Bitcoin Will Surprise ‘Everyone and Their Cat’ in 2026, Says Analyst Michaël Van De Poppe – Here Are His Targets

A widely followed crypto analyst believes Bitcoin ( BTC ) is primed to defy expectations early next year.

Crypto trader Michaël Van De Poppe tells his 816,000 followers on X that institutional players are about to change the game.

“Do you really think that institutions are going to wait placing positions on the best asset on this planet, BTC, because of some Web 3 4-year cycle type of theory?

Do you really think that a Web 3 founder, building the next era of decentralized finance, cares about the 4-year cycle more than mass adoption after the approval of the Genius (and hopefully Clarity act)?

Of course not. A lot of Web 3 people think that Web 3 is the only thing that exists in this ecosystem. That’s behind us.

Institutions have come. Bitcoin has become a mature asset.

Bitcoin is the best form of money ever existed, that’s why more and more players are forced to adopt Bitcoin as it’s simple game theory.

No, that doesn’t mean that we’re going to see the same 4-year cycle repeat again.

The markets have seen a harsh, but relatively regular correction and are about to surprise everyone and their cat in Q1 2026.”

According to Van De Poppe, BTC is primed to explode after one last dip.

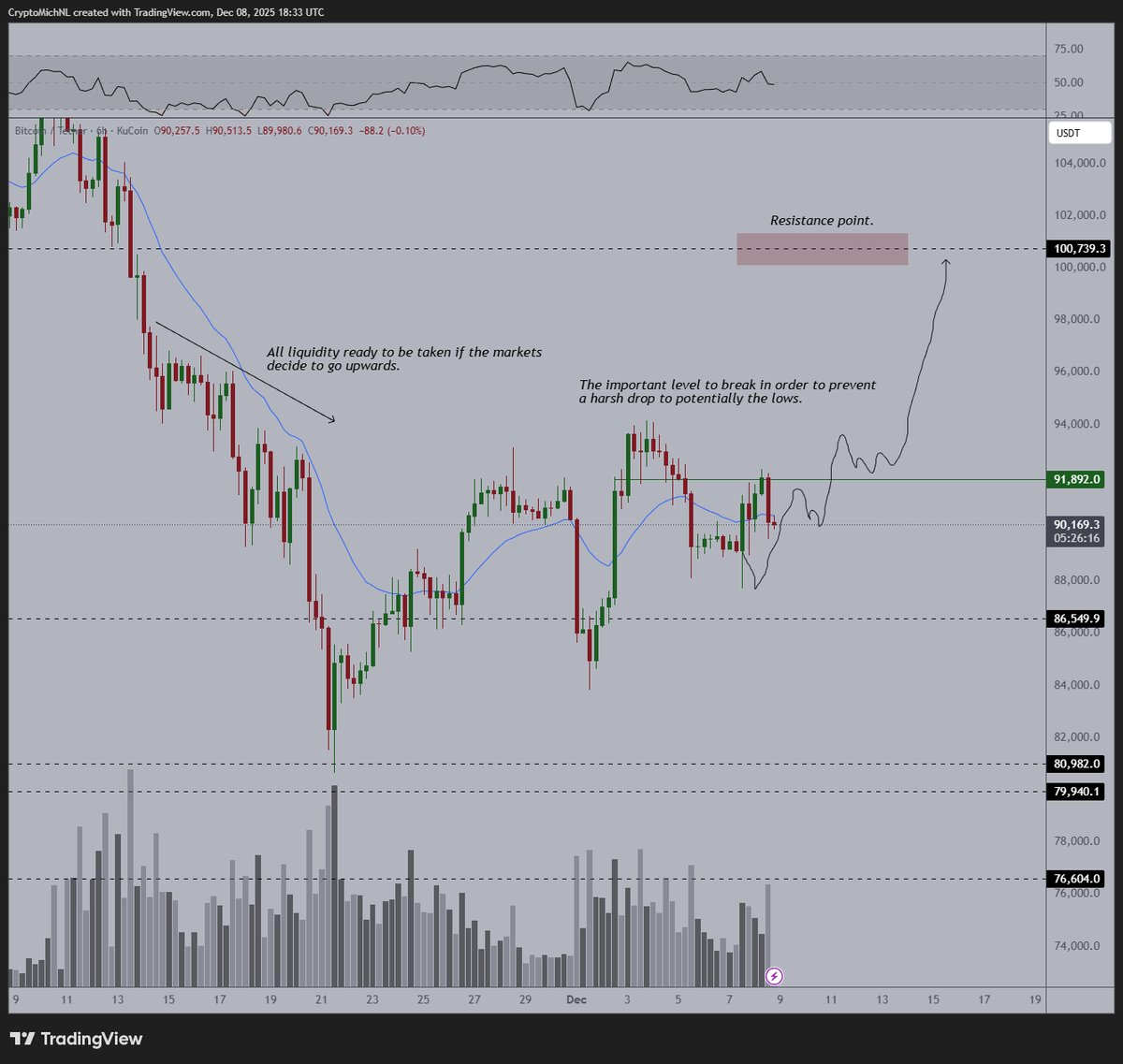

“The $92,000 level is the crucial level for Bitcoin.

Relatively harsh rejection has taken place, which means that it doesn’t look great in the short-term.

I would love to see this breakout occur, and it remains a scenario, however, given all the lows looking at me in the eyes, I wouldn’t be surprised if we get a standard approach like this:

Jerome Powell comes out and remains to be hawkish and says ‘I don’t know whether we’ll proceed with rate cuts’ and the entire does a classic sell-off the news type of correction.

This would mean, the markets sweep those lows a final time in 2025, crash to $78-82K and reverse quickly from there.

I think those two scenarios are my scenarios going into FOMC.”

Source: Michaël Van De Poppe/X

Source: Michaël Van De Poppe/X

BTC is trading at $90,165 at time of writing, down 12% in the last 30 days.

Featured Image: Shutterstock/ShutterDesigner/Chuenmanuse

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Zcash Halving 2025: Impact on Cryptocurrency Market Trends

