350 Million XRP Changes Hands as Bigger Whales Take Over Amid Price Downtrend

XRP continues to struggle under a persistent downtrend as bearish cues from the broader crypto market limit recovery attempts. Despite this weakness, the altcoin still benefits from the support of major wallets, even as some whale cohorts reduce their exposure. XRP Supply Changes Hands Whale activity shows a notable redistribution of XRP supply between major

XRP continues to struggle under a persistent downtrend as bearish cues from the broader crypto market limit recovery attempts.

Despite this weakness, the altcoin still benefits from the support of major wallets, even as some whale cohorts reduce their exposure.

XRP Supply Changes Hands

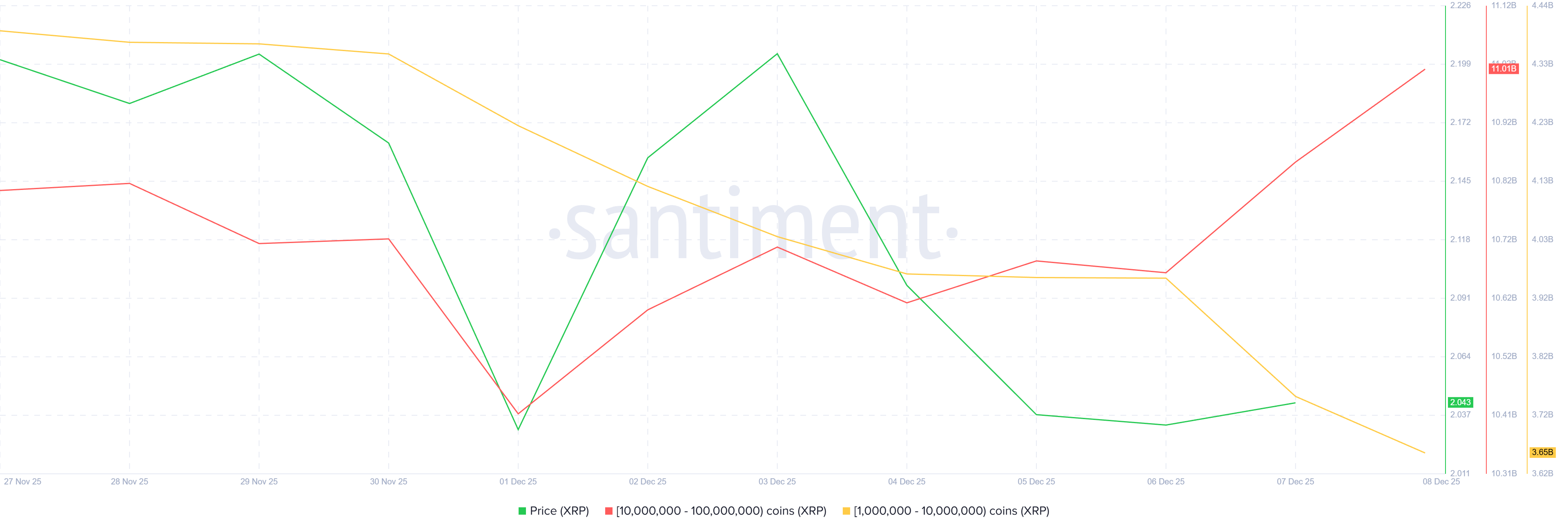

Whale activity shows a notable redistribution of XRP supply between major cohorts. Addresses holding 1 million to 10 million XRP offloaded more than 330 million XRP in the past four days, reflecting skepticism among mid-sized whales. Their selling pressure, however, did not send supply to exchanges or retail holders.

Instead, larger wallets holding 10 million to 100 million XRP absorbed this supply. Their combined holdings climbed by 350 million XRP during the same period, worth more than $729 million. This accumulation signals confidence from deeper-pocketed investors who often act as stabilizing forces when market sentiment weakens.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

XRP Whale Holding. Source:

