Key Market Information Discrepancy on December 10th - A Must-Read! | Alpha Morning Report

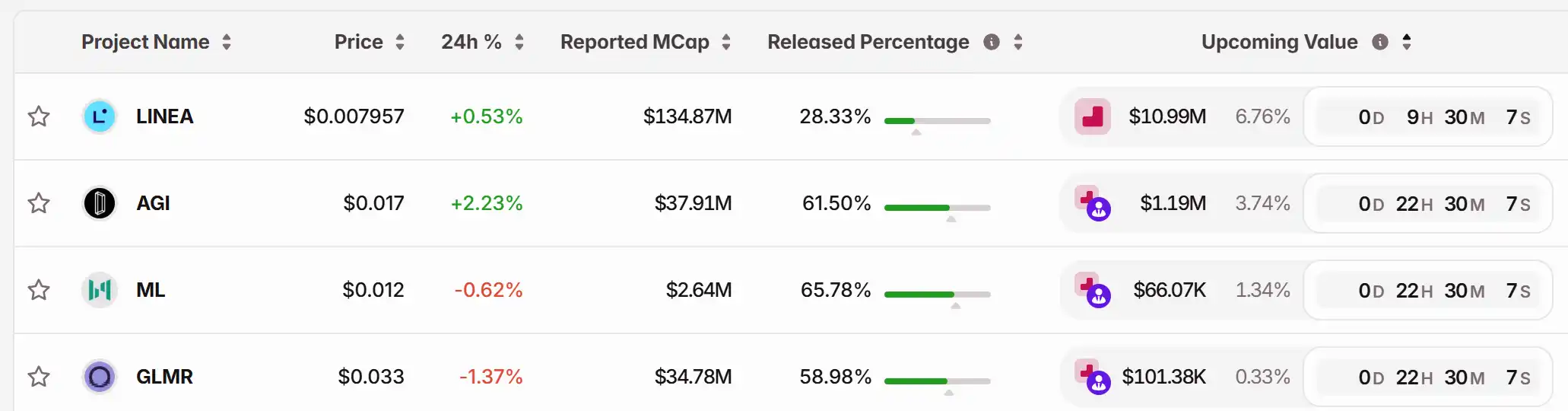

1. Top News: The "CLARITY Act" draft is expected to be released this week, with a hearing and vote scheduled for next week. 2. Token Unlock: $LINEA, $AGI, $ML, $GLMR

Featured News

1."CLARITY Act" Draft Expected to Be Released This Week, Hearing and Vote Scheduled for Next Week

3.SpaceX Plans IPO at $1.5 Trillion Valuation, Poised for Largest-Ever Public Offering

Articles & Threads

1. "Crypto VIPs Spending Eight Figures a Year on Security, Fear Blue Kirby-Style Heists"

A travel blogger with over 20 million followers on TikTok, Blue Kirby, was robbed. In recent years, from France to the UAE, from the US to South America, kidnappings of cryptocurrency holders have been on the rise. As assets do not rely on banks and can be transferred on the go, coupled with the often "digitally astounding" wealth of crypto elites, they have become top targets for certain criminal groups, rather than "random victims." This also explains why the security budgets of crypto VIPs are so high that even traditional businesses are stunned.

2. "Exclusive Interview with Solstice Founder: How to Redefine Yield on Solana from First Principles"

By the end of November 2025, Solstice Staking, in collaboration with the Liechtenstein Trust Integrity Network (LTIN), Swiss crypto finance giant Bitcoin Suisse, and the decentralized staking protocol Obol, jointly launched an institutional-grade Ethereum Distributed Validator Technology (DVT) cluster. This seemingly technical collaboration hides a grander ambition. On the very same day, the DeFi platform Kamino in the Solana ecosystem announced the launch of the PT-USX token on Solstice Market, offering a fixed yield of 16.5%. At this time, Solstice's Total Value Locked (TVL) had surpassed $3.2 billion, with over 26,000 holders and 131,000 monthly active users.