- Zcash's 2025 halving reduced block rewards to 1.5625 ZEC, triggering a 950% price surge to $589 amid ZIP 1015 scarcity mechanisms. - Institutional adoption accelerated, with Grayscale acquiring 5% supply and Cypherpunk committing $100M, mirroring Bitcoin's post-halving trends. - Speculative trading drove $1.11B in Zcash futures open interest, causing 24% 24-hour price swings as retail investors chased scarcity-driven gains. - Hybrid consensus and optional privacy features differentiate Zcash from Bitcoin

ICP Network's Rapid Expansion and Increasing Institutional Embrace: Key Strategic Considerations for Long-Term Investors in Web3 Infrastructure

- ICP's 2025 growth stems from Fission/Chain Fusion upgrades enabling Bitcoin-Ethereum interoperability and Caffeine AI's no-code dApp platform attracting 2,000+ developers. - Institutional adoption surged with $1.14B TVL, Microsoft-Google partnerships, and first ICP ETP via Copper-DFINITY collaboration expanding institutional access. - Despite $4.71 price peak in November 2025, 10%+ volatility highlights risks, though 11,500 TPS capacity and $357M daily trading volume signal infrastructure strength. - Lon

New Prospects in STEM Learning and Career Advancement: Sustained Institutional Commitment to Academic Initiatives Fueling Tomorrow’s Innovation

- Global STEM education is accelerating as AI and engineering drive economic transformation, with 2025 government initiatives expanding AI-focused programs and workforce development. - U.S. universities report 114.4% growth in AI bachelor's enrollments, supported by corporate partnerships and $25M+ in tech industry investments for AI labs and teacher training. - EdTech's AI-powered platforms, valued at $5.3B in 2025, are projected to reach $98.1B by 2034, with startups like MagicSchool AI securing $45M in

ICP Caffeine AI: Leading the Way in AI-Powered Investment Prospects within the Web3 Landscape

- ICP Caffeine AI, developed by DFINITY Foundation, merges AI and blockchain to enable no-code app development via natural language prompts. - Its "chain-of-chains" architecture and Chain Fusion technology enhance scalability and cross-chain interoperability for AI-native applications. - With $237B TVL and partnerships with Microsoft/Google Cloud, ICP faces competition from TAO and RNDR but aims to rival AWS with on-chain AI solutions. - Institutional adoption in finance and energy, plus regulatory alignme