Apart from Transactions, a List of Star New Projects in the Solana Ecosystem with Major Updates

Solana Breakpoint 2025 Conference Was Truly Spectacular

The Solana Breakpoint 2025 Conference was truly amazing. Apart from the most anticipated validator client Firedancer officially launching on the mainnet (expected to increase TPS to a potential million-level) and the full integration of Coinbase DEX, many updates have emerged in various areas of the Solana ecosystem.

While ETH remains committed to the ideal of decentralization, Solana seems like a bustling construction site, with full throttle in all aspects, focusing on efficiency, construction, construction, and more construction. So, let's take a look at the various track updates that appeared at the Solana Breakpoint 2025 Conference.

DeFi

Splyce Finance

Splyce Finance announced the launch of $SFULC on Solana, which is a 10% annual interest rate-bearing stablecoin introduced by Fulcrum Lending, backed by real cash flow from advanced collateralized multi-family residential mortgages. Users can mint $SFULC through the stablecoin or acquire it through Raydium trading.

Streamflow

Streamflow announced the launch of $USD+ on Solana, also a interest-bearing stablecoin with an annual interest rate of up to 3.6%, fully backed by U.S. Treasuries.

RockawayX

RockawayX announced the launch of 3 RWA Yield Vaults on Solana, which will operate on Kamino, Exponent Finance, and Midas respectively. These vaults will be managed by professional third-party risk managers responsible for setting risk parameters, monitoring, and dynamically adjusting vault funds in RWA-related opportunities to provide returns to users depositing funds into the vaults.

WisdomTree

WisdomTree, a $140 billion AUM asset management company, plans to launch yield vaults on Solana.

SWEEP

Global asset management company State Street, with over $5 trillion in AUM, plans to launch the tokenized liquidity fund SWEEP on Solana in early 2026 in partnership with Galaxy Digital. The fund will facilitate on-chain subscriptions and redemptions using $PYUSD and will be seeded with $200 million by Ondo Finance.

Carrot

Carrot has announced the launch of Turbo Tokens, leveraged tokens with no liquidation risk, allowing users to trade the leveraged version of corresponding assets directly as spot. The leverage will be dynamically adjusted, preventing user liquidations.

Huma Finance

Huma Finance has partnered with Obligate and TradeFlow to provide Solana-based stablecoin liquidity for global rare earth mineral trading.

Light Protocol

Light Protocol introduces Light Token, a new token standard on Solana that is 200 times cheaper than the existing SPL standard and fully compatible with DeFi.

deBridge

Cross-chain interoperability protocol deBridge has launched a new execution model called "Bundle," allowing users to sign an intent describing the desired outcome, which the protocol will then execute without the need to interact directly with the blockchain. In simpler terms, for complex cross-chain transactions, a single click will take care of all the details seamlessly.

RWA

Oro

Oro is a digital gold savings platform on Solana, and they have announced the launch of $StGOLD, a new gold savings token. Additionally, they will deploy physical gold redemption centers in 5 locations globally.

Uranium Digital

Uranium Digital showcased their product on Solana Breakpoint, which for the first time enables institutions to purchase physical uranium on-chain, with transaction settlements conducted entirely on Solana.

Privacy

Arcium

Arcium is introducing a new privacy token standard, C-SPL, which provides encrypted privacy protection for the balance and transaction amounts of any Solana token. Additionally, they bring forth a zero-trust dishonest-majority privacy protocol, the Cerberus Protocol.

AI

Solflare

Solflare introduces Magic AI, a decentralized, intent-driven assistant that can understand plain language commands and execute on-chain operations. Simply describe your needs in spoken language, such as "Swap all my USDC to SOL when SOL hits below $150." Magic AI will translate it into precise, secure on-chain actions.

Glider

A new AI-driven investment app on Solana, planning to leverage AI to help users adjust their cryptocurrency investments based on their needs, automate investment strategies, and incur zero gas fees. The project has secured a $4 million investment led by a16z, with participation from Coinbase Ventures, Uniswap Ventures, and GSR.

Wallet

Unruggable

The latest Colosseum hackathon champion. This is a hardware wallet designed specifically for Solana, and natively built for Solana.

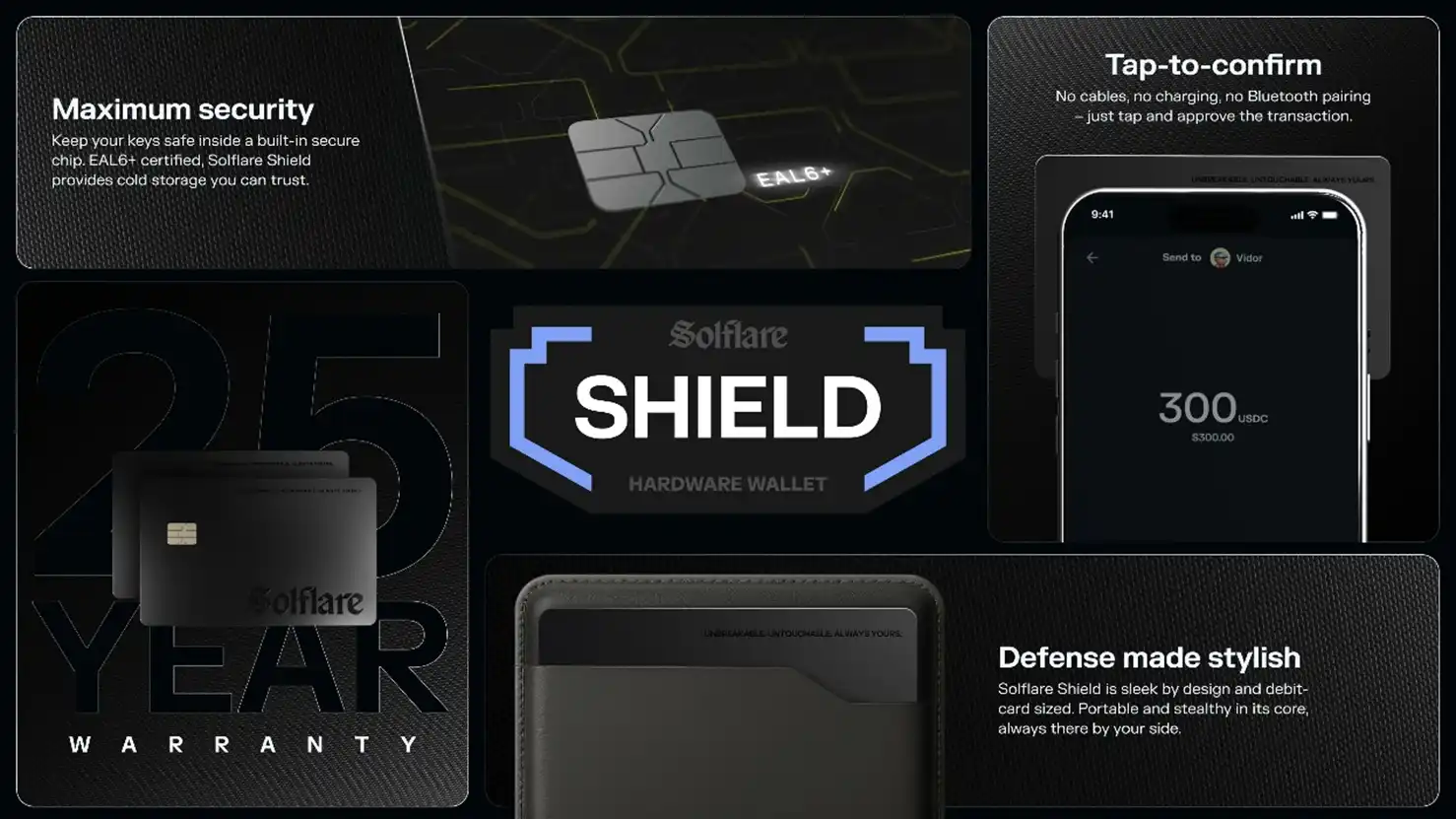

Solflare

Solflare has announced the shipping of its new wallet, 'Solflare Shield,' which is a hardware wallet that looks like a credit card and enables transaction signing through NFC.

Phantom

Phantom collaborates with Kalshi, integrating the prediction market into its own wallet. Phantom wallet users will be able to directly use any SOL token in the wallet for transactions on Kalshi.

Prediction Market

worm.wtf

A leveraged prediction market. Previously, we saw the TROVE collaboration on Kalshi and Hyperliquid for leveraged prediction market trading, but now there is a prediction market on Solana that allows direct leverage trading.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The HYPE Token Crypto Rally: Unveiling the Driving Force Behind Its Week-Long Surge

- HYPE Token's 7-day surge in late 2025, reaching $35.08, was driven by protocol upgrades, institutional backing, and retail FOMO. - Institutional investments like Paradigm’s $581M stake and retail-driven momentum mirrored the 2021 Dogecoin rally. - However, looming token unlocks and bearish indicators, including a $11B unlock of 237M tokens, raised sustainability concerns. - Technical analysis showed mixed signals, with consolidation near support levels and short-term volatility risks, while broader trend

How CFTC-Recognized Platforms Such as CleanTrade Are Transforming the Landscape of Clean Energy Investments

- CFTC-approved CleanTrade introduces a regulated SEF for clean energy derivatives, addressing market fragmentation and liquidity gaps. - The platform enables institutional-scale trading of vPPAs/RECs, achieving $16B notional volume in two months by aggregating demand/supply. - Integrated risk analytics (e.g., CleanSight) enhance transparency, allowing investors to hedge project-specific risks like grid congestion and curtailment. - Dual investment pathways attract hedge funds/pension funds through direct

The Rise of CFTC-Regulated Clean Energy Markets: Opening a New Chapter for Institutional Investors

- CFTC's 2025 approval of REsurety's CleanTrade as a SEF marks a landmark shift in clean energy markets by introducing standardized, transparent trading for VPPAs and RECs. - The platform attracted $16B in notional value within two months, enabling rapid institutional-grade transactions that previously took months to negotiate. - By addressing liquidity gaps and enabling precise risk modeling, CleanTrade is accelerating capital flows into decarbonization while bridging ESG investment gaps for institutional

The Increasing Overlap Between Health and Financial Wellbeing in Managing Personal Finances

- Global wellness economy to hit $9 trillion by 2028, driven by holistic well-being trends. - Millennials/Gen Z prioritize wellness as lifestyle, with 55% spending over $100/month on health. - Employers integrate financial wellness into health programs to reduce burnout and boost productivity. - Investors target wellness-driven SaaS, healthcare tech , and financial literacy platforms for holistic solutions.