Pi Coin Price Faces Doomsday Risk After Pattern Break — Here’s How It Can Recover?

Pi Coin price had a steady run in November when most large tokens struggled. But the tone changed this week. The token is down almost 10% over the past seven days and more than 4% in the last 24 hours. The move under a key level confirmed a clear pattern break on the daily chart,

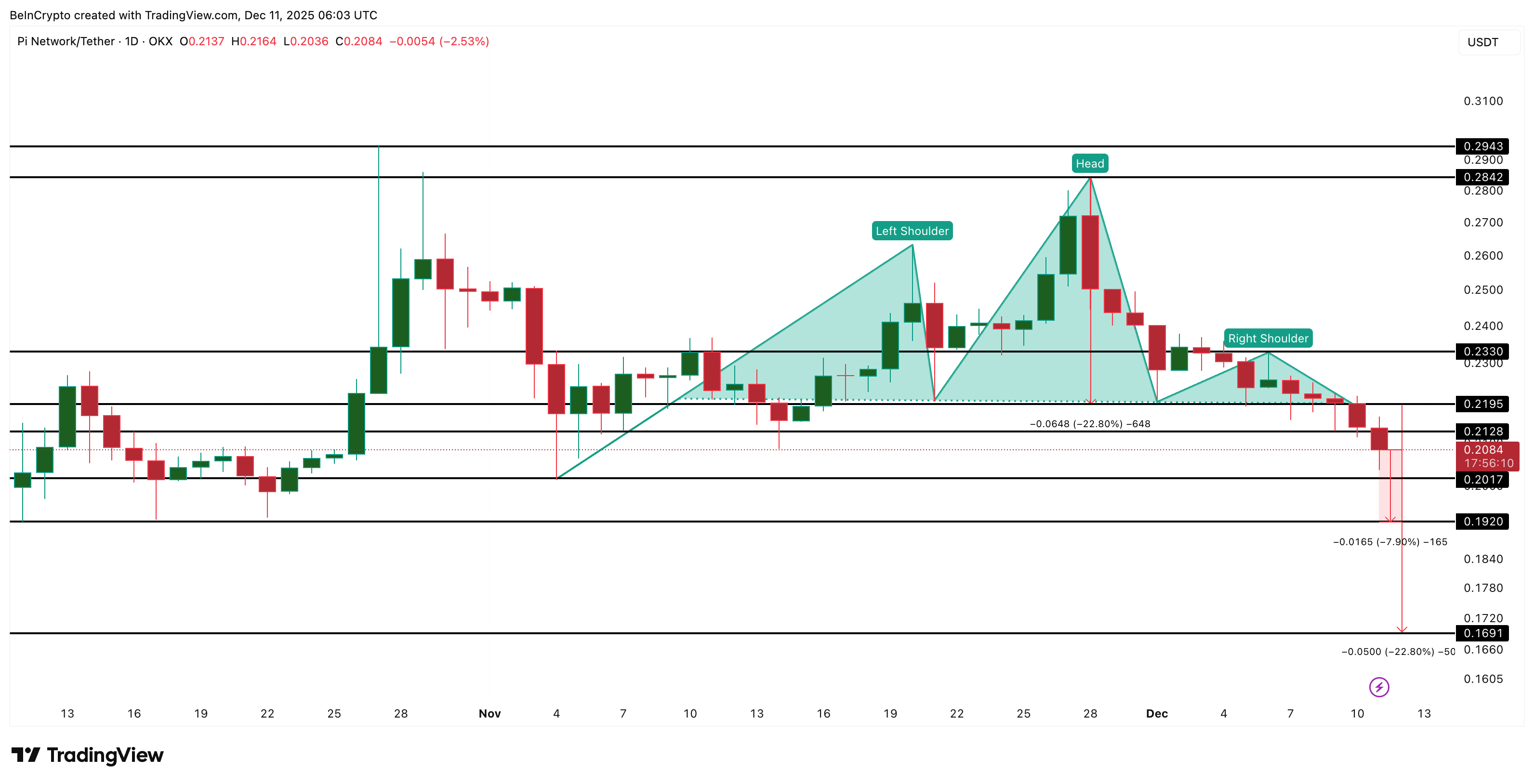

Pi Coin price had a steady run in November when most large tokens struggled. But the tone changed this week. The token is down almost 10% over the past seven days and more than 4% in the last 24 hours. The move under a key level confirmed a clear pattern break on the daily chart, which many traders might link with “doomsday” risk because it can push the price toward a new all-time low if selling continues.