Market Data

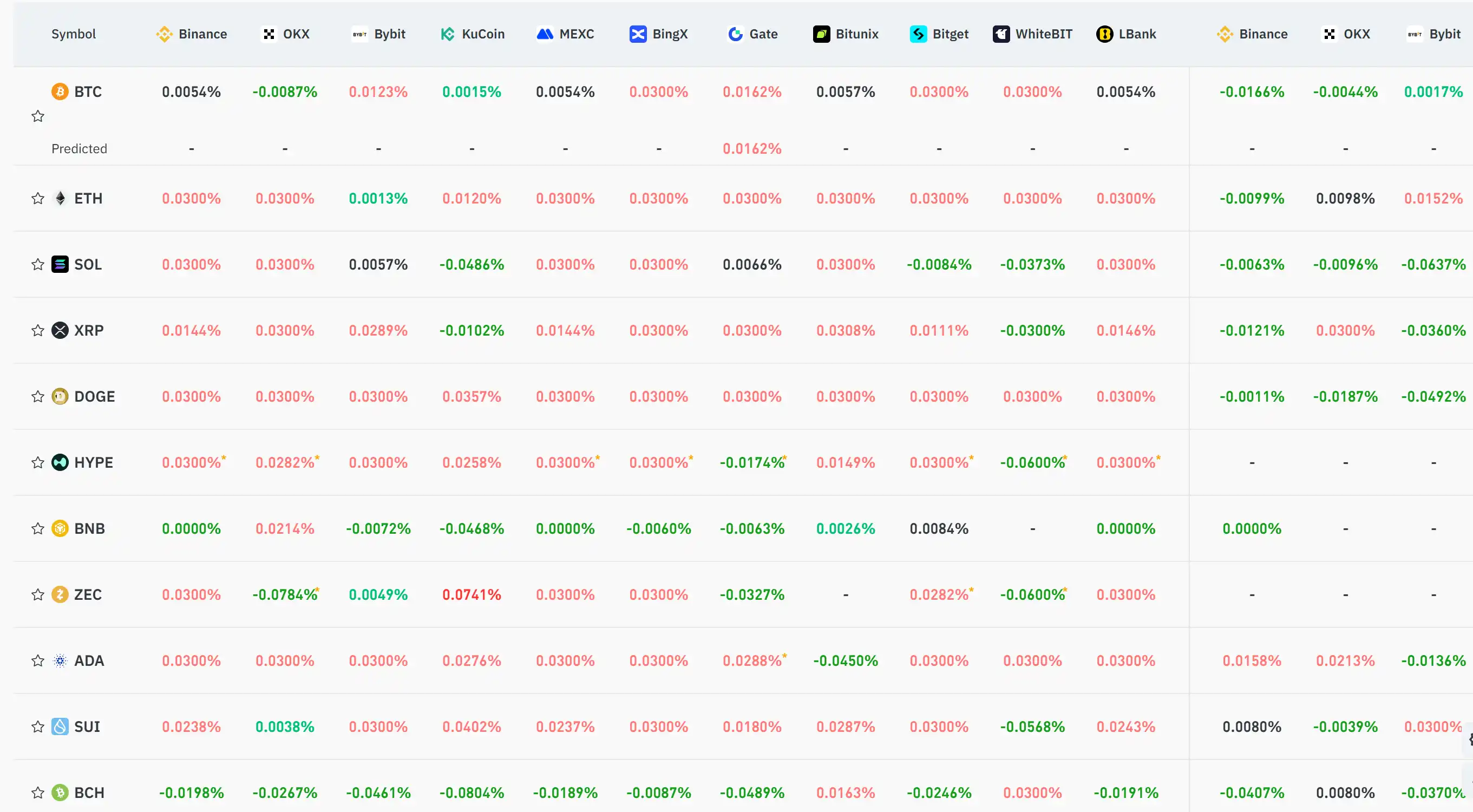

Daily Market Overall Capital Heatmap (Reflected by Funding Rate) and Token Unlocks

Data Source: Coinglass, TokenUnlocks

Funding Rate

Token Unlocks

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Navigating the Fluctuations of AI Tokens: Insights Gained from the ChainOpera AI Downturn

- ChainOpera AI's (COAI) 2025 token crash from $44.90 to $0.52 highlights systemic risks in AI-driven crypto projects due to centralized governance and regulatory ambiguity. - The CLARITY Act's regulatory framework created short-term volatility while exposing fragility in AI-linked tokens like algorithmic stablecoins xUSD and deUSD. - Investors must prioritize diversification, technical due diligence (e.g., EY six-pillar model), and compliance tools to mitigate risks in volatile AI crypto markets. - Succes

MMT and the Renewed Interest in Modern Monetary Theory within Policy Discussions

- Modern Monetary Theory (MMT) resurges in policy debates, challenging traditional fiscal rules by prioritizing resource availability and inflation risks over revenue constraints. - U.S. policymakers reject formal MMT adoption but align pragmatically with its principles through infrastructure investments and municipal bond financing. - MMT advocates argue debt sustainability is overstated, while critics warn of inflationary risks and fiscal misallocation in supply-constrained economies. - Global infrastruc

Tether fails with €1.1 billion offer for Juventus Turin

XRP Trades at $2.01 While Support and Resistance Contain Short-Term Movement