NFT Market Slumps as Monthly Sales Drop to $320 Million

The NFT market, once thriving, is going through a cold period at the end of 2025. After months of speculation and rampant enthusiasm, the indicators have just turned red. Sales are collapsing, market capitalization is falling, and investors are questioning the future of this emblematic sector of crypto.

In brief

- Monthly NFT sales dropped to $320 million in November 2025, a 50% decrease compared to October.

- Major NFT collections like CryptoPunks, Bored Ape Yacht Club, and Hypurr suffered declines of up to 48%.

- Ethereum may feel the effects of this NFT crisis, although its resilience also relies on other use cases such as DeFi.

NFT: Monthly Sales Reach Their Lowest Level of the Year

The numbers speak for themselves: in November 2025, NFT sales plunged to $320 million, a 50% drop compared to October. This level, the lowest of the year, recalls the volumes of September 2024, when transactions amounted to $312 million. Furthermore, the market’s capitalization has declined by 66% since January, dropping from $9.2 billion to only $3.1 billion.

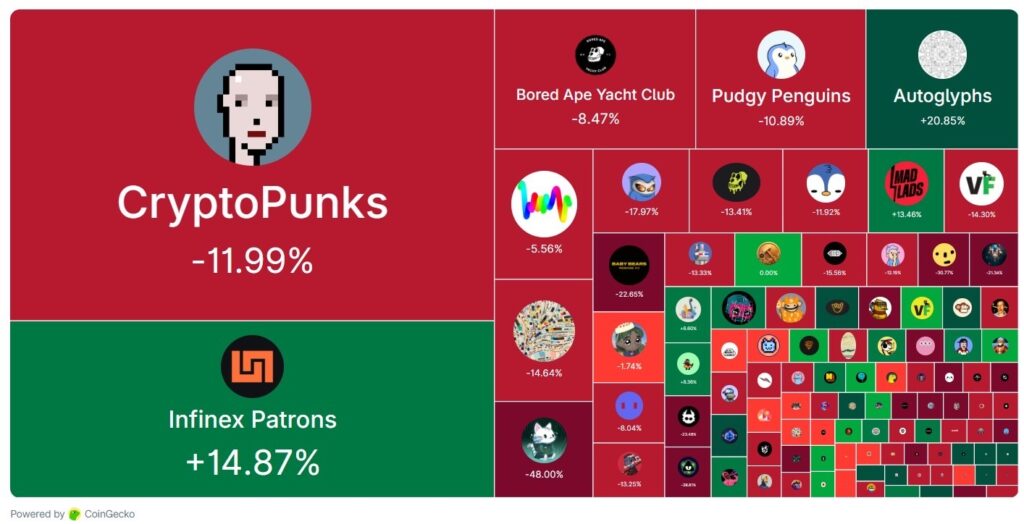

NFT Market Decline.

NFT Market Decline.

Leading collections are not spared:

- CryptoPunks, the historical leader, lost 12% of its value in one month;

- Bored Ape Yacht Club and Pudgy Penguins fell by 8.5% and 10.6% respectively;

- The biggest drop goes to Hypurr, with a collapse of 48%;

- Only Infinex Patrons and Autoglyphs resist, showing increases of 14.9% and 20.9%.

The NFT collections most affected by the crisis.

The NFT collections most affected by the crisis.

This downward trend of NFTs continued in early December , with only $62 million in sales recorded in one week, a negative record for 2025.

NFTs Fall: What Risks for the End of 2025?

Several factors explain this sudden cooling of NFTs. First, a natural correction after years of excessive speculation. Indeed, NFTs, often seen as purely speculative assets, are now undergoing a purge, eliminating projects without real utility. Next, the macroeconomic context plays a key role: restrictive monetary policies and geopolitical uncertainties weigh on all markets, including crypto.

The consequences are already visible. Liquidity is drying up, investors are withdrawing, and many projects are closing doors. Market players, platforms and creators, might face restructuring or layoffs by the end of the year. The risks for the coming months are real. If the trend does not reverse, investor confidence could erode further, extending this NFT winter well beyond 2025.

Ethereum on the Brink of Crisis Due to NFTs?

Ethereum still dominates the NFT market, holding a majority share of collections issued on its blockchain. Such dependence exposes ETH to sector shocks. Historically, NFT sales declines have often coincided with ETH price corrections. In 2021 and 2022, for example, drops in NFT volumes preceded significant ETH recessions.

However, Ethereum is not limited to this use case alone. The blockchain remains a pillar of decentralized finance (DeFi) and smart contracts, giving it some resilience. Developers and investors might turn to other applications, reducing the impact of the NFT crisis. Nevertheless, if NFT declines persist, it could weigh on ETH demand, affecting its price in the short to medium term.

The NFT winter is settling in for the long term, with sluggish sales and plummeting capitalization. This decline, although brutal, could mark the end of a speculative era and the beginning of a more mature phase, focused on the real utility of digital assets . In your opinion, is this crisis just a correction or a sign of a deeper decline in the NFT market?

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BCH Value Rises 2.32% Over the Past Week as Market Remains Steady

- Bitcoin Cash (BCH) rose 2.32% in 7 days, with a 31.78% annual gain despite no recent catalysts. - Stable 24-hour prices and gradual monthly growth reflect long-term investor confidence in BCH's value. - Analysts expect continued consolidation as BCH gains stem from sustained adoption rather than short-term speculation. - No direct link exists between BCH's performance and Balchem's recent dividend announcement or corporate actions.

LUNA Price Climbs 4.28% Following Network Upgrade and Increased Inflows

- Terra Luna (LUNA) surged 4.28% in 24 hours to $0.2054, driven by a network upgrade and rising investor optimism . - On-chain data shows increased open interest and capital inflows, signaling bullish momentum ahead of the Dec 18 v3.6.1 upgrade. - Technical indicators suggest LUNA trading above its 50-week EMA and RSI at 56, pointing to potential further gains. - The upgrade aims to enhance Terra Classic's security and functionality, bolstering long-term viability and investor confidence.

The COAI Token Fraud and Potential Dangers in Developing Cryptocurrency Environments

- COAI token's 88% collapse in 2025 exposed DeFi vulnerabilities, with $116.8M losses and extreme supply concentration in 10 wallets. - 2025 saw $80M+ in crypto frauds via memecoins, rug pulls, and AI deepfakes, exploiting regulatory gaps and investor naivety. - Bybit's $1.5B hack and COAI's algorithmic flaws highlight urgent need for global crypto regulation and smart contract security. - U.S. CLARITY Act reforms and investor education on tokenomics, KYC, and self-custody emerge as critical safeguards aga

The Legal and Geopolitical Consequences of the U.S. Not Ratifying UNCLOS and Their Effects on Blue Economy Investments

- U.S. non-ratification of UNCLOS excludes it from ISA governance, blocking seabed mining licenses and creating legal conflicts with international norms. - Reliance on domestic DSHMRA law risks litigation and undermines "common heritage" principles, fragmenting regulatory standards with global rivals. - Geopolitical tensions escalate as U.S. unilateralism challenges multilateral systems, drawing criticism from China and allies over destabilizing ocean governance. - Investors shift to U.S. EEZ projects and