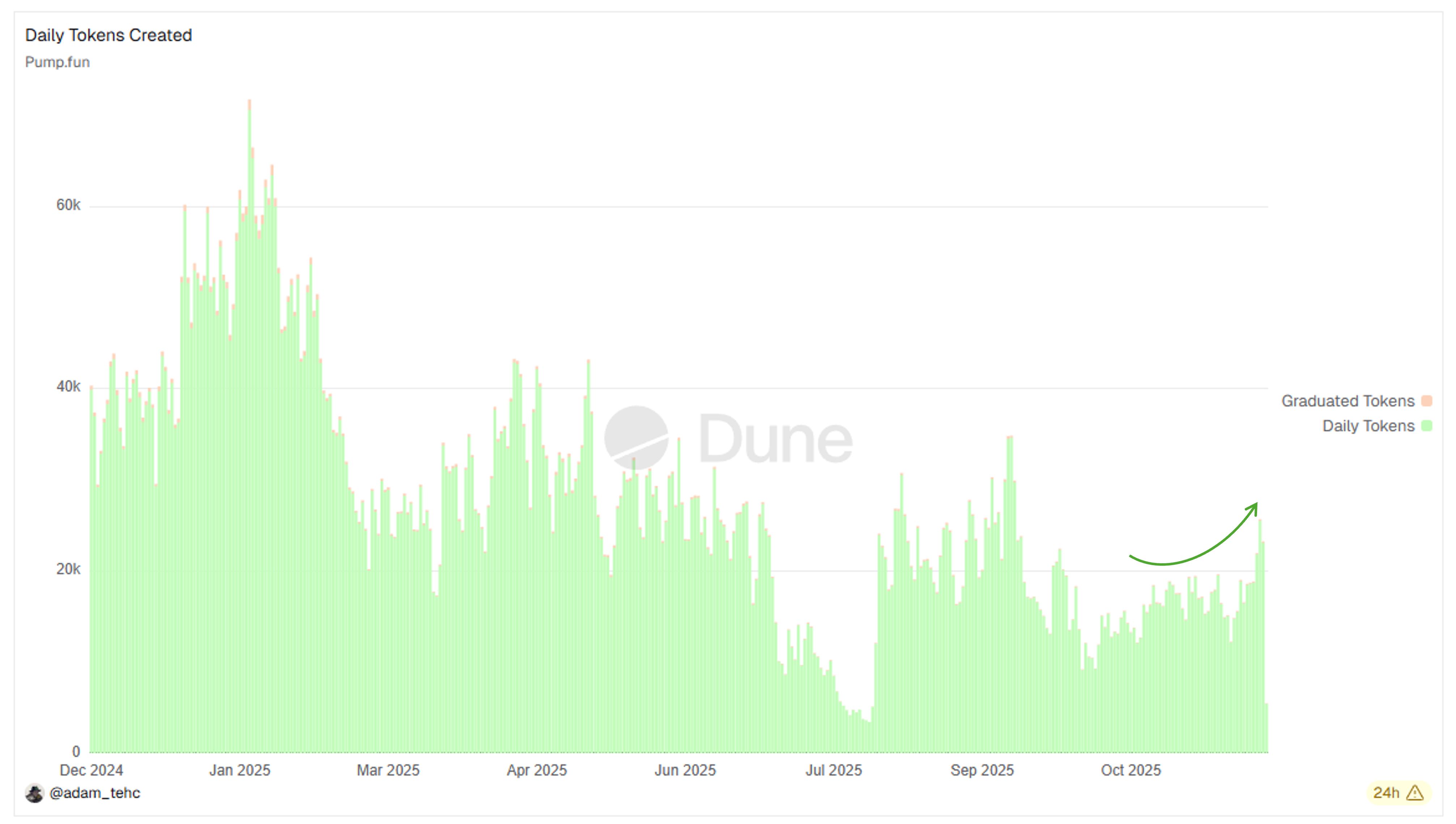

Dune data shows that the number of new meme tokens created daily on Pump.fun has stayed above 20,000 throughout December. On December 2, the figure exceeded 25,000. This was the highest level since mid-September, marking a notable shift.

Daily Token Created on Pump.fun. Source:

Daily Token Created on Pump.fun. Source:

This rebound still cannot match the peak levels seen in early 2025. However, it signals a shift in investor psychology.

Many appear to believe that this is a favorable moment for retail capital to flow back into low-cap and newly launched tokens.

Although the number of new tokens shows a mild upward trend, Pump.fun’s revenue and DEX volume remain down more than 80% compared to early 2025.

