New Bitcoin On-Chain Signals Arrive Ahead of FOMC Meeting and Rate Cut Expectations

New Bitcoin on-chain signals have surfaced just days before the FOMC meeting, with dormant 10-year-old supply moving back into circulation. Analysts say the shift arrives at a critical moment, as markets wait for the Federal Reserve’s anticipated rate cut and its impact on liquidity and price momentum.

Bitcoin traders are facing fresh on-chain signals that suggest older coins are re-entering the market as investors prepare for the upcoming Federal Reserve policy decision. Analysts expect the Fed to cut rates at its December meeting, and markets have already priced in a 25-basis-point move.

However, on-chain activity indicates uncertainty beneath the surface.

Dormant Bitcoin Supply Returns as Market Waits for Policy Clarity

Over 2,400 BTC aged more than ten years moved this week, activating long-dormant supply worth more than $215 million. These coins usually stay untouched, and movement often precedes distribution rather than accumulation.

2,400 BTC aged 10+ years just moved 🚨That’s $215.8M worth of ancient coins coming back to life.

— Maartunn (@JA_Maartun) December 6, 2025

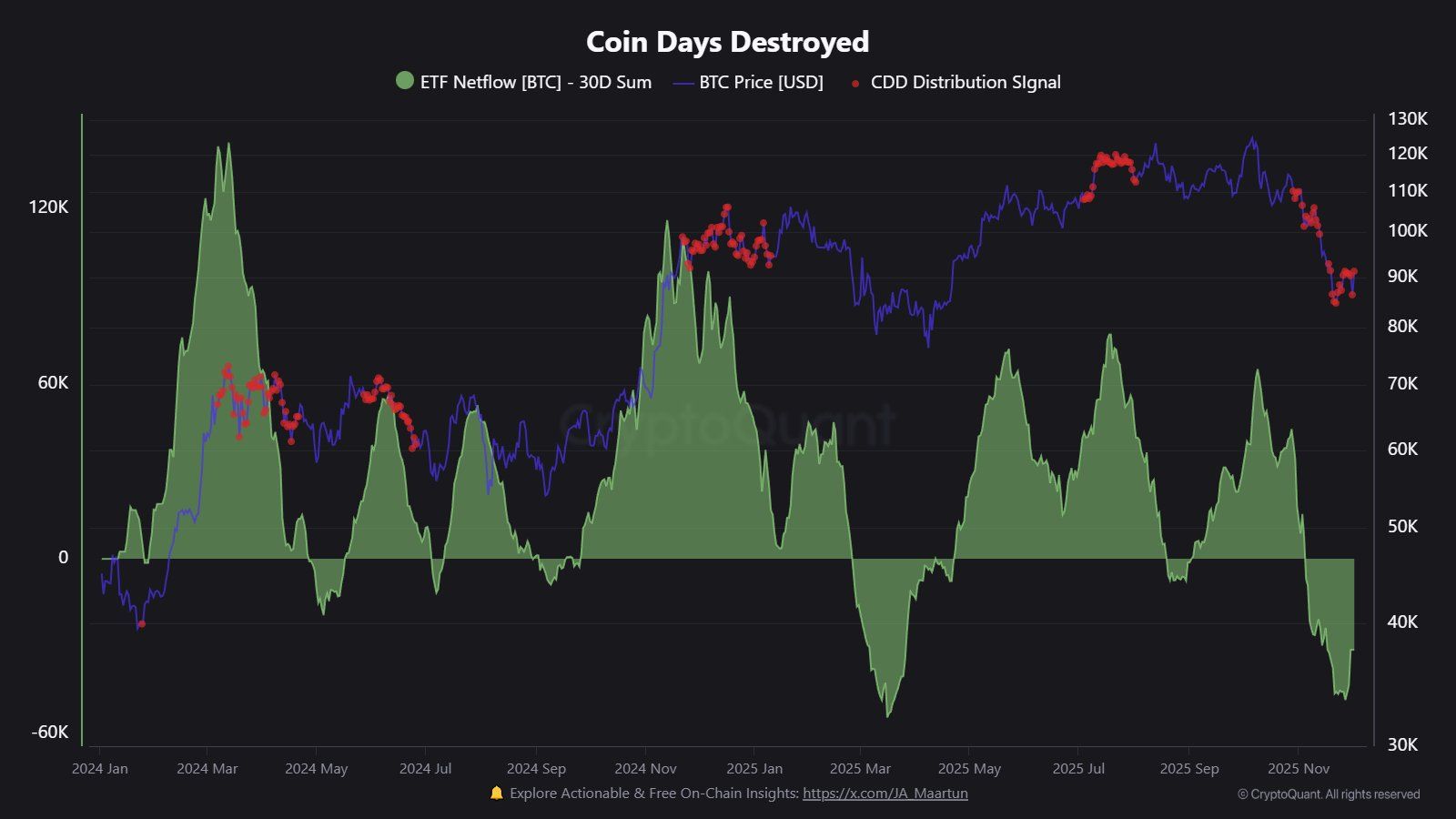

Another signal shows Coin Days Destroyed flashing again. This metric highlights old holders moving Bitcoins, often to sell into strength.

