Key Notes

- ADGM approves USDT as Accepted Fiat-Referenced Token on nine additional blockchain networks for regulated use.

- The recognition follows October 2024 initial approval and months of compliance collaboration with FSRA.

- Tether strengthens Middle East strategy with plans for AED-pegged stablecoin and UAE real estate partnerships.

Tether announced that its USDT stablecoin has been officially recognized as an Accepted Fiat-Referenced Token (AFRT) by the Abu Dhabi Global Market (ADGM) for use on multiple blockchains, including Aptos, Celo, Cosmos, Kaia, Near, Polkadot, Tezos, TON, and TRON. The approval allows ADGM-authorized entities to conduct regulated activities involving USDT across these networks.

This recognition expands upon ADGM’s earlier approval , which covered USDT on Ethereum, Solana, and Avalanche. With this extension, USDT is now approved across nearly all major blockchains it operates on, strengthening its global compliance profile.

ADGM’s Role in The New Global Digital Finance

Abu Dhabi Global Market (ADGM) serves as an international financial center and a key regulatory hub for digital assets in the United Arab Emirates. ADGM’s Financial Services Regulatory Authority (FSRA) oversees the licensing and supervision of virtual asset activities, aiming to combine innovation with strong compliance and investor protection.

The approval follows months of collaboration between Tether and FSRA, showcasing Tether’s efforts to align with ADGM’s compliance and transparency standards. Paolo Ardoino, CEO of Tether, said the decision demonstrates both entities’ commitment to advancing financial inclusion and innovation through regulated digital assets, according to their announcement .

This Expansion Follows Earlier Recognition From 2024

Tether first secured regulatory recognition within ADGM in October 2024, when USDT was acknowledged as a virtual asset under the jurisdiction’s framework. This latest multi-chain approval is a continuation of that process, broadening the token’s reach and regulatory acceptance.

USDT now joins another five stablecoins already listed as an Accepted Fiat-Referenced Token under the FSRA’s official AFRT list as of November 2025, reflecting growing institutional acceptance of stablecoins in the region’s financial markets.

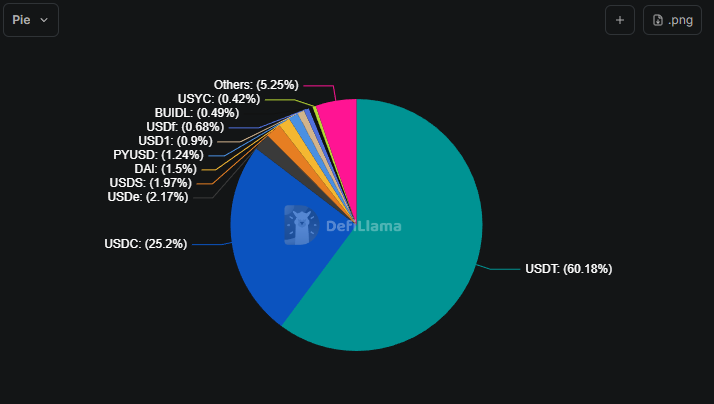

Graph of the market share of USDT among all the stablecoins | Source: DefiLlama

Strengthening Tether’s Regional Strategy

Tether’s continued engagement with ADGM aligns with its broader expansion strategy in the Middle East. In addition to USDT’s recognition, the company announced in 2024 plans to issue a new stablecoin pegged to the UAE dirham (AED) , underscoring its intention to integrate closely with the region’s financial systems. Currently, they don’t make any other announcements about this project.

In 2025, Tether partners with Reelly Tech to accelerate the stablecoin transactions of the UAE real estate industry. The ADGM’s new decision enhances interoperability across blockchain networks and creates new settlement opportunities for regulated institutions and decentralized applications. As the UAE continues to shape clear policies for digital assets, Tether’s cooperation with regulators positions it advantageously in one of the world’s most active fintech jurisdictions.

next