The main question now is whether the chart can recover this time.

Pattern Breakdown Opens the Path to a New Low

Pi Coin dropped below the neckline near $0.219, completing a standard head and shoulders pattern, signifying a possible bearish reversal.

The usual downside projection comes from the gap between the neckline and the head. That projection suggests a possible fall of about 22.8%, placing Pi Coin near $0.169.

PI Price Risk:

TradingView

PI Price Risk:

TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

This matters because Pi Coin’s current all-time low is near $0.172, so a move toward $0.169 would create a new low. But two metrics can still help PI avert the risk.

Sellers Are Strong, but Buyers Still Show Signs of Life

There are still hints of support from larger buyers. One sign comes from the money flow. The Chaikin Money Flow (CMF), which tracks how much big money is entering or leaving, shows a small divergence. Between December 9 and December 11, the price made a lower low, but the CMF trended higher. This usually signals that some buyers are absorbing the dips.

CMF has also broken above its short-term downtrend, but it has not yet moved over the zero line. The zero line is where money flow shifts from net selling to net buying. Pi Coin needs that shift to confirm strength.

Money Flow Might Be Returning:

TradingView

Money Flow Might Be Returning:

TradingView

Momentum shows a similar picture. The Relative Strength Index (RSI), which measures buying pressure and selling pressure, formed a divergence of its own. Between November 4 and December 10, the PI price made a higher low, but the RSI made a lower low — hidden bullish divergence. This can mean that the selling pressure is starting to weaken.

Hidden Bullishness Surfaces:

TradingView

Hidden Bullishness Surfaces:

TradingView

These early signals do not reverse the breakdown, but they show that sellers do not have full control.

Key Pi Coin Price Levels Decide The Fate

The Pi Coin price trades near $0.208 at press time. The most important line is $0.192. A break below it would open the path toward $0.169—the pattern target — and lock in a fresh low for the chart.

For a recovery, Pi Coin must first reclaim $0.233. This level sits above the right shoulder and would show early improvement. A full trend reversal only happens if the price moves above $0.284, which is the zone above the head of the pattern.

Pi Coin Price Analysis:

TradingView

Pi Coin Price Analysis:

TradingView

Right now, Pi Coin sits between pressure and early support signs. The breakdown points to a new low, but the divergences show that buyers are still active. The next move depends on whether the price holds the $0.192 support or gives in to the downtrend.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Tether Eyes a $20 Billion Raise at a $500 Billion Valuation

The Growing Need for Financial Services Focused on Wellbeing

- Financial services are integrating nine wellness dimensions into financial planning to align well-being with economic outcomes. - Studies show only 38% of individuals achieve ideal financial wellness, linking health and financial resilience. - AI tools and wellness programs boost productivity and retention, with 52% growth in AI coaching since 2020. - Wellness-focused real estate and cultural investments reflect rising demand for holistic prosperity. - The $2 trillion wellness industry drives sustainable

Bitcoin Price Fluctuations: Optimal Entry Strategies Amid Changing Macroeconomic Conditions

- Bitcoin's volatility offers high returns but poses psychological risks, requiring disciplined risk management and emotional resilience. - Social media and behavioral biases like FOMO and loss aversion exacerbate impulsive trading during market swings. - Strategic frameworks (position sizing, DCA) and financial literacy help investors navigate volatility while avoiding overleveraging. - Case studies show predefined plans and diversification reduce panic selling during crashes like the 2024 "Black Friday"

Investing in Sectors Focused on Wellness in 2026: Strategically Aligning with Enduring Human-Centered Trends

- Global wellness market to grow from $6.87T in 2025 to $11T by 2034 at 5.4% CAGR, driven by preventive health, mental wellness, and financial well-being integration. - Wearables (Apple Watch, Oura Ring) and AI platforms (Calm, Headspace) are reshaping physical/emotional wellness, with corporate programs boosting productivity and reducing healthcare costs. - Financial wellness emerges as critical axis, with companies like CHC Wellbeing linking health incentives to economic stability through gamified reward