Demand absorbed this supply earlier in the year, but analysts now observe buyers stepping back while experienced holders send coins to market.

Bitcoin Coin Days Destroyed Metrics. Source:

CryptoQuant

Bitcoin Coin Days Destroyed Metrics. Source:

CryptoQuant

Older supply returning during weak demand has historically pressured price action. ETF inflows remain soft, and netflows show reduced institutional appetite compared with recent peaks. This suggests rallies may struggle unless liquidity returns.

Institutional analysts remain confident in the broader cycle. Bernstein argues Bitcoin may have broken the four-year halving rhythm and is entering an extended adoption phase.

The firm expects Bitcoin to reach $150,000 in 2026, with a potential 2027 peak near $200,000.

Yet market direction now depends on the Federal Reserve. If policymakers cut rates as expected, liquidity may improve and strengthen risk assets through early 2026.

Bernstein: "In view of recent market correction, we believe, the Bitcoin cycle has broken the 4-year pattern (cycle peaking every 4 years) and is now in an elongated bull-cycle with more sticky institutional buying offsetting any retail panic selling. Despite a ~30% Bitcoin…

— matthew sigel, recovering CFA (@matthew_sigel) December 8, 2025

A weaker dollar and lower capital costs could help support ETF demand and absorb long-term holder selling.

A delay or smaller cut could create volatility. Combined with revived supply, Bitcoin may face deeper corrections before recovering.

Analysts warn that strong bids will be necessary to offset aging supply reactivation.

For now, Bitcoin sits between shifting on-chain behavior and macro expectations. Investors will watch the FOMC signal closely to understand whether the next move strengthens market resilience or exposes further downside.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The ICP Surge: Unpacking a 30% Jump and Its Driving Factors

- ICP surged 30% in late October 2025 amid speculation and institutional adoption, driven by Microsoft/Azure partnerships and AI upgrades like Caffeine. - On-chain data shows 35% growth in active addresses but 91% fewer token transfers during downturns, highlighting fragile retail-driven momentum. - TVL hit $237B via asset tokenization, yet dApp engagement dropped 22.4%, signaling volatility despite 40+ tech upgrades including Chain Fusion. - Analysts project $11.15–$88.88 price ranges by 2030, contingent

The Rise of a Structured Market for Clean Energy Derivatives and Its Influence on Institutional Investors

- CFTC's 2025 approval of CleanTrade and other platforms as SEFs transformed the opaque clean energy derivatives market into a transparent, institutional-grade ecosystem. - CleanTrade's $16B notional trading volume in two months highlights surging demand for standardized instruments, attracting BlackRock and Goldman Sachs to hedge decarbonization risks. - ESG-driven institutional investment in renewables reached $75B in Q3 2025, with global clean energy derivatives projected to grow from $39T to $125T by 2

The Rise of a Fluid Clean Energy Marketplace: How CleanTrade is Transforming Institutional Investment in Renewable Resources

- CleanTrade's CFTC-approved SEF platform transforms VPPAs, PPAs, and RECs into institutional-grade renewable energy commodities. - The platform addresses historic market issues like illiquidity and opacity, enabling $16B in notional trading volume within two months. - Industry giants Cargill and Mercuria validate clean energy as a serious asset class through strategic participation in the regulated market. - By aligning financial and ESG goals, CleanTrade creates scalable alpha opportunities as global cle

Clean Energy Market Dynamics and Investment Prospects: The Role of CFTC-Approved Platforms in Facilitating Institutional Participation

- CFTC-approved platforms like CleanTrade are transforming clean energy markets by standardizing derivatives and centralizing trading infrastructure, boosting institutional liquidity and transparency. - CleanTrade’s SEF designation in September 2025 enabled $16B in notional trades within two months, converting illiquid assets like RECs into tradable commodities with ESG-aligned risk management tools. - Institutional demand surged as 70% of large asset owners integrated climate goals, with IRA-driven clean