Key takeaways

- Cardano’s ADA is down 10% in the last 24 hours and is now trading at $0.415.

- The coin could bounce back to the $0.50 region as the $0.40 support level holds.

ADA is the worst performer among the top 10 cryptocurrencies by market cap, losing 10% of its value in the last 24 hours. The bearish performance comes amid the Fed’s interest rate and declining Open Interest.

However, on-chain data suggests that Cardano could recover soon and rally higher in the near term.

Derivatives data adds to ADA’s woes

Data obtained from CoinGlass reveals a 13% drop in Cardano futures Open Interest (OI) over the last 24 hours to $725.61 million. The decline in OI suggests a massive drop in active positions, including both longs and shorts, indicating that traders are not interested in the cryptocurrency at the moment.

With the risk-off sentiment, ADA’s funding rate has dropped to 0.0019% from the 0.0047% recorded on Wednesday, suggesting a decline in bullish sentiment.

Furthermore, the short positions account for 54.62% of all active positions in the last 24 hours by press time, indicating that traders are more bearish about ADA’s price action.

Despite the decline in the derivatives data, on-chain data obtained from Santiment shows that transactions reached a nine-month high of 4.11 billion ADA on Tuesday. The increase in on-chain activity could boost ADA’s price in the short to medium term.

Finally, the daily active addresses have also hit a four-month high of 34,229, indicating renewed interest in the Cardano network.

Cardano could break out above $0.50 soon

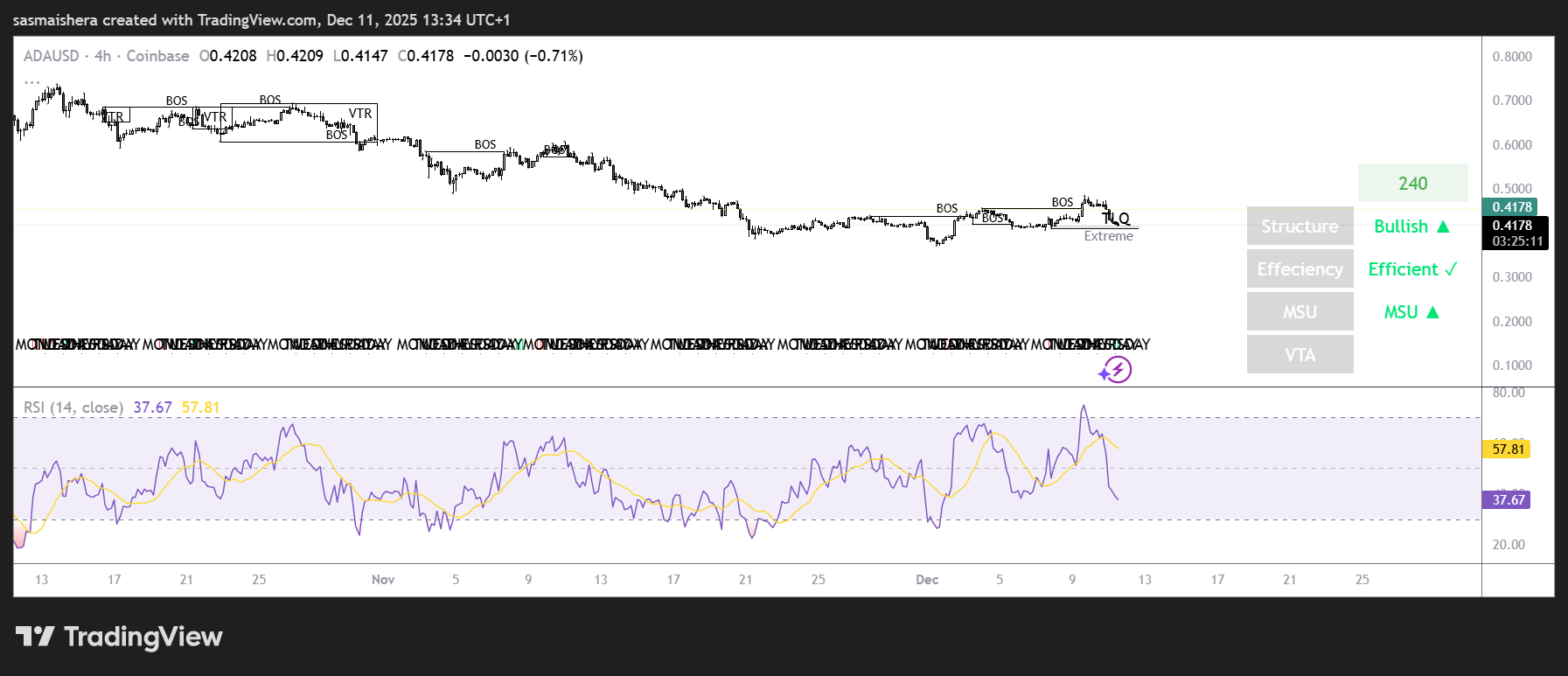

The ADA/USD 4-hour chart is bullish and efficient, with an MSU (Market Shift) structure formed on this timeframe. The technical indicators remain bearish but could soon switch bullish as ADA holds the $0.40 support level.

The RSI of 36 shows that ADA is still within the bearish territory. However, the MACD lines are within the positive territory, indicating a growing bullish bias.

If the trend reverses, ADA could rally towards the $0.50 resistance level over the next few hours or days. The breakout rally could push Cardano prices to $0.6069, a level marked by the November 11 high.

However, failure to reverse could see ADA retest the December 1 low of $0.3707 over the next few hours or days.