Is Ethereum Price Headed Toward $3,700 Next? One Metric Hints at a Longer Wait

Ethereum price is up 6.7% in the past 24 hours and trades near $3,320. The move follows a breakout structure confirmed on December 3, which still points toward $3,710. But mixed signals now suggest the climb may take longer. Breakout Structure Holds as a Bullish Crossover Approaches The Ethereum price continues to move within the

Ethereum price is up 6.7% in the past 24 hours and trades near $3,320. The move follows a breakout structure confirmed on December 3, which still points toward $3,710.

But mixed signals now suggest the climb may take longer.

Breakout Structure Holds as a Bullish Crossover Approaches

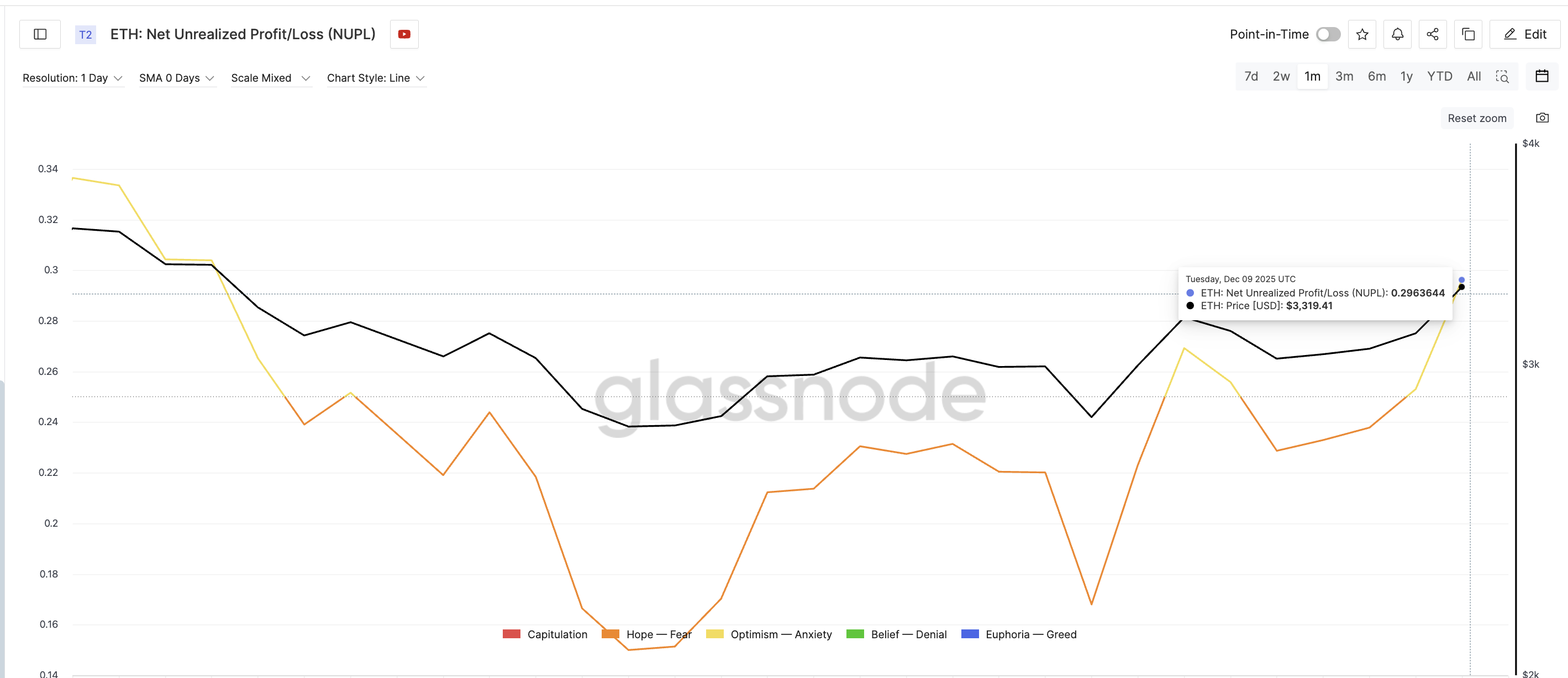

The Ethereum price continues to move within the same inverse head-and-shoulders breakout setup that formed in late November. The move stayed valid after December 3 because the right-shoulder support at $2,710 held. The structure weakens only if ETH drops under that level.