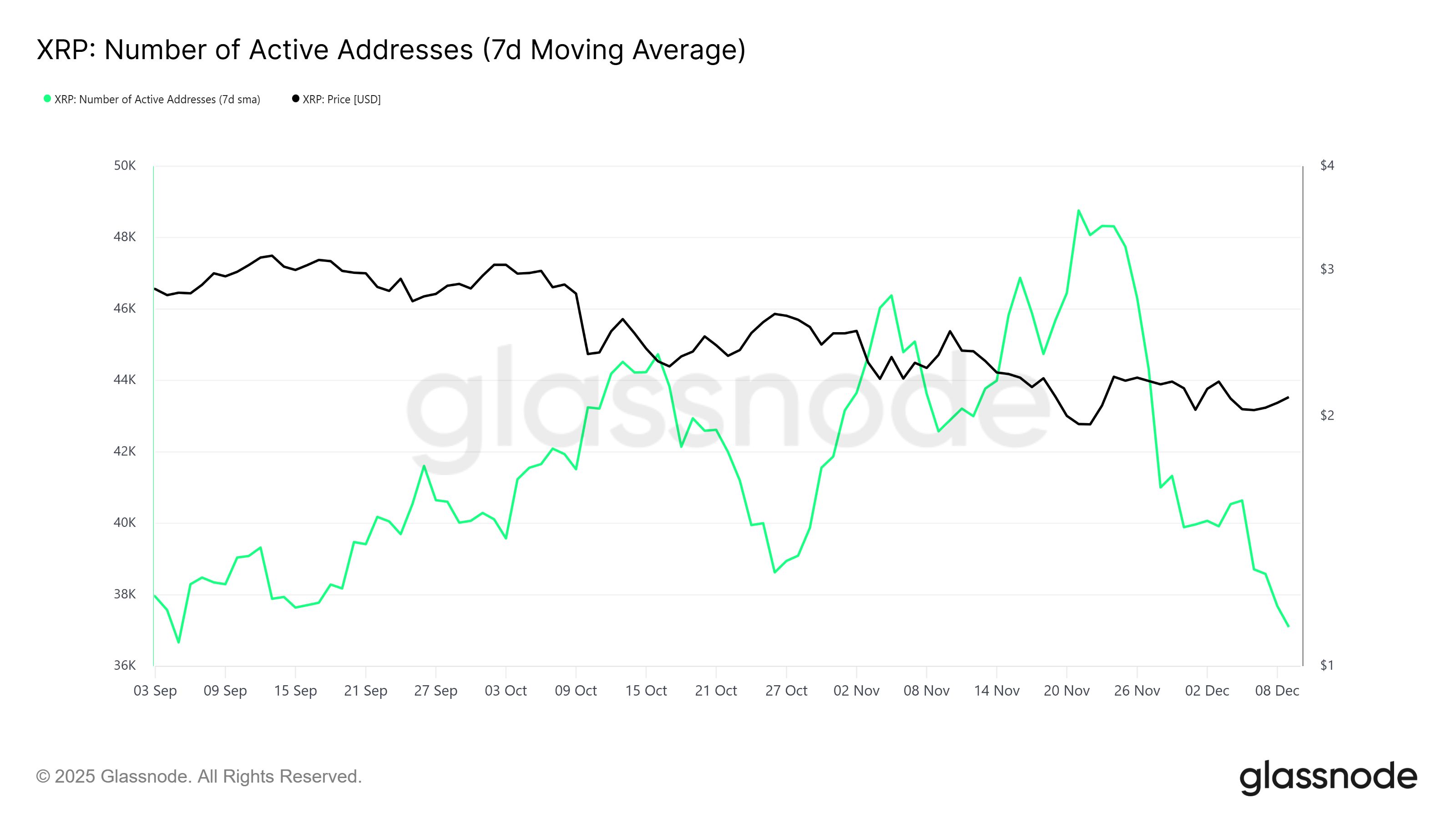

XRP’s macro picture remains challenged by declining network activity. Active addresses have fallen to a three-month low of 37,088, showing that many investors are not transacting or engaging with the network. Such a drop typically signals fading interest or uncertainty about near-term price direction.

XRP Whale Holding. Source:

XRP’s macro picture remains challenged by declining network activity. Active addresses have fallen to a three-month low of 37,088, showing that many investors are not transacting or engaging with the network. Such a drop typically signals fading interest or uncertainty about near-term price direction.

Reduced participation also impacts liquidity, making it harder for XRP to stage a strong recovery even when large holders are accumulating. With fewer users initiating transactions, demand remains muted, slowing down the pace at which XRP can escape its downtrend.

XRP Active Addresses. Source:

XRP Active Addresses. Source:

XRP Price Could Remain Rangebound

XRP is trading at $2.08 at the time of writing, extending a nearly month-long downtrend. For several days, the altcoin has oscillated within the narrow range between $2.20 and $2.02. This highlights the ongoing struggle to generate momentum.

The mixed signals from whales and weak network activity suggest that XRP may continue consolidating within this band. If broader market conditions improve, a break above $2.20 could allow XRP to target $2.36. This would mark its first meaningful recovery attempt in weeks.

XRP Price Analysis. Source:

XRP Price Analysis. Source:

If bullish sentiment fails to develop, XRP faces the risk of another downturn. Losing the $2.02 support level would send the price below $2.00. This would invalidate the bullish thesis, exposing the altcoin to deeper losses.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Clean Energy Market Fluidity: Exploring Emerging Opportunities for Institutional Investors

- CleanTrade's CFTC approval as a SEF in 2025 revolutionized clean energy derivatives by centralizing trading, boosting liquidity to $16B in two months. - The platform standardized VPPAs and RECs under regulated frameworks, reducing counterparty risk and aligning renewable assets with traditional energy markets. - Institutional investors now access transparent, scalable tools for decarbonization, with 84% expecting increased sustainable asset allocations by 2027. - Regulatory alignment with ICE standards e

The Emergence of Hyperliquid and What Lies Ahead for Perpetual Trading Platforms

- Hyperliquid dominates 56% of decentralized perpetual trading volume in 2025 with $86.6M 30-day revenue, driven by HyperCore's on-chain CLOB and HyperBFT consensus. - Its sub-second finality and 200k orders/second capacity rival centralized exchanges while maintaining transparency, attracting institutional traders seeking compliance and security. - Strategic partnerships with Anchorage Digital and Circle's CCTP V2, plus a $888M strategies fund, reinforce institutional adoption aligned with U.S. and EU reg

COAI's Unexpected Price Decline: Causes, Impacts, and Potential Prospects?

- COAI token's nearly 90% drop from $44.90 to $2.18 in October 2025 driven by C3.ai's $116.8M loss, governance issues, and regulatory uncertainty. - Market fear index hit 10/100 as top wallets (88% supply control) accelerated selling, shifting capital to Binance Chain meme coins. - Technical indicators show oversold RSI (31.4) but broken key support levels, creating asymmetric risks for contrarian investors. - Regulatory ambiguity and governance flaws persist, with 30-day -92.6% decline highlighting struct