November Exchange Report: CEX Spot Volume Down by 27%, Futures Trading Reduced by 26%, DEX Perpetual Contracts Slightly Decreased by 1.7%

In November 2025, the spot trading volume of mainstream CEXs decreased by 27% compared to October, while the perpetual contract trading volume decreased by 26%.

In November 2025, the spot trading volume of mainstream CEXs decreased by 27% compared to October. The top three in terms of percentage change were Coinbase -5.42%, Kucoin -16.50%, and Crypto.com -17.72%. The bottom three were OKX -27.18%, Bybit -31.42%, and Gate -43.91%.

In November, the perpetual contract trading volume of mainstream CEXs decreased by 26% compared to October. The top three in terms of percentage change were HTX -14.21%, Kucoin -14.38%, and OKX -21.15%. The bottom three were Kraken -26.07%, Bybit -28.66%, and Bitget -48.47%.

In November, the website traffic of mainstream CEXs decreased by 14.21% compared to October. The top three in terms of percentage change were OKX -10.22%, HTX -9.96%, Kraken -0.60%. The bottom three were Crypto.com -25.69%, Gate -23.12%, Kucoin -17.50%.

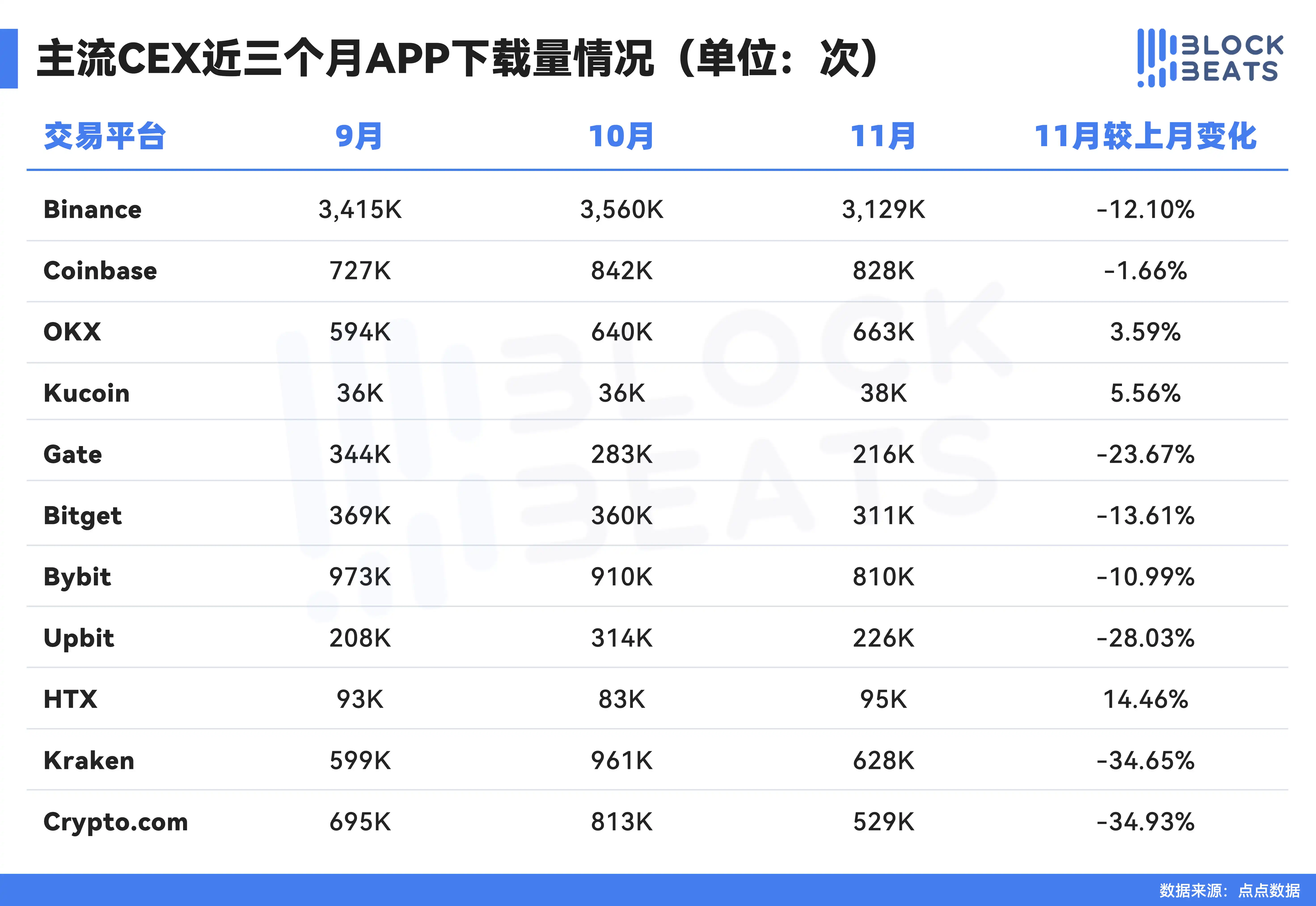

In November, the website download volume of mainstream CEXs decreased by 15% compared to October. The top three in terms of percentage change were HTX 14.46%, Kucoin 5.56%, and OKX 3.59%. The bottom three were Upbit -28.03%, Kraken -34.65%, and Crypto.com -34.93%.

In November, the perpetual contract trading volume of mainstream Perp DEXs decreased by 1.70% compared to October, and the website traffic decreased by 35.5%.

Note: Some data may indicate significant wash trading or bot activity. Spot and derivative data from Coingecko; traffic data from Similarweb; download data from DotDot platform.

CEX Data

DEX Data

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Navigating the Fluctuations of AI Tokens: Insights Gained from the ChainOpera AI Downturn

- ChainOpera AI's (COAI) 2025 token crash from $44.90 to $0.52 highlights systemic risks in AI-driven crypto projects due to centralized governance and regulatory ambiguity. - The CLARITY Act's regulatory framework created short-term volatility while exposing fragility in AI-linked tokens like algorithmic stablecoins xUSD and deUSD. - Investors must prioritize diversification, technical due diligence (e.g., EY six-pillar model), and compliance tools to mitigate risks in volatile AI crypto markets. - Succes

MMT and the Renewed Interest in Modern Monetary Theory within Policy Discussions

- Modern Monetary Theory (MMT) resurges in policy debates, challenging traditional fiscal rules by prioritizing resource availability and inflation risks over revenue constraints. - U.S. policymakers reject formal MMT adoption but align pragmatically with its principles through infrastructure investments and municipal bond financing. - MMT advocates argue debt sustainability is overstated, while critics warn of inflationary risks and fiscal misallocation in supply-constrained economies. - Global infrastruc

Tether fails with €1.1 billion offer for Juventus Turin

XRP Trades at $2.01 While Support and Resistance Contain Short-Term Movement