A key trigger now is the bullish crossover forming between the 20-period EMA (Exponential Moving Average) and the 50-period EMA. An EMA, or Exponential Moving Average, tracks price with extra weight on recent candles.

A bullish crossover usually hints that buyers are gaining strength and momentum may continue in the same direction. That trigger could push the ETH price higher, towards the projected target of $3,710.

Bullish Pattern With Looming Crossover:

TradingView

Bullish Pattern With Looming Crossover:

TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

But this crossover will form only if sellers do not step in. One on-chain metric shows why caution remains.

Rising Paper Profits Create a Profit-Taking Window

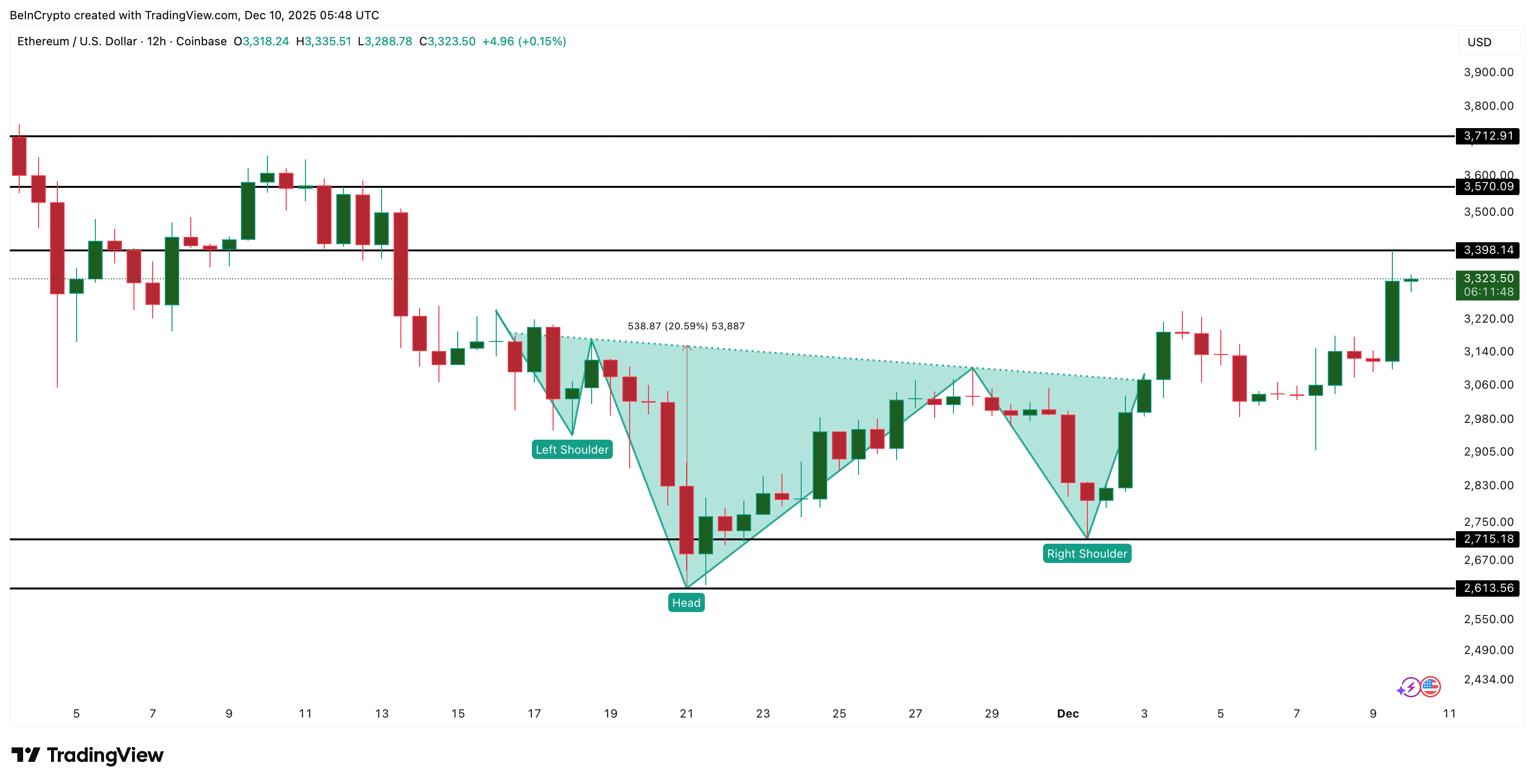

Ethereum’s Net Unrealized Profit/Loss (NUPL) measures the “paper profit” held by all ETH wallets. When NUPL rises, more holders have a reason to sell because they sit on larger unrealized gains.

ETH’s NUPL has now climbed to 0.296, pushing it into the Optimism–Anxiety zone. This is the highest reading since early November.

Paper Profits Rising Again:

Glassnode

Paper Profits Rising Again:

Glassnode

The last time NUPL reached a similar level — on December 3 — ETH fell about 5.2% within two days as holders booked profits.

A similar setup is visible now. Profitability is rising again while ETH sits near resistance. This increases the chance that some holders may sell before the bullish crossover finalizes. If that happens, the crossover may fail, and momentum could pause even though the breakout structure is still intact. That explains the longer wait time.

Key Ethereum Price Levels: What Opens the Path to $3,710 — and What Breaks It

If the bullish crossover completes and NUPL pressure stays limited, the Ethereum price has a clear upward path:

- A 12-hour close above $3,390 is the first signal

- The next resistance sits at $3,570