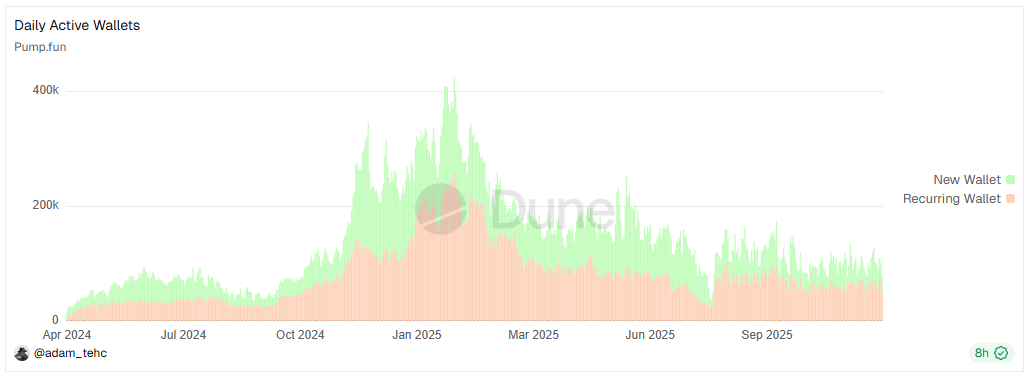

Daily Active Wallets on Pump.fun. Source:

Daily Active Wallets on Pump.fun. Source:

One positive indicator stands out: the number of active addresses — including new addresses and returning users — has consistently stayed around 100,000 on average since August. The market experienced multiple major liquidation events during this period, yet user participation did not drop sharply.

Additionally, Michael Nadeau, founder of The DeFi Report, highlighted a notable comparison between user retention in Web2 and on Pump.fun. Pump.fun achieved higher retention rates, with 12.4% in Week 4 and 11.4% in Week 8. In contrast, Web2 averages range from 5% to 10% in Week 4 and 2% to 5% in Week 8.

We just pulled 12 weeks of @Pumpfun user data, and the weekly retention numbers are pretty interesting when you compare them to Web2 norms.Here’s the rough benchmark for Web2 consumer apps:1. Fintech: Week-1 retention: 10–15%2. Gaming: Week-1 retention: 7–12%3. Consumer…

— Michael Nadeau | The DeFi Report (@JustDeauIt) December 4, 2025

These data points appear encouraging within a market environment defined by falling valuations and persistent extreme fear during the final quarter of the year.

Furthermore, well-known trader Daan Crypto Trades observed that meme coins have outperformed major altcoins over the past two weeks.

Crypto Sector Performance. Source:

Crypto Sector Performance. Source:

“Over the past two weeks, memes were the outperformer for a change. It has been a long time since those did well. This is after a long streak of outperformance back in 2023 & 2024,” Daan Crypto Trades stated.

He added that this performance could be an early sign that the market is ready to accept higher risk levels. However, he also cautioned that the trend may be short-lived and might not reflect a long-term shift.

A recent report from BeInCrypto also highlighted at least three indicators suggesting that the meme coin season could return in December. If that scenario plays out, the Pump.fun ecosystem may attract retail investors — those who embrace high risk in pursuit of large potential returns.

At the time of writing, the Pump.fun Ecosystem ranks as the market’s third-best performing category during the first week of December, according to Coingecko.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Price Fluctuations: Optimal Entry Strategies Amid Changing Macroeconomic Conditions

- Bitcoin's volatility offers high returns but poses psychological risks, requiring disciplined risk management and emotional resilience. - Social media and behavioral biases like FOMO and loss aversion exacerbate impulsive trading during market swings. - Strategic frameworks (position sizing, DCA) and financial literacy help investors navigate volatility while avoiding overleveraging. - Case studies show predefined plans and diversification reduce panic selling during crashes like the 2024 "Black Friday"

Investing in Sectors Focused on Wellness in 2026: Strategically Aligning with Enduring Human-Centered Trends

- Global wellness market to grow from $6.87T in 2025 to $11T by 2034 at 5.4% CAGR, driven by preventive health, mental wellness, and financial well-being integration. - Wearables (Apple Watch, Oura Ring) and AI platforms (Calm, Headspace) are reshaping physical/emotional wellness, with corporate programs boosting productivity and reducing healthcare costs. - Financial wellness emerges as critical axis, with companies like CHC Wellbeing linking health incentives to economic stability through gamified reward

The Growth and Evaluation of Investments in AI-Powered Educational Technology

- The global AI-driven EdTech market is projected to grow from $7.05B in 2025 to $112.3B by 2034 at 36.02% CAGR, driven by personalized learning and AI-powered tools reducing educator workloads by 25%. - However, 50% of students report reduced teacher connections, 70% of educators fear weakened critical thinking, and 63% of specialists cite AI-related cybersecurity risks, highlighting ethical and systemic challenges. - Anthropology and interdisciplinary approaches address AI biases and cultural gaps, exemp