Brazil's largest private asset management company recommends investors allocate 1% to 3% of their portfolio to bitcoin

Foresight News reported that Itáu Asset Management, the largest private asset management company in Brazil, recommended in its year-end report that investors allocate 1% to 3% of their portfolios to bitcoin. Renato Eid, Head of Beta Strategies and Responsible Investment at Itáu Asset Management, stated that cryptocurrencies can be used as a supplementary asset to help absorb the impact of currency devaluation and global volatility.

Renato Eid also noted that investing in cryptocurrencies requires moderation and discipline: set a proportion (for example, 1% to 3% of the total portfolio), maintain a long-term perspective, and resist the temptation to react to short-term noise.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Juventus shares surge nearly 14% after rejecting Tether's acquisition offer

JPMorgan launches its first tokenized money market fund

JPMorgan to launch its first tokenized money market fund on Ethereum, with a seed fund size of 100 millions

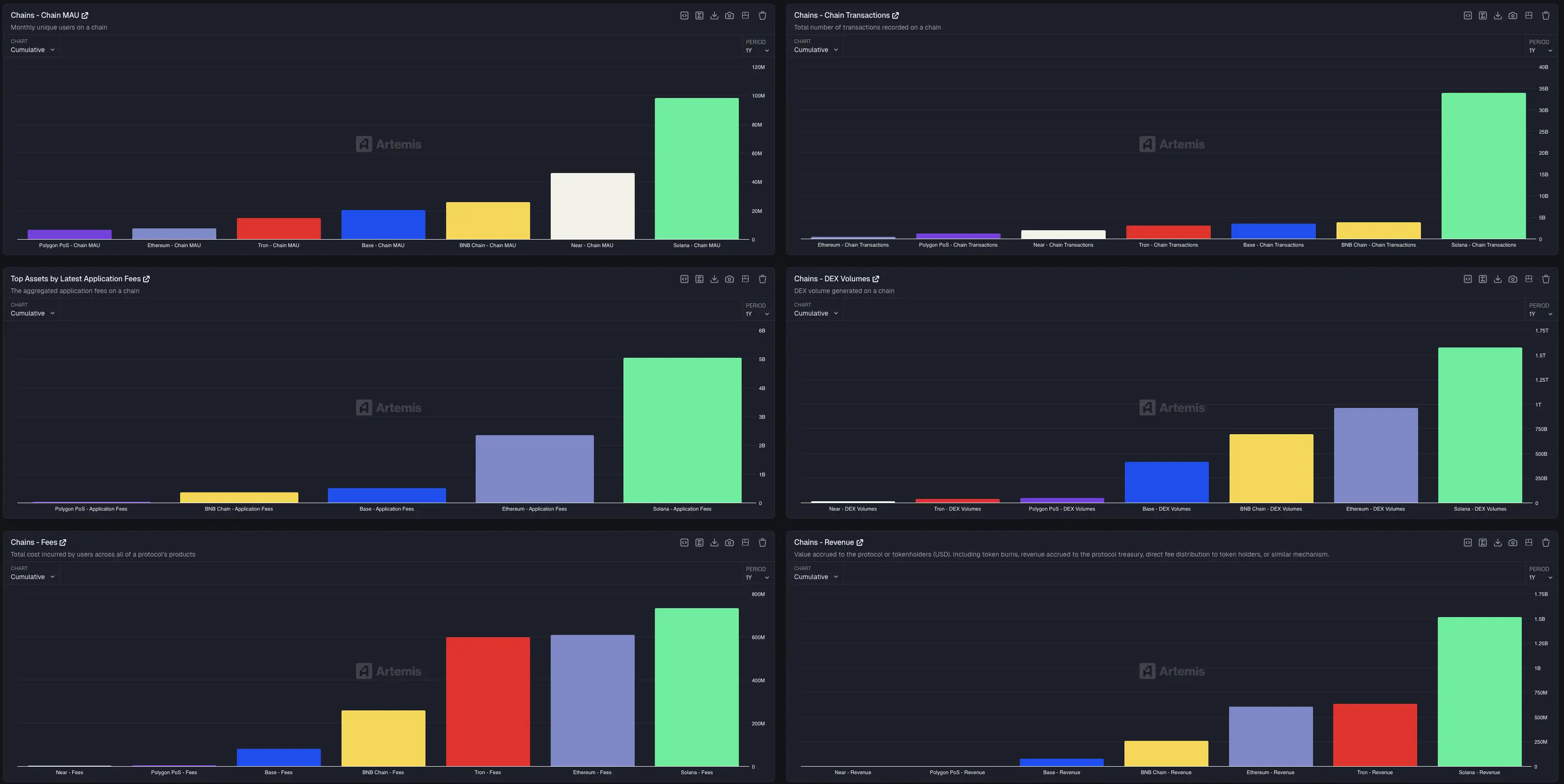

Artemis CEO: Solana leads the market in key on-chain metrics, with transaction volume 18 times that of BNB