- Clearing $3,570 unlocks the full move toward $3,710, the measured 20% projection from the breakout point.

Ethereum Price Analysis:

TradingView

Ethereum Price Analysis:

TradingView

If selling grows instead, the structure weakens. ETH remains valid above $2,710, but a move under $2,610 invalidates the setup and points to a deeper pullback.

For now, ETH sits between two forces: a bullish crossover that could push toward $3,710, and rising paper profits that may delay the move. The next few sessions will decide which side leads.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Financial Wellness Factor: An Overlooked Driver of Sustainable Wealth Building

- Financial wellness combines objective financial health and subjective well-being to drive long-term wealth creation, beyond mere asset accumulation. - Behavioral traits like conscientiousness correlate with disciplined investing habits, while neuroticism increases impulsive decisions during market volatility. - Studies show financially literate investors maintain portfolios during downturns, with 38% of "content" quadrant participants achieving superior risk-adjusted returns. - Debt management and saving

Aster DEX’s Latest Protocol Update and What It Means for DeFi Liquidity Providers

- Aster DEX's v2 upgrade enhances capital efficiency and privacy for liquidity providers (LPs) through ASTER token collateral and leveraged trading features. - The "Trade & Earn" functionality boosted TVL to $2.18B by November 2025, leveraging yield-bearing assets as trading margin. - However, 300x leverage and reduced tick sizes increase liquidation risks during volatility, while fee stagnation below $20M contrasts with $2B daily trading volumes. - Upcoming Aster Chain's privacy tools aim to attract insti

PEPE Steadies at $0.054711 With Narrow Range Shaping Short-Term Outlook

PEPE Maintains Structured Movement After 2.8% Gain as Analysts Watch Narrow Range