Proposed ‘AfterDark’ Bitcoin ETF Would Skip U.S. Trading Hours

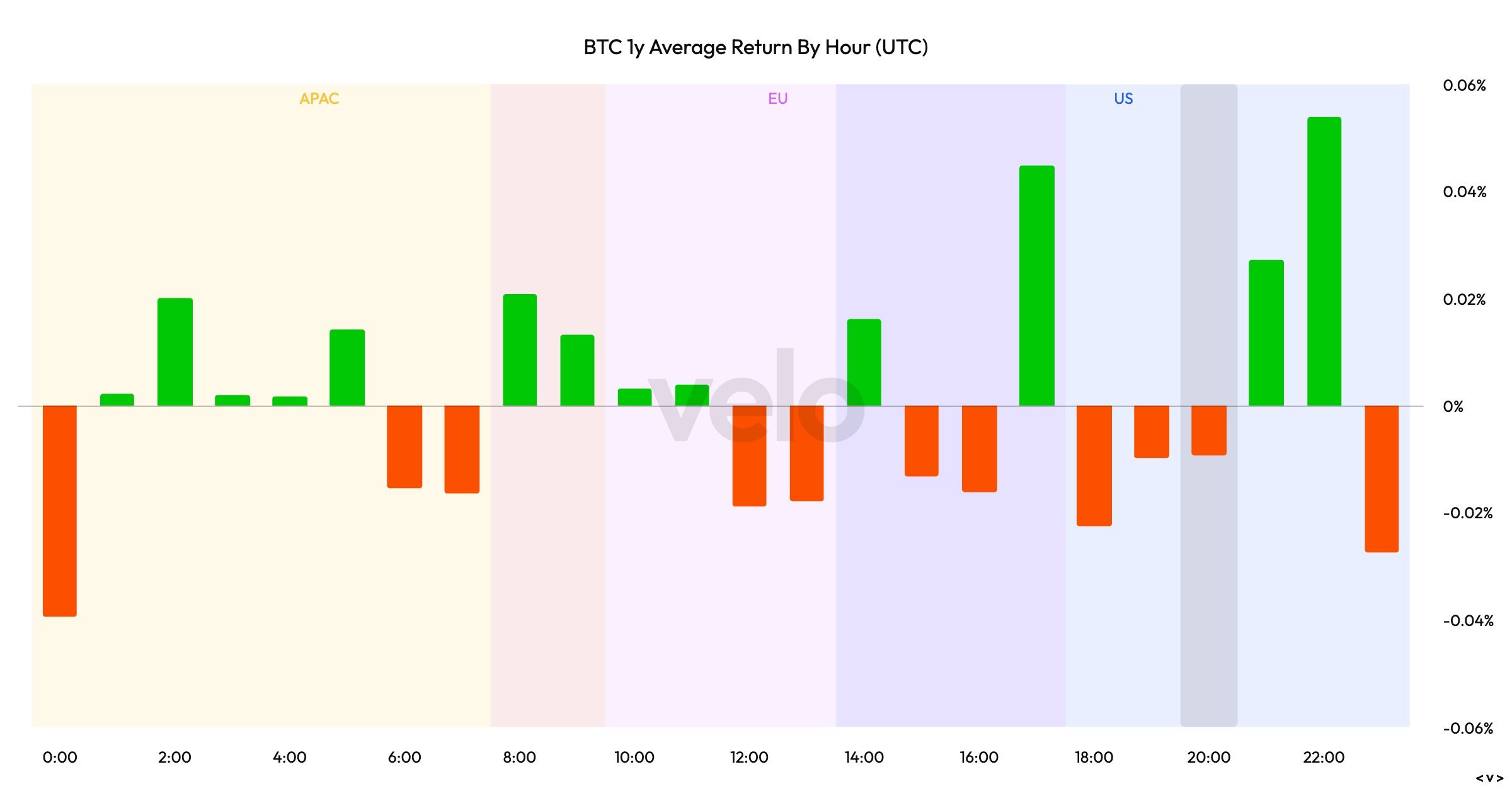

Weary U.S.-based bitcoin BTC$93.110,27 bulls might think it's their imagination that they seem to wake up every morning to BTC doing pretty well only for prices to head lower during the U.S. trading session.

They are, in fact, not imagining things.

Data from crypto analytics platform Velo.xyz shows that over the past year, bitcoin is more likely to be in the green when traditional U.S. markets are closed and in the red when they're open.

Bloomberg's Eric Balchunas said the data on better performance after U.S. hours was similar for 2024 as well and suggests the spot ETFs or derivatives positioning could be having an impact.

Seeking to take advantage, Nicholas Financial Corporation, a boutique wealth management firm, has filed with the U.S. Securities and Exchange Commission (SEC) to launch a bitcoin BTC$93.110,27 ETF that holds the asset only during overnight hours, opting out of the U.S. trading day entirely.

The fund, called the Nicholas Bitcoin and Treasuries AfterDark ETF (NGTH), would buy bitcoin at 4 p.m. ET—when U.S. markets close—and sell by 9:30 a.m. ET the following day, before the markets reopen. During daytime hours, the fund would rotate into short-term U.S. Treasuries to preserve capital and generate yield.

The firm also submitted paperwork for a second product, the Nicholas Bitcoin Tail ETF (BHGD).

If approved, the ETF would add a novel twist to the growing ecosystem of bitcoin investment products by treating time of day as a key factor in its strategy.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Cardano Shows Strong Momentum as ADA Leads Today’s Crypto Market

Quick Take Summary is AI generated, newsroom reviewed. ADA jumps 8 percent in 24 hours and leads major altcoins. Cardano price rally gains strength with rising demand and strong momentum. ADA trading volume increases 72 percent and shifts altcoin market trends. Traders expect more movement as ADA builds support and shows strong conviction.References 🚨CARDANO IS UP BIG IN 24H! #Cardano leads high-cap altcoins as $ADA jumps 8% in 24 hours, with trading volume soaring 72%.

Twenty One Capital Enters NYSE Trading with a Major Bitcoin Treasury

Michael Saylor Bitcoin Advice Sparks Interest Amid Schiff Criticism

BlackRock Bitcoin ETF Sees $135.4M Outflow This Month