What Crypto Whales Are Buying After December FOMC Rate Cuts

The crypto market is still under pressure after the latest FOMC meeting. The Federal Reserve delivered its third 25 bps rate cut of the year, but the tone that followed was more cautious than expected. Inflation risks and slower growth signals have kept prices weak across most major assets. Despite this pullback, crypto whales are

The crypto market is still under pressure after the latest FOMC meeting. The Federal Reserve delivered its third 25 bps rate cut of the year, but the tone that followed was more cautious than expected. Inflation risks and slower growth signals have kept prices weak across most major assets. Despite this pullback, crypto whales are quietly adding to their positions.

Their buying has focused on three tokens that show early signs of rebound or breakout setups.

Aster (ASTER)

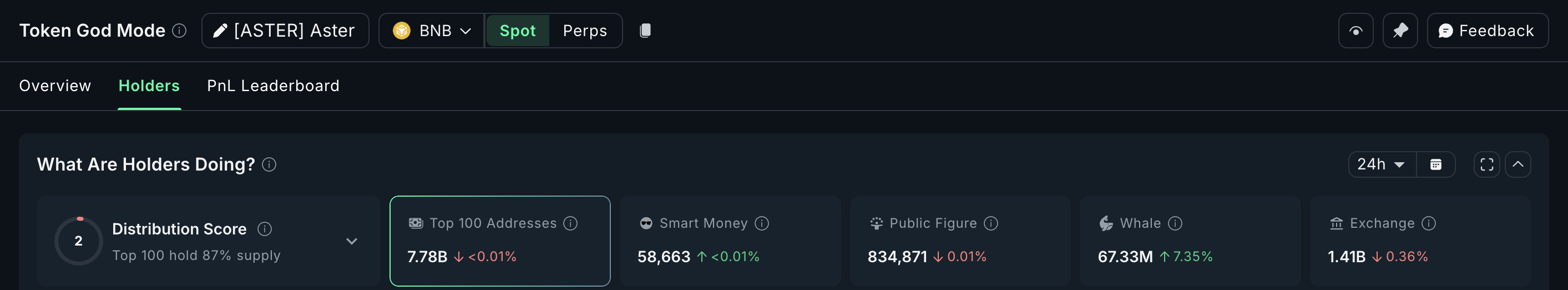

Aster’s price has slipped almost 4% in the past 24 hours, extending its month-on-month losses to about 14%. Yet whales are moving in the opposite direction.

Their holdings jumped 7.35% over the past day, adding about 4.59 million ASTER, worth roughly $4.22 million at the current price. What’s interesting is that ASTER is one of those rare coins that saw whale buying both before and after the FOMC decision.

This buying stands out because the chart shows a technical setup that may help explain why whales stepped in.

Aster Whales:

Aster Whales:

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter .

Between November 3 and December 11, the ASTER price formed a higher low, while the RSI made a lower low. RSI, or Relative Strength Index, measures the strength of buying and selling. When the price rises but RSI falls, this creates a hidden bullish divergence. It usually signals that selling pressure is fading, even if the chart still looks weak on the surface.

Aster showed the same pattern between November 3 and December 1. That divergence produced a bounce of almost 22%. The current setup looks similar, and whales may be positioning for the same kind of rebound.

ASTER Price Analysis:

ASTER Price Analysis:

For upside continuation, Aster needs a clean daily close above $1.08, the level where the last bounce stalled. If it breaks that line, the price can aim for $1.25 and $1.40, which match the next major resistances.

If the structure weakens instead, the downside is clear too. A daily close below $0.88 would break the rising structure and weaken whale conviction. Under that floor, ASTER may revisit $0.81 or lower.

Maple Finance (SYRUP)

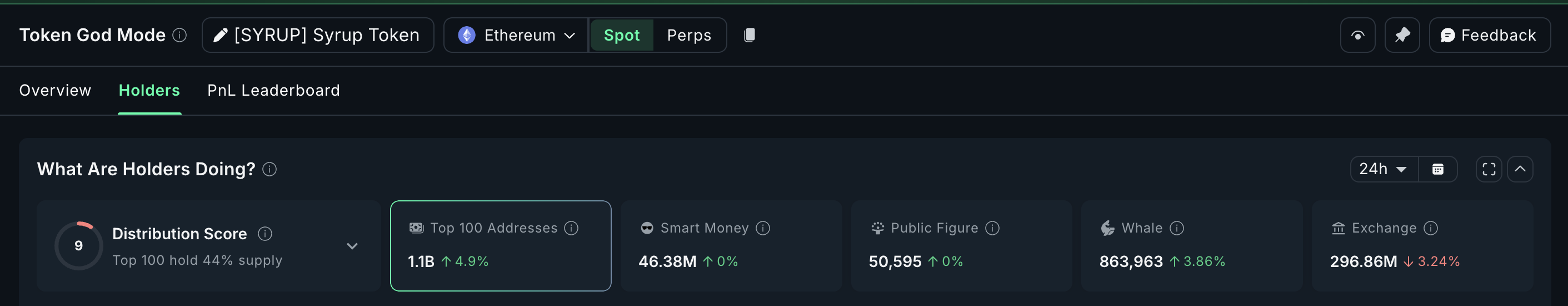

Maple Finance (SYRUP) is still down about 2.2% in the past 24 hours and nearly 40% over the past month. Even with this weakness, crypto whales continued building positions. Normal whale wallets increased their holdings by 3.86% in the past day, while mega whales increased their stash by 4.9%, taking their total to 1.1 billion SYRUP.

That 4.9% jump means mega whales added roughly 51.4 million SYRUP, worth about $14.4 million at the current price. The fresh accumulation comes right after the slightly hawkish FOMC tone, which makes the buying move more interesting.

Maple Finance Whales:

Maple Finance Whales:

Whales seem to be counting on the $0.23 support to hold. SYRUP touched this level several times since early December. It has not broken once, which may be the reason whales stepped in. The token has been moving in a broad $0.23 to $0.31 range, with its last support test on December 4.

Momentum gives a short-term boost. Between December 9 and December 11, the price made a lower low while the RSI made a higher low. RSI, or Relative Strength Index, measures buying and selling strength. When price drops but RSI rises, it forms a bullish divergence. On lower time frames, this usually points to a bounce even during a wider downtrend.

SYRUP Price Analysis:

SYRUP Price Analysis:

If a bounce forms, the first target is $0.31, the ceiling that has rejected every move since December 6. A clear break above $0.31 opens the path to $0.39 and $0.48.

But if the SYRUP price loses $0.23, the whale conviction weakens. A breakdown there exposes open downside and likely resets the setup.

Pudgy Penguins (PENGU)

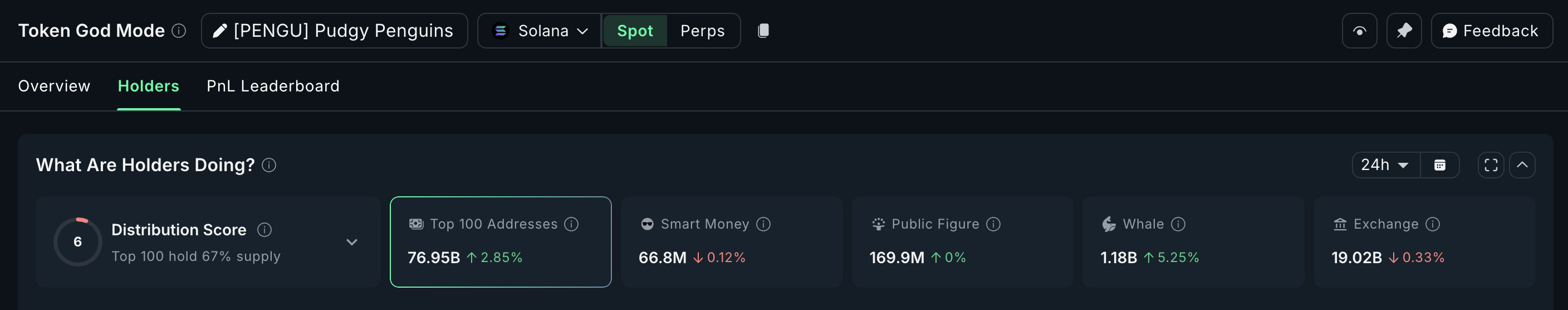

Pudgy Penguins is down almost 10% in the past 24 hours, but crypto whales continue to buy through the dip. Whale wallets increased their holdings by 5.25%, taking their total stash to 1.18 billion PENGU. That increase means whales added about 58.9 million PENGU.

Top 100 addresses or mega whales also showed steady accumulation. Their holdings rose 2.85% in the past day, lifting their combined stash to 76.95 billion PENGU. That comes to an addition of about 2.13 billion tokens, worth close to $21.3 million at today’s price. For a token that just slipped double digits, this kind of synchronized whale and mega whale buying is rare.

PENGU Holders:

PENGU Holders:

The PENGU price chart explains why the whales continue to load up. Pudgy Penguins is forming an inverse head and shoulders pattern on the daily timeframe. This is a bullish reversal setup that often forms when a downtrend is losing pressure. The neckline sits near $0.014, and because it is sloping upward, it signals improving buyer-aligned structure even before a breakout forms.

Whales may be betting on that breakout. If PENGU closes above $0.014, the pattern’s height projects a move of roughly 35%, which places the upside target near $0.019. That is likely the reason large wallets are entering despite the price weakness.

PENGU Price Analysis:

PENGU Price Analysis:

But the pattern has clear invalidation levels. If Pudgy Penguins loses $0.010, the setup weakens. A drop under $0.009 fully invalidates the pattern and removes the bullish projection. For now, as long as PENGU holds above $0.010, the inverse head and shoulders remains in play, and crypto whales look prepared for a possible breakout.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Zcash (ZEC) Price Rally and Contributing Factors in Late 2025: Privacy-Focused Cryptocurrencies Amid Increasing Regulatory Pressure

- Zcash (ZEC) surged 700% in late 2025, peaking at $728 amid rising demand for privacy-focused crypto amid regulatory scrutiny. - Technological upgrades like Orchard protocol and Zerdinals drove adoption, while institutional investments and endorsements from figures like Winklevoss twins boosted market confidence. - A dynamic fee model stabilized transaction costs, addressing privacy coins' usability challenges during price volatility. - U.S. regulatory engagement with Zcash contrasted with EU plans to ban

ICP Network Expansion: The Adoption of Blockchain Infrastructure and Its Impact on DeFi Investment Approaches

- ICP's 2025 upgrades (Fission, Stellarator) boosted throughput to 11,500 TPS but face decentralization concerns due to 80% node centralization. - Chain Fusion cross-chain protocol enabled Bitcoin/Ethereum interoperability, driving $1.14B TVL growth and attracting institutional partnerships with Microsoft/Google. - Institutions adopt ICP for hybrid cloud/Web3 solutions, prioritizing tokenized RWAs over speculative dApps amid 22.4% Q3 engagement decline. - Analysts project $11.15–$88.88 ICP price range by 2

Zcash Halving and Its Effects on Crypto Markets: Deflationary Dynamics and Investor Perspectives

- Zcash (ZEC) will undergo its next halving in late 2028, reducing block rewards by 50% and aligning with Bitcoin's deflationary model. - The 2024 halving triggered a 1,172% price surge followed by a 96% crash, highlighting volatility from scarcity-driven speculation and macroeconomic factors. - Regulatory challenges like EU MiCA framework scrutiny and reliance on transaction fees raise sustainability concerns as block rewards shrink. - Future success depends on balancing deflationary scarcity with regulat

Assessing How Federal Reserve Policies Influence Emerging Blockchain Assets Such as Solana

- Fed's 2025 rate cuts and liquidity injections initially boosted Solana prices by 3.01% but triggered 6.1% drops during October 2025 liquidations. - Regulatory frameworks like EU MiCA and U.S. GENIUS Act drove 8% institutional ownership of Solana, attracting $101.7M in November 2025 inflows. - 35% of crypto volatility stems from Fed policy shifts, with high-rate environments eroding Solana's appeal as investors favor cash equivalents. - Solana's SIMD-0411 proposal aims to reduce token issuance by $2.9B by