Terra (LUNA) Surges Over 55%: Here’s What’s Driving the Rally

Terra (LUNA) has emerged as one of the top gainers in the cryptocurrency market today, having recorded a strong double-digit price surge. The sharp rally coincides with the sentencing of founder Do Kwon, scheduled for today, and recent ecosystem updates that have drawn attention to the network. Why is Terra (LUNA) Token’s Price Surging? The

Terra (LUNA) has emerged as one of the top gainers in the cryptocurrency market today, having recorded a strong double-digit price surge.

The sharp rally coincides with the sentencing of founder Do Kwon, scheduled for today, and recent ecosystem updates that have drawn attention to the network.

Why is Terra (LUNA) Token’s Price Surging?

The altcoin began rallying late last week, with momentum accelerating on Monday following the v2.18.0 network upgrade. Major exchanges such as and supported the update, temporarily suspending deposits and withdrawals to ensure a smooth transition for users.

This contributed to a noticeable boost in market sentiment. In fact, the token surged to a 7-month high yesterday. The uptrend has continued today as well.

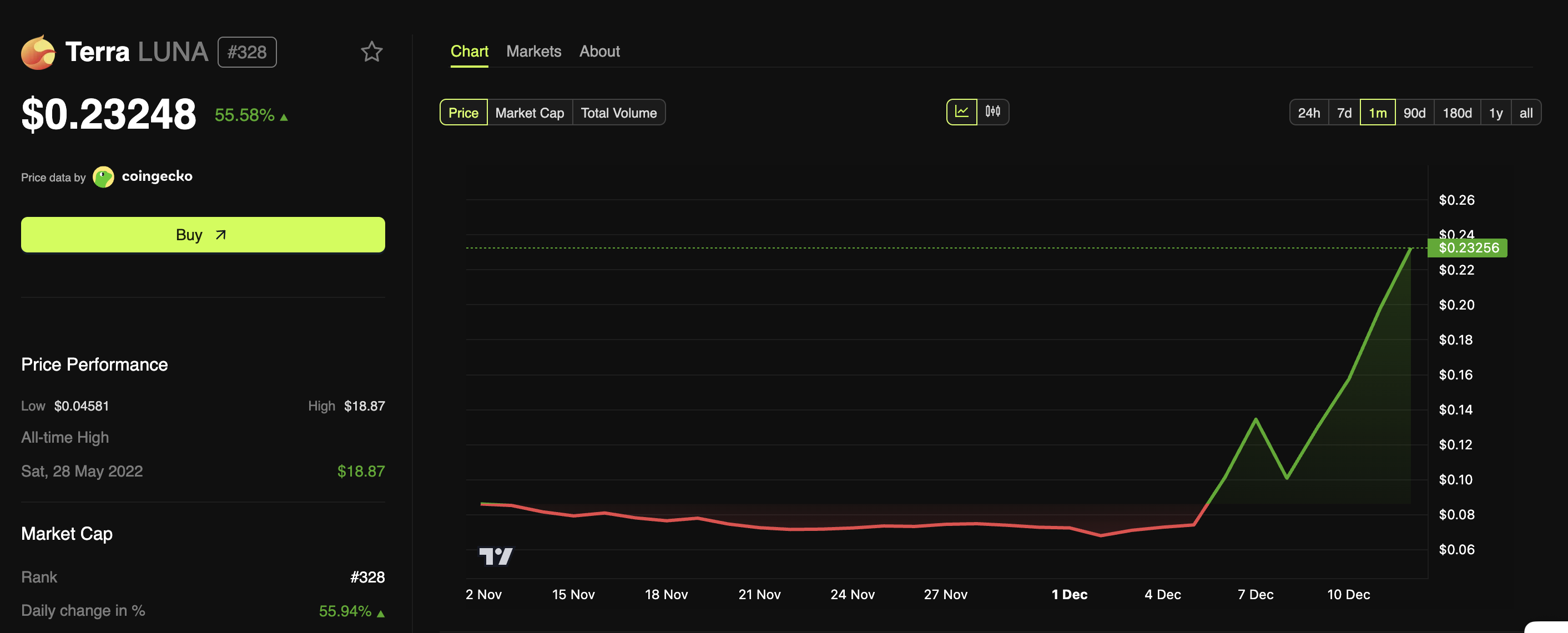

BeInCrypto Markets data showed that LUNA’s price has appreciated by 55.58% over the past 24 hours. At the time of writing, the altcoin was trading at $0.232.

Terra (LUNA) Price Performance. Source:

Terra (LUNA) Price Performance. Source:

Notably, today’s surge positioned LUNA as the second-largest daily gainer on . Trading activity has also increased, with daily volume surging 192.10% to exceed $700 million.

Beyond the network upgrade, another major catalyst driving heightened attention is the sentencing of Terraform Labs founder Do Kwon.

Kwon is set to appear before Judge Engelmayer in the Southern District of New York today. The Department of Justice is seeking a 12-year prison sentence.

However, an analyst noted that sentences can differ from requests. Sam Bankman-Fried received 25 years while prosecutors had asked for 40-50 years. Alex Mashinsky received a 12-year sentence, despite a 20-year request.

“I’m not gonna speculate on the amount of time he will get to be exact, but it would be naive to think he gets 12+ years, especially when considering time served,” Camol posted.

Nonetheless, Toknex has raised concerns about LUNA’s price rally, warning traders not to view the surge as a genuine recovery.

“This is not a comeback. This is not fundamentals. It is just community driven trading pressure. The real Terra ecosystem died in 2022. This new LUNA has no narrative and no lasting value. It only moves when traders feel like gambling on volatility,” Toknex wrote.

As the sentencing approaches, the community has shown heightened interest in not only LUNA but also Terra Luna Classic (LUNC). The renewed attention has pushed both tokens to the top of CoinGecko’s trending list today.

BeInCrypto reported last week that LUNC’s price surged 100% after a journalist wore a vintage Terra Luna t-shirt at the Binance Blockchain Week in Dubai.

Thus, as both LUNA and LUNC move back into the spotlight, market participants remain divided on whether the latest upswing represents genuine revitalization or simply another volatility-driven breakout.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Financial Wellness Factor: An Overlooked Driver of Sustainable Wealth Building

- Financial wellness combines objective financial health and subjective well-being to drive long-term wealth creation, beyond mere asset accumulation. - Behavioral traits like conscientiousness correlate with disciplined investing habits, while neuroticism increases impulsive decisions during market volatility. - Studies show financially literate investors maintain portfolios during downturns, with 38% of "content" quadrant participants achieving superior risk-adjusted returns. - Debt management and saving

Aster DEX’s Latest Protocol Update and What It Means for DeFi Liquidity Providers

- Aster DEX's v2 upgrade enhances capital efficiency and privacy for liquidity providers (LPs) through ASTER token collateral and leveraged trading features. - The "Trade & Earn" functionality boosted TVL to $2.18B by November 2025, leveraging yield-bearing assets as trading margin. - However, 300x leverage and reduced tick sizes increase liquidation risks during volatility, while fee stagnation below $20M contrasts with $2B daily trading volumes. - Upcoming Aster Chain's privacy tools aim to attract insti

PEPE Steadies at $0.054711 With Narrow Range Shaping Short-Term Outlook

PEPE Maintains Structured Movement After 2.8% Gain as Analysts Watch Narrow Range