Stanford’s top journalist challenges Silicon Valley’s startup scene, calling out its obsession with wealth

Theo Baker: A Standout in Modern Investigative Journalism

In an era when journalism programs are dwindling and some universities are even discontinuing the major, Theo Baker, a senior at Stanford University, has embraced the traditions of investigative reporting—and his commitment is yielding remarkable results.

Baker first drew national attention as a freshman when his investigative work for The Stanford Daily led to the resignation of Stanford’s president, Marc Tessier-Lavigne. Within his first month at college, Baker uncovered decades-old allegations of research misconduct. He found himself navigating anonymous tips, conducting surveillance, and seeking out confidential informants, all while facing attempts by influential attorneys to undermine his findings. By the end of that year, Tessier-Lavigne had stepped down, and Baker made history as the youngest recipient of the prestigious George Polk Award.

Soon after, Warner Bros and renowned producer Amy Pascal secured the rights to adapt his story for film, following a highly competitive bidding process.

While that high-profile investigation put Baker in the spotlight, his forthcoming book may further establish him as a bold young journalist unafraid to scrutinize Silicon Valley’s startup culture.

Set for release on May 19—just weeks before Baker’s graduation—“How to Rule the World” promises a revealing exploration of how venture capitalists treat Stanford undergraduates as assets, courting them with secret funds, shell corporations, lavish parties, and investment offers before they even have concrete business ideas, all in pursuit of the next billion-dollar entrepreneur.

“I witnessed firsthand as my classmates were encouraged to take shortcuts and offered immense wealth by those eager to capitalize on their abilities,” Baker, who turns 21 soon, shared with Axios. Drawing from over 250 interviews with students, CEOs, venture capitalists, Nobel Prize winners, and three Stanford presidents, his book seeks to uncover what he describes as a “strange, money-driven subculture with global influence.”

Baker’s path may not be surprising given his background—his father, Peter Baker, is the chief White House correspondent for The New York Times, and his mother, Susan Glasser, writes for The New Yorker. While many of his peers pursue startup funding and lucrative tech careers, Baker dedicated his sophomore year to reporting and took a year off from school to write, including a two-month residency at the Yaddo writers’ retreat.

His choices stand out even more against the backdrop of journalism’s current challenges. As traditional journalism programs struggle to attract students and media organizations face ongoing layoffs, Baker represents a rare and inspiring example of a young journalist committed to holding power accountable. Whether his success signals a revival of interest in investigative reporting remains to be seen, but his upcoming book is sure to spark conversation among college students—and is likely to make a significant impact in Silicon Valley.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget Releases Major Upgrades to GetAgent With Smarter Responses and Free Access for All Users

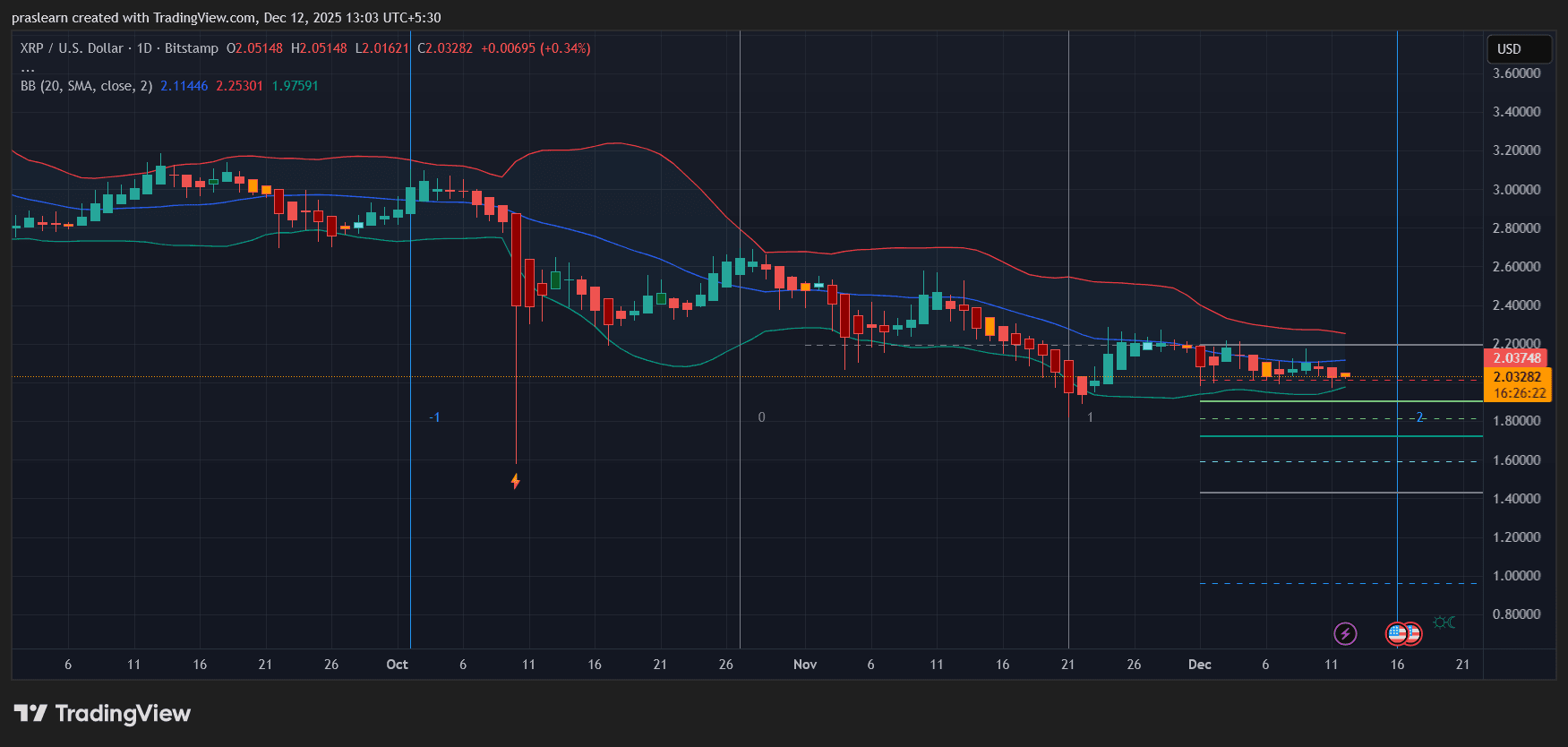

Will Fed Uncertainty Cap XRP’s Upside in 2026?

They already knew the TGA Game of the Year in advance, earning tens of thousands of dollars.

Violating history, yet persisting.

The Convergence of Social Justice and Renewable Energy Implementation in Developing Economies

- IEA data shows emerging markets need $45B/year by 2030 to achieve universal clean energy access, with Africa and Asia facing the greatest demand. - Renewable projects in low-income regions demonstrate nonlinear ESG impacts, with solar microgrids directly reducing energy poverty for 600M+ Africans. - PIDG's $27M guarantees mobilized $270M in African renewables, proving blended finance models can de-risk investments while creating 200-300MW capacity. - Kenya's M-KOPA and Indonesia's JETP showcase scalable