For Solana, one of the leading Layer-1 blockchain networks, 2025 has been a year of consolidation. Its price has fluctuated significantly, but the coin has kept its place among the largest altcoins. Solana’s price prediction for 2026 comprises several variables and questions, one of them being how quickly SOL can regain a $100 billion market cap.

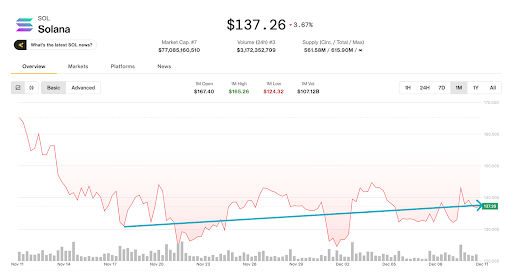

Solana hits a liquidity level that usually precedes a rally

A recently released Solana price prediction observed that SOL is hitting a near-zero liquidity level. While in itself that is a poor situation, the analysts pointed out that such a level has been historically the starting point of sustained recoveries.

This technical sign is good news not only for SOL itself but also for all its ecosystem, which comprises numerous other coins. One of these, Raydium, is also showing signs of recovery.

In the next section, apart from a SOL long-term outlook and a brief mention of Raydium, a more detailed analysis of DeepSnitch AI and its potential is made.

Coins that are likely to succeed in 2026

- DeepSnitch AI (DSNT)

DeepSnitch AI is positioning itself as the most expected crypto for 2026. The expectations aren’t just about how well its native coin, DSNT, will do once it hits exchanges. They also have to do with a deeper question: how much will DeepSnitch AI disrupt crypto investing?

At its core, DeepSnitch AI is about empowering retail investors. The system provides them with business intelligence, including insights on a broad range of issues, from scam detection to estimating the current Solana price prediction. This is accomplished by a set of AI agents (three of which are already alive and thinking) that scan and analyse crypto data.

The target market for such a product is massive. More than half a billion crypto investors can significantly improve their portfolios with a tool like DeepSnitch AI.

- Solana (SOL)

An optimistic Solana price prediction for 2026 forecasts the coin to surge above the key $200 mark in the first half of the year. Failing to do so might complicate its long-term outlook, even if SOL maintains a market cap close to $100 billion .

In this sense, the current Solana technical trajectory only shows support above $130 and a slightly upward trend, but nothing that would imply a Solana price forecast above the desired cap in the near future. If, however, the liquidity indicators turn out to be right in predicting a new rally, Solana’s price prediction for early 2026 will look much better than it does now.

- Raydium (RAY)

Raydium’s forecast is linked to Solana’s price prediction because it is a coin that works on SOL’s ecosystem. In fact, RAY’s price curve in the month prior to December 10 is pretty similar to that of SOL.

The key test for Raydium will be to recover its $2 mark, lost 2 months ago when bears started to prevail in crypto markets. Given its relatively low price, Raydium seems a good choice for investing in an undervalued coin that has a fair chance of recovery in 2026.

Conclusion

If the latest liquidity indicators evolve in the same way they have done in the past, Solana’s price prediction for 2026 is one of a likely recovery. For DeepSnitch AI, however, everything points towards a crypto eruption of 100x or even more.

FAQs

Can Solana recover the key $250 mark in 2026?

That belongs to a bullish Solana price prediction. Even if it happens, this mark has preceded deep falls in the past, so it’s unlikely that SOL could consolidate at that level.

What makes investing now in Raydium a choice to consider?

The fact that it is an undervalued coin that seems to have built a solid support. That’s a situation where the upside is likely much bigger than the downside.

In which scenario could DeepSnitch AI rise 100x?

In the scenario where a million users milestone is reached. At that level, a DSNT price around $3 is projected, which would imply more than 100x over its current presale price.