A Satoshi Nakamoto statue just appeared outside the New York Stock Exchange, Australia trimmed back its stablecoin licensing requirements, and Republicans are venting that a promised CBDC ban never made it into the defense bill. Regulations are taking turn after turn, while XRP leans on a crucial support zone.

The XRP price prediction for 2026 largely depends on whether the token can defend the $2 region and echo its 2017 fractal. But while charts debate that future, DeepSnitch AI is delivering tools you can use now, its current funding now at $776,918.

Still priced low at $0.02735, it’s at 81% above its $0.01510 starting price. Launch is coming up quickly, but the platform already has tools shipping.

NYSE hosts Satoshi statue while Australia opens stablecoin doors

The New York Stock Exchange described Valentina Picozzi’s new Satoshi statue as “ shared ground between emerging systems and established institutions.” It’s the sixth piece in her series, timed with the 10 December anniversary of Nakamoto’s Bitcoin mailing-list debut, a skip from taboo to tribute. If the XRP price prediction is of interest, then it’s worth keeping a close eye on signals like this, where cultural recognition meets institutional interest.

Meanwhile, Australia’s securities regulator has now finalized exemptions that remove separate licensing requirements for stablecoin intermediaries. Total stablecoin supply has pushed past $300 billion, up 48% this year. These regulatory steps are key XRP price drivers, reinforcing a more predictable environment for cross-border settlement tokens.

And in Washington, the House advanced a $900 billion defense bill without the anticipated CBDC ban. Markets benefit from clearer rules, but progress is still made in uneven steps.

With policy moving in fits and starts, the next edge is going to have to come from elsewhere, most likely sharper intelligence. DeepSnitch AI is built precisely for that.

XRP price prediction: DeepSnitch AI vs. XRP vs. Stellar

- DeepSnitch AI: Ask questions, get answers, act fast

The idea of being able to type a question about any token and get a clear, data-backed answer instead of scrolling through five dashboards sounds dreamy. But that’s exactly the idea behind DeepSnitch AI, specifically one of its five AI agents, SnitchGPT. This tool is already live, deployed, and wired into DeepSnitch AI’s adaptive intelligence network. It turns scattered data streams into straight answers you can act on.

And with BTC slicing through support levels and traders feeling cornered, tools like these could be the most crucial lifeline, and DeepSnitch AI’s platform is especially sophisticated and cutting-edge. With tools shipping already, DeepSnitch AI holders are getting to operate on the informed side of market swings while everyone else panics their way through Twitter threads.

Unified Intelligence ties SnitchFeed, SnitchScan, and SnitchGPT into one cognitive layer. You can track anomalies, follow wallet movements, run token checks, or spot narrative shifts before they flare up publicly.

The platform already built the core system, and the five snitches will continue running once it hits exchanges. That’s the sort of value that will sustain itself well beyond the initial phase.

With $776,918 raised and the race toward $1 million nearly there, Stage 3 is close to closing. DeepSnitch delivers tools others only describe. And launch is imminent, so if you’re going to participate, do it now to reap the very best of its entirely plausible 100x gains.

- XRP price prediction: 2017 fractal pattern returns

XRP sits at $2.00 and has triggered a pattern that once preceded its enormous 7,452% breakout in 2017. The 2025 setup closely mirrors the pre-rally structure, with the same consolidation pocket and nearly identical price sequences.

That narrow zone sparked XRP’s historic climb eight years ago, and XRP price prediction models are tracking the repeat setup carefully.

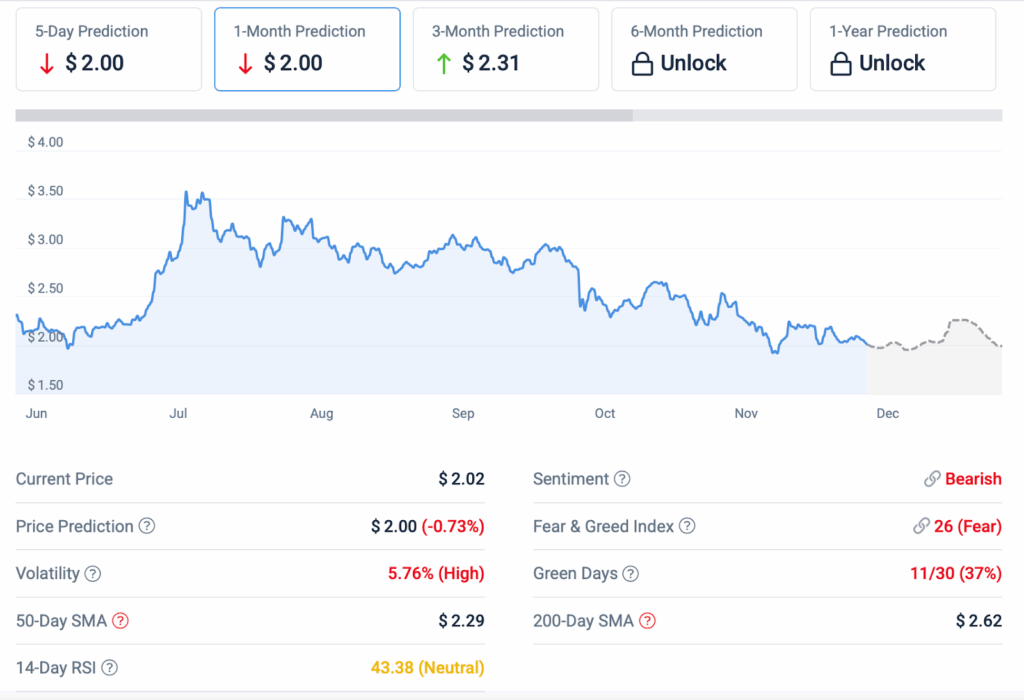

Even so, short-term XRP price prediction readings from technical indicators point to a mild pullback toward $2.00 by January 2026. Sentiment is soft, with Fear and Greed at 26, and XRP has logged only 37% green sessions. The token sits under its 20-day EMA near $2.10, while sellers need a clean break below $1.98 to regain control.

If the old structure plays out again, some analysts outline long-range targets above $150. Key XRP price drivers now include stronger fundamentals than 2017: broader partnerships, deeper institutional usage, and a more defined regulatory backdrop.

The XRP market outlooks hinge on reclaiming the 50-day SMA. As for now, the XRP price prediction narrative is compelling but still unresolved.

- Stellar price prediction: Compression with upside intent

Stellar is trading around $0.24 and pressing into a compression zone. Its descending channel is flattening into a tighter horizontal range, a setup that often hints at building bullish pressure. Support holds at $0.24, with $0.26 acting as the key breakout level.

Forecast models suggest XLM could climb nearly 20% and move above $0.29 by January 2026, though sentiment is still bearish with Fear and Greed at 26. And for those comparing cross-border networks through the lens of XRP technical analysis, Stellar presents a similar payments narrative, just driven by its own distinct mechanics.

The bottom line

Satoshi statues at the NYSE, stablecoin rules easing, CBDC bans losing momentum, and XRP testing its familiar 2017 fractal in the background. DeepSnitch AI at $0.02735 delivers live intelligence, with launch closing in.

The XRP market outlook has promise, but DeepSnitch AI has more precisely because it’s offering tools you can put to work right now, and it has all the room in the world to run because of its current stage.

FAQs

What is the XRP price prediction for 2026?

Some XRP technical analysis models highlight a 2017-style fractal with major upside potential. Others expect more modest movement unless XRP can clear key resistance. Overall, the XRP price prediction remains split.

What are the main XRP price drivers right now?

Partnership expansion, institutional usage, and clearer regulation all shape the XRP price drivers list. The XRP market outlook will strengthen if the token can reclaim its moving averages, which anchor most XRP technical analysis models.

How does XRP compare with DeepSnitch AI?

XRP offers long-term potential tied to broader adoption. DeepSnitch AI at $0.02735 offers near-term asymmetry with live tools and a launch around the corner. The XRP market outlook is compelling, but DeepSnitch AI has its utility on